The Rule of 72 is a simple, eye-opening rule of thumb that helps you estimate how long it takes for your money to grow, making complicated financial math feel approachable for everyday investing. Using a Rule of 72 calculator, you input an expected rate of return and instantly see a rough timeline, empowering you to compare strategies without spreadsheets. This quick heuristic highlights how investments with higher returns can help you double your money faster, supporting goals like retirement, education funding, or a dream purchase. The math is simple: divide 72 by the rate of return to get the approximate years needed, and it applies to compounded interest as a practical, intuitive guide—the compounded interest rule of 72. If you’re asking how long to double your money in real life, remember that this is a rough estimate to inform decisions, not a guarantee, and you should verify with a trusted investment rule of 72 resource.

What is the Rule of 72 and why it helps you plan to double your money

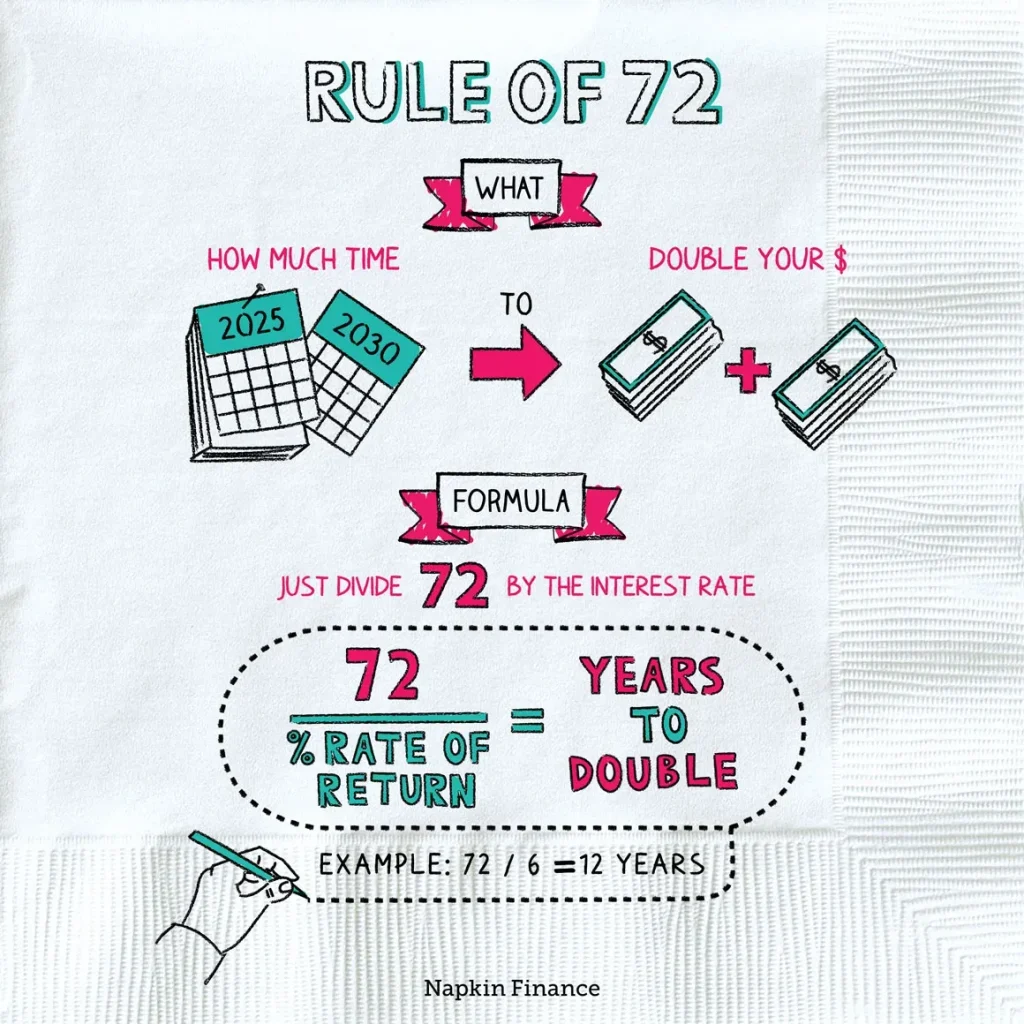

The Rule of 72 is a simple mental math shortcut that estimates how long it takes for an investment to double in value given a fixed annual rate of return. By dividing 72 by the expected rate, you get the approximate number of years needed to double your money. This rule works with any instrument that earns compounding interest and serves as a practical planning tool for investors.

While it’s a handy quick gauge, accuracy improves for returns in the 6–10% range and for steady compounding. It also highlights the broad link between rate and time, applying to inflation or GDP growth when you want a rough sense of exponential growth in personal finance or macro environments.

Rule of 72 calculator: Quick projections for your investments

Rule of 72 calculator: A lightweight tool that lets you input an anticipated rate of return and instantly see how many years it would take to double your money. This calculator makes scenarios tangible and supports quick comparisons across investment options and time horizons.

Use the calculator to test conservative and aggressive assumptions, such as 7%, 12%, or higher returns, to understand how quickly wealth might compound. Seeing the relationship between rate and time helps with planning, budgeting for goals, and choosing suitable investments within your risk tolerance.

Applying the Rule of 72 to fixed deposits and PPF

Fixed deposits (FDs) and the Public Provident Fund (PPF) are common low-to-moderate return tools. At roughly 7% per year, the Rule of 72 points to about 10.3 years to double your money, illustrating how steady compounding can grow wealth over a decade.

PPF rates change with policy decisions, but even with current yields around 7%, the Rule of 72 provides a quick benchmark to compare against other instruments like mutual funds or equities. This helps you build a diversified, long-term plan aligned with your risk tolerance and goals.

Doubling your money with equities: A Rule of 72 case study

Equities and stock market exposure offer higher potential returns but come with greater volatility. If you assume roughly 13.5% annual return, the Rule of 72 estimates doubling time at about 5.3 years, underscoring the power of compounding in growth assets.

Historical indicators such as broad market indices illustrate how time in the market and reinvested gains convert to wealth, though actual results depend on fees, taxes, and drawdown risk. A rule of thumb helps set expectations without promising guaranteed outcomes.

Mutual funds and the Rule of 72: expectations vs reality

Mutual funds, when reliably managed, can deliver 12–15% annual returns over the long run. Using the Rule of 72, an investment of 1 lakh could double in roughly 6 years at 12% returns, highlighting the value of a disciplined, diversified fund approach.

Investors should compare funds on expense ratios, exposure to sectors, and volatility. While the Rule of 72 provides a quick doubling forecast, real-world performance varies, so ongoing monitoring using an investment rule of 72 mindset is essential.

How long to double your money: interpreting numbers across investment tools

How long to double your money varies with the rate of return you can reasonably expect. Higher returns shrink the doubling period; lower returns extend it. The Rule of 72 translates a rate into time, making it easier to compare different investment paths at a glance.

When evaluating options, factor in inflation, taxes, and fees because they erode real returns. The same mental model helps you compare strategies—from conservative savings to growth-oriented portfolios—across time horizons and risk profiles.

Compounded interest rule of 72: the power of compounding explained

The compounded interest rule of 72 emphasizes how compounding accelerates wealth growth. Because returns generate additional returns, small advantages in rate compound into large differences in the final wealth after many years.

This effect explains why starting early and staying invested matters. Even small changes in your rate of return can lead to substantially different outcomes over a decade or more, reinforcing the value of long-term investing and diversification.

Investment rule of 72: limitations, accuracy, and best use cases

Investment rule of 72: limitations and caveats. The formula is a rough approximation, not a precise forecast, and it ignores taxes, fees, and changing market conditions. Use it as a quick mental model rather than a guarantee.

It’s most useful when comparing broad scenarios and when you want a simple way to communicate potential timelines to family or clients. For detailed planning, rely on a formal financial plan and scenario analysis beyond the rule.

Practical steps to apply the Rule of 72 in your personal finance plan

Practical steps to apply the Rule of 72 in a personal plan. Start by estimating a realistic rate of return for each asset class, then use the rule to compute doubling timelines and set milestones for your goals such as retirement or education funding.

Next, compare options with a Rule of 72 calculator, document assumptions, and adjust for risk tolerance. Finally, incorporate inflation and tax considerations, and revisit the numbers periodically as markets and rates change.

Tax considerations and disclaimers when using the Rule of 72 for investing

Tax considerations and disclaimers when using the Rule of 72 for investing. Certain accounts offer tax-advantaged growth that can improve real returns, while others are taxed on gains, altering the effective doubling time and realized wealth.

This content is informational and not financial advice. Always consult certified experts to tailor the investment rule of 72 to your personal situation, and use the Rule of 72 in conjunction with a comprehensive plan that accounts for risk, diversification, and long-term goals.

Frequently Asked Questions

What is the Rule of 72 and how does it help you estimate how long to double your money?

The Rule of 72 is a quick mental math shortcut for estimating the time needed for an investment to double. It uses the formula years ≈ 72 ÷ rate, where rate is the annual return in percent and compounding is assumed. It’s most accurate for rates around 6–10%. Example: at 7% annual return, 72 ÷ 7 ≈ 10.3 years to double your money.

How can I use a Rule of 72 calculator to estimate how long to double your money with a given rate?

Using a Rule of 72 calculator, simply enter the expected rate of return. The calculator applies the 72 ÷ rate rule to estimate the years required to double your money, assuming compounded interest. It’s a quick, approximate guide, not a guaranteed outcome. For example, 7% yields about 10.3 years.

If I want to double my money in 9 years, what rate should I target using the Rule of 72?

Target a rate of roughly 72 ÷ 9 = 8% per year. With an 8% annual return, the Rule of 72 estimates about 9 years to double your money, assuming the rate stays constant and compounding occurs.

What is the investment rule of 72 and how does it apply to different investment types to estimate when your money will double?

The investment rule of 72 provides a quick way to estimate how long it will take for your money to double across various investments, such as fixed deposits, PPF, equities, and mutual funds. Enter each instrument’s expected rate of return (e.g., 7% for FD, 13.5% for equities) into the Rule of 72, and you’ll get an approximate time to double your money. Remember, this is a rough guide based on compounded interest.

What is the compounded interest rule of 72 and how is it used to project when your investment will double?

The compounded interest rule of 72 is a common method to estimate how long to double your money under compound growth. It uses 72 ÷ rate to give years, assuming a constant rate and reinvestment. It’s useful for quick comparisons, but keep in mind real-world factors can alter outcomes.

What are the limitations of the Rule of 72 when estimating how long to double your money?

The Rule of 72 is a helpful quick rule, not an exact forecast. Limitations include its rough accuracy (best for rates ~6–10%), assumption of a constant rate, and ignoring fees, taxes, inflation, and changing market conditions. For planning, use a Rule of 72 calculator to explore scenarios, but rely on detailed projections for decisions.

| Aspect | What it means | Examples / Notes |

|---|---|---|

| What is it? | Rule of 72 provides a quick estimate of how many years it will take to double an investment based on its rate of return. | Formula: years ≈ 72 ÷ rate of return |

| Scope | Applies to compounded interest and other exponential increases (inflation, GDP). | Useful for a quick mental gauge of investment growth |

| Accuracy range | Reasonably accurate for interest rates in the 6–10% per year range. | Better suited for moderate-return investments |

| How to use | Divide the rate by 72 to estimate years to double | Example: 7% → about 10.3 years (72/7) |

| FD example | Fixed deposits (FDs) often range 3–7% depending on the bank. | At 7%: 72/7 ≈ 10.3 years to double |

| PPF example | Public Provident Fund (PPF) current interest around 7.1% | 72/7.1 ≈ 10.1 years to double |

| Equities example | Higher returns shorten doubling time; Nifty50 example given | 13.5% → 72/13.5 ≈ 5.33 years |

| Mutual funds example | Mutual funds with disciplined investment around 12% returns | 72/12 = 6 years |

| Disclaimer | Investors should check with certified experts before making investment decisions. | Important caution about relying on a rule of thumb |

Summary

Rule of 72 is a simple rule of thumb that helps investors gauge how long it takes to double money, based on the rate of return. It applies to compounded interest and other exponential growth scenarios like inflation and GDP. While useful for quick mental math, this method is approximate and works best for moderate, stable returns (roughly 6–10% annually). Always consider more detailed analysis and professional financial advice for investment decisions.