Economic indicators are the compass that helps investors, policymakers, and everyday readers gauge the health of the economy. Rather than rely on a single data point, we watch a small set of trusted signals such as GDP growth, the unemployment rate, and the inflation rate to reveal momentum and price dynamics. These indicators also help interpret consumer confidence and other leading indicators to form a broader narrative about macro trends. In practice, analysts combine multiple measures to translate raw numbers into a clear view of growth, inflation pressures, and employment prospects. This overview primes readers to assess how signals interact and what they imply for policy, business strategy, and household decisions.

Viewed through alternative terms, the topic appears as macroeconomic metrics, growth gauges, or the overall health of the economy. Analysts often summarize these signals with phrases like GDP expansion, labor-market momentum, or price stability, rather than relying on a single figure. Using LSI-friendly language means connecting related ideas such as consumer behavior, monetary policy, productivity, and business investment to form a cohesive picture. Together, these semantically linked concepts help readers explore how shifts in demand, wages, and financing conditions shape the trajectory of macro conditions. By weaving synonyms and related terms, the content remains comprehensive, accessible, and optimized for search while preserving clarity.

Economic indicators and GDP growth: Reading the health of the economy

Economic indicators are the compass that helps investors, policymakers, and readers gauge the health of the economy. Rather than rely on a single data point, a small set of trusted signals—GDP growth, the unemployment rate, the inflation rate, and consumer confidence—reveals whether growth is accelerating or slowing and whether price stability is within reach.

Viewed together, these indicators form a narrative about macro momentum. GDP growth signals the overall demand and productive capacity, the unemployment rate shows how many households have income to spend, and the inflation rate reflects price stability that shapes real incomes. Leading indicators can point to turning points before they show up in the headline numbers, while lagging indicators confirm the direction. Interpreting them in concert helps readers distinguish durable trends from temporary blips.

Leading indicators, consumer confidence, and the roadmap for macro forecasting

Leading indicators, such as the yield curve, surveys of business sentiment, housing starts, and durable goods orders, tend to move ahead of GDP growth and unemployment rate. Pairing these with a read on consumer confidence provides a forward-looking snapshot of how households and firms expect the economy to perform, which in turn feeds into the inflation rate and policy outlook.

With a balanced view of these signals, readers can assess the trajectory of the economy. When leading indicators strengthen and consumer confidence rises, GDP growth and employment prospects often improve, and inflation remains manageable. When confidence cools and early signals weaken, it can foreshadow slower growth and a shifting unemployment picture, prompting closer attention from policymakers and investors.

Frequently Asked Questions

How should GDP growth and the unemployment rate, two core economic indicators, be interpreted together to gauge the economy’s momentum?

GDP growth measures the overall output of the economy and signals expansion or contraction, while the unemployment rate reflects the labor market and tends to move after broader cycles. When GDP growth accelerates and the unemployment rate falls, demand, hiring, and consumer spending typically strengthen. If growth slows but unemployment remains low, productivity, wages, or policy support may be sustaining jobs. Interpreting these two indicators together—with attention to data revisions and other signals—offers a clearer view of macro momentum.

Why are the inflation rate and consumer confidence important economic indicators, and how do they function as leading indicators for the near-term path of demand and policy?

The inflation rate measures price changes and influences purchasing power and policy expectations; moderate inflation supports stable growth, while rising inflation can erode real incomes and prompt policy tightening. Consumer confidence gauges households’ sentiment about the economy and is commonly treated as a leading indicator for near-term consumption. While inflation is not always a leading signal on its own, its interaction with confidence helps forecast demand and the policy path when viewed alongside other leading indicators such as yields, inventory data, and sentiment surveys.

| Topic | Key points |

|---|---|

| What are economic indicators? | Describe the economy at a point in time; categories include leading, coincident, and lagging; aim to translate numbers into a narrative about growth, inflation, labor, and consumer behavior; indicators move at different speeds. |

| The big four: GDP growth, unemployment rate, inflation rate, and consumer confidence | They provide a broad view of economic momentum, job prospects, price stability, and sentiment. When they align, the economy is often on solid footing; when they diverge, deeper analysis is needed to understand underlying dynamics. |

| GDP growth | Measures total value of goods and services produced over a period. Positive growth signals expansion; supports higher incomes, hiring, and spending. Shrinking GDP signals contraction. Short-term changes may reflect weather, inventory, or one-offs. Focus on sustained quarterly trends rather than a single print. Accelerating growth correlates with robust investment and consumption; slowing growth can precede tighter lending or cautious spending. |

| Unemployment rate | Summarizes how many people who want to work cannot find jobs. It is a lagging indicator. A falling rate signals improving labor demand; a rising rate signals weakening conditions. Distinguish headline unemployment from underemployment and participation to get a fuller job-market picture. |

| Inflation rate | Measures how quickly prices rise. Moderate inflation supports planning and growth; high or accelerating inflation erodes purchasing power and may prompt policy tightening. Very low inflation or deflation signals weak demand or policy challenges. Inflation interacts with GDP and unemployment; analyzing with wage growth and productivity helps identify whether price changes are demand-driven, supply-driven, or policy-induced. |

| Consumer confidence | Gauges households’ optimism about their financial future. High confidence tends to boost spending and borrowing; low confidence leads to caution. It is a leading indicator of near-term consumption and can foreshadow shifts in GDP and employment. |

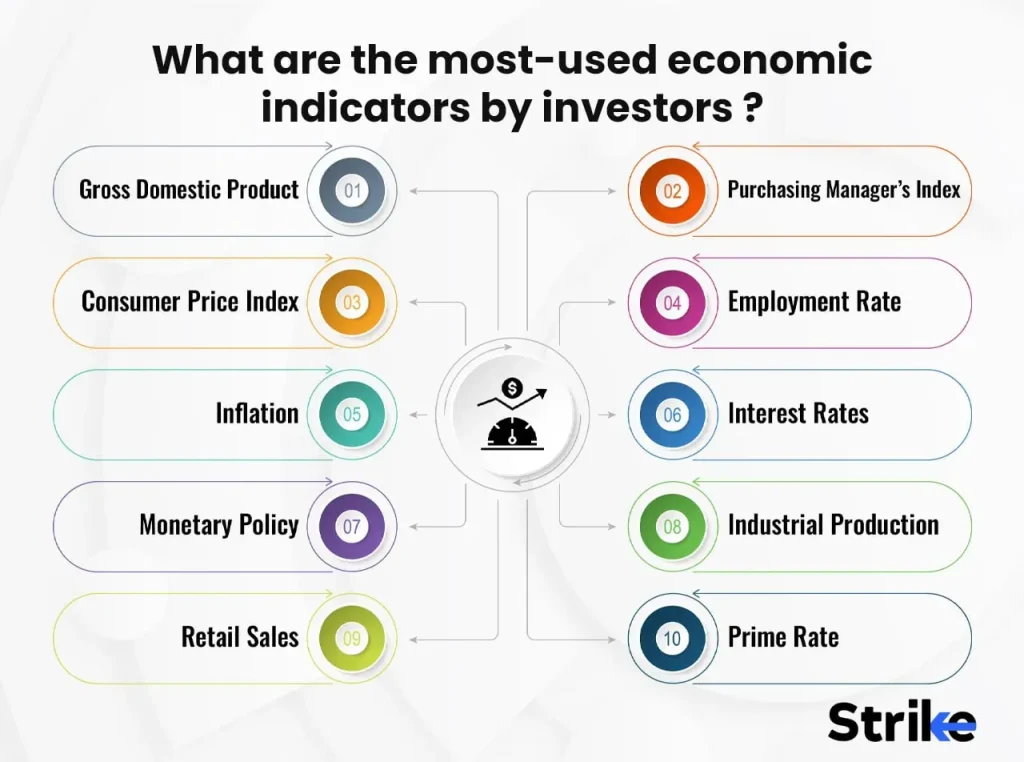

| Beyond the big four | Includes indicators like the yield curve, business sentiment surveys, and inventory timing. Housing starts, durable goods orders, retail sales, and PMI provide a granular view of different sectors. Taken together, these signals help assess sustainability, inflation pressures, and the labor market’s trajectory. |

| Interpreting indicators together | No single data point tells the full story. Weights across indicators create a coherent view of the economy’s health. For example, strong GDP growth with falling unemployment and moderate inflation suggests healthy demand; rising unemployment with positive GDP may indicate structural weakness; accelerating inflation with slowing growth points to demand-pull pressures and possible policy tightening. Look for consistency across indicators over several quarters and be mindful of revisions and seasonal adjustments. |

| Practical monitoring | Start with the big four: GDP, unemployment, inflation, and consumer confidence. Add monthly data like retail sales, housing starts, and durable goods orders. Track revisions, provide context with business cycles (expansion, peak, contraction, trough), and build a mental model of how signals move together to gauge macro health. |

| Note on sources and credibility | Rely on reputable agencies with transparent methodologies and revisions. Cross-check numbers across sources, note release dates, and understand definitions. Use central banks, official statistics portals, and academic or think-tank analyses to add context and historical perspective. |