Understanding how to carry forward business losses is crucial for any entrepreneur navigating the ever-changing landscape of tax regulations. With the introduction of the new tax regime in 2025, many business owners wonder how their previously reported losses will be treated under this system. Taxpayers need to be aware that not all business losses are eligible for set-off under the new regime, particularly those connected to disallowed deductions. It is essential to familiarize yourself with carry forward losses rules to optimize your tax deductions business effectively. By understanding the implications of business losses tax within this new framework, you can strategically manage your finances and make informed decisions about your tax filings.

The utilization of prior fiscal setbacks, often referred to as carried-forward losses, plays a critical role in a business’s financial strategy, especially with the recent shifts brought about by the new tax structure. Entrepreneurs must navigate the complexities of tax offset rules concerning their previous financial losses while considering adjustments in tax deduction eligibility. The transition from the older tax framework to the new regime presents both opportunities and challenges for those seeking to offset their current income with past losses. Given the stringent criteria surrounding Income Tax set-off, it’s vital to assess how these losses can be harnessed effectively. Familiarizing yourself with the intricacies of business losses and their treatment under the revised tax laws is a strategic move for any business aiming for financial resilience.

Understanding Business Losses and Tax Regimes

When managing your finances, understanding the implications of business losses in relation to tax regimes is crucial. The current tax environment involves navigating through the complexities of the old regime versus the new tax regime that came into effect in 2024-25. Taxpayers must consider how formerly claimed business losses, which can significantly impact tax obligations, can still be utilized or may even be forfeited depending on the deductions allowed under the new regime.

A relevant concern arises for taxpayers who have carried forward business losses from previous years. If these losses were linked to deductions that are now disallowed under the new tax regime, such as additional depreciation or investment-linked deductions, they cannot be set off against the income in the current assessment year. Understanding how these losses interface with the new structure is vital for effective tax planning.

Carry Forward Business Losses After Switching Tax Regimes

Navigating the rules around ‘carry forward business losses’ is a critical aspect of tax planning, especially when transitioning from the old tax regime to the new. Under current legislation, if substantial business losses were claimed under the old regime and are now associated with disallowed deductions in the new regime, taxpayers may face challenges in utilizing these losses. This can lead to a forfeiture of the set-off, potentially resulting in higher tax liabilities.

However, taxpayers retain the option to opt-out of the new tax regime by filing Form 10-IEA before the return due date. This option allows you to maintain your previous deductions and continues to support the carry forward of losses linked to regular business expenses, ensuring you can minimize your tax burden effectively. It is essential to analyze your losses carefully and determine the best approach to managing them under the selected tax regime.

Income Tax Set-Off Rules: What You Need to Know

The Income Tax Act outlines crucial rules regarding the set-off of business losses, particularly about how these losses can be utilized under different tax regimes. According to Section 115BAC(2), if business losses are associated with any deductions that are considered disallowed under the new regime, they cannot be set off against any business income. This understanding is essential for taxpayers who are looking to optimize their tax situation, as it directly affects their ability to adjust for past losses.

Taxpayers must perform careful evaluations of each carried-forward loss category, especially if they significantly depend on former deductions that have been eliminated under the new tax framework. By understanding these distinctions, individuals can strategically plan their finances to maximize their tax benefits while minimizing liabilities.

Key Deductions Under the New Tax Regime

The transition to the new tax regime has introduced notable changes in the way taxpayers can claim deductions. At the heart of this change, the regime offers lower tax rates but restricts the scope of tax deductions available. For instance, while standard business expenses remain eligible, certain deductions such as those linked to investment allowances or additional depreciation are no longer permissible.

Taxpayers should focus on identifying which of their deductions still qualify under the new rules and how these deductions can influence their overall business losses. By aligning deductions effectively with their business operations, individuals can still maintain healthy cash flow despite the restrictions imposed by the new tax regime.

Impact of Non-Eligible Deductions on Business Losses

The impact of non-eligible deductions under the new tax regime is significant for business owners managing their finances. Many taxpayers may mistakenly believe that they can still benefit from past losses despite switching to the new regime; however, if those losses were based on deductions that are no longer allowed, they might face stark reality. Understanding which deductions are non-eligible is imperative for retaining advantageous tax positions.

For example, if a manufacturing business took deductions for additional depreciation and then switched to the new tax regime, those losses derived from those deductions would no longer allow for set-off. Therefore, it’s crucial to assess which expenses are applicable and align your tax strategy accordingly to avoid unexpected financial outcomes.

Strategizing Business Loss Carry Forward to Maximize Tax Benefits

Strategically carrying forward business losses can significantly aid in reducing tax liabilities, especially in light of the new tax regime. Taxpayers should meticulously analyze their past deductions and make informed decisions about whether to carry forward these losses into the new framework or stick with the old. Crafting a plan that considers the nature of past deductions, whether they are eligible or disallowed under the new regime, can help in maintaining beneficial tax scenarios.

In many instances, businesses encounter mixed situations where some losses are relatable to allowable deductions while others are not. Understanding this landscape allows taxpayers to devise a strategy for carrying forward the eligible losses while potentially opting out of the new regime to maximize their financial efficiency. This strategic insight into tax benefits can thus be a valuable asset for many business owners.

Assessing Business Income Before Switching to the New Regime

Before making the pivotal decision to switch from the old to the new tax regime, it is crucial for taxpayers to thoroughly assess their current business income and any associated losses. This evaluation should focus not only on current earnings but also on how previous losses can be leveraged against future profits. Doing so helps ensure that the transition won’t trigger unforeseen tax liabilities.

Moreover, this assessment allows taxpayers to align their business strategies with their tax obligations, fostering a comprehensive understanding of how to best utilize any of their carried-forward losses. When considering the implications of switching regimes, the core financial stability of a business must always take precedence.

Navigating Tax Computations with Previous Business Losses

The necessity of performing accurate tax computations in light of previous business losses cannot be overstated. Understanding how losses can be reported, especially when transitioning to the new tax regime, creates a pathway for taxpayers to legitimately reduce tax burdens. Taxpayers must familiarize themselves with income tax legislation to comprehend exactly how past losses influence tax calculations.

Careful accounting for these prior losses against current and future business income can ensure adherence to tax compliance while still reaping the benefits of tax deductions. Therefore, integrating solid tax computation practices with business loss analysis should be a priority for any taxpayer contemplating an adjustment to their tax strategy.

Consulting Tax Professionals for Business Loss Management

Given the complexities surrounding the carry forward of business losses and the implications of switching tax regimes, consulting with tax professionals is highly advisable. Tax consultants can offer tailored insights regarding the current regulations governing deductions under both the old and new regimes, allowing taxpayers to navigate their options more effectively.

Utilizing the expertise of tax professionals facilitates better understanding of how to manage losses moving forward and the potential ramifications on future tax filings. This guidance is invaluable for businesses looking to optimize their tax situations while comprehensively understanding their obligations.

Frequently Asked Questions

Can I carry forward business losses after switching to the new tax regime 2025?

Yes, you can carry forward business losses even after switching to the new tax regime 2025, but it depends on the type of deductions associated with those losses. If the business losses are linked to disallowed deductions under the new regime, you may not be able to set them off. It’s crucial to analyze your carried-forward business losses on an item-by-item basis and ensure they align with the permissible deductions under the new tax laws.

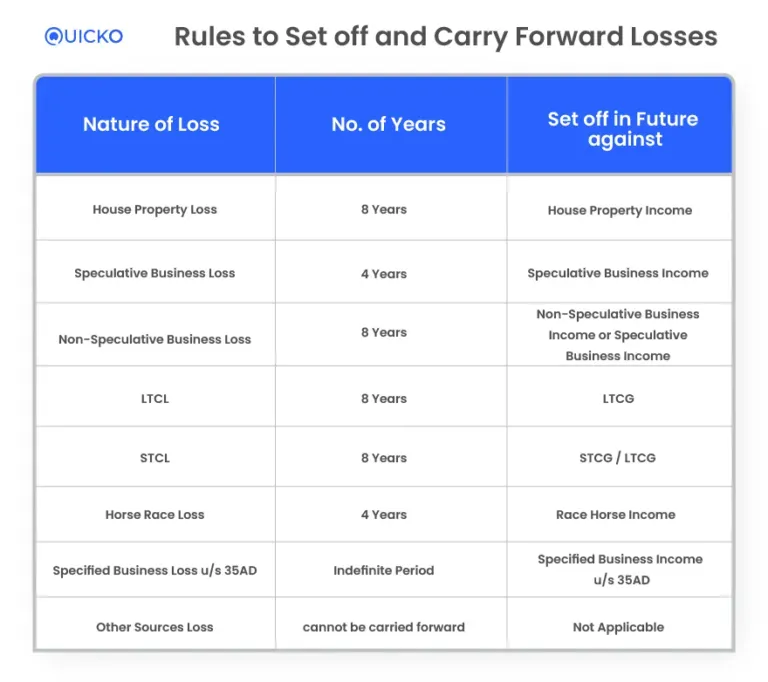

What are the carry forward losses rules under the new tax regime?

Under the new tax regime, carry forward losses are permitted for regular business operations and standard depreciation, but not for losses related to deductions that are disallowed. This includes specific capital investment deductions or additional depreciation claims under old sections. Taxpayers must evaluate their specific business loss situations to confirm eligibility.

How do I calculate carry forward business losses for tax deductions?

To calculate carry forward business losses for tax deductions under the new tax regime, first identify all your business expenses and losses from previous years. Ensure that these losses are not linked to any disallowed deductions such as additional depreciation or certain investment-linked deductions. Document these expenses properly in your Income Tax Return (ITR) to facilitate their set-off against future income.

Are there any limitations on carry forward business losses to set off income?

Yes, there are limitations. Taxpayers cannot set off carry forward business losses that are linked to deductions disallowed under the new tax regime. Specific deductions such as those outlined in Section 115BAC(2) may result in forfeiting the ability to set off related business losses. It’s advised to review your past claims closely.

What should I do if I have substantial past business losses in the new tax regime?

If you have substantial past business losses, you should assess whether those losses are linked to any disallowed deductions under the new tax regime. If they are, you may want to consider opting out of the new regime by filing Form 10-IEA by the due date for returns. This would allow you to retain your ability to set off those losses under the old regime rules.

Can freelancers carry forward their business losses in the new tax regime?

Yes, freelancers can carry forward their business losses in the new tax regime as long as the losses are incurred from regular business expenses. For instance, losses arising from standard operational costs can be carried forward, unlike losses from disallowed deductions. It’s essential for freelancers to maintain detailed records of their expenses for accurate carry forward claims.

What types of business losses can’t be carried forward in the new tax regime?

In the new tax regime, business losses related to disallowed deductions cannot be carried forward. This includes losses from claims of additional depreciation under Section 32(1)(iia) and various investment-linked deductions like Section 35AD. Only losses from regular business operations and standard depreciation can be carried forward.

Do I need to file any special forms to carry forward business losses?

If you are opting out of the new tax regime to retain your carry forward business losses, you need to file Form 10-IEA before the due date for filing your Income Tax Return (ITR). This is crucial for maintaining eligibility for set-off for your carried-forward losses.

Will I benefit from the new tax regime if I have significant business losses?

The new tax regime offers lower tax rates but fewer deductions, which may not be beneficial for those with significant business losses. You might end up forfeiting your ability to set off these losses unless they are incurred from regular business expenditures. A careful calculation and comparison of both regimes will help determine the best financial approach.

What is the impact of deductions disallowed under the new tax regime on carry forward losses?

Deductions disallowed under the new tax regime can severely impact your ability to carry forward and set off business losses. Specific deductions associated with additional depreciation or capital investments prevent the related losses from being carried forward. It’s vital to analyze your losses against the rules to ensure any claims made are valid.

| Key Point | Details |

|---|---|

| Carrying Forward Losses | Taxpayers may carry forward business losses; however, specific conditions apply when switching tax regimes. |

| Old vs New Tax Regime | The new tax regime was established as the default from assessment year 2024–25, but taxpayers can opt for the old regime if they file Form 10-IEA. |

| Impact of Deductions | Carried-forward losses associated with disallowed deductions under the new regime cannot be set off. |

| Allowed Business Losses | Losses from regular business expenses or standard depreciation can still be carried forward and set off under the new regime. |

| Scenarios of Loss Carry Forward | 1. Regular expenses (e.g., rent, salaries) can be carried forward. 2. Unabsorbed depreciation on normal business assets (like laptops) can be carried forward. |

| Non-Allowed Losses | Losses associated with deductions such as additional depreciation or capital investment deductions (e.g., under Section 35AD) cannot be carried forward. |

Summary

Carrying forward business losses is a critical aspect for taxpayers switching between the old and new tax regimes. Taxpayers must carefully analyze their carried-forward losses, particularly considering the types of deductions associated with them. If substantial past losses link to deductions now disallowed, opting for the new regime may lead to forfeiting those losses. Ultimately, a thorough understanding of your finances and the related regulations is key to effectively managing business losses moving forward.