Economic impact on retirement planning and savings shapes how people prepare for the years beyond work, influencing decisions, timelines, and confidence. A solid grasp of these macro forces helps you anticipate rising costs, adjust saving targets, and protect purchasing power over decades. Inflation, interest rates, and market volatility and retirement savings interact with personal goals to determine how much you can safely save and how you withdraw in retirement. When you align strategies with economic realities, you reduce stress and build a more resilient path to a comfortable, sustainable retirement. This overview highlights practical steps and related considerations, including inflation and retirement planning and how market dynamics influence long-term wealth, underscoring the Economic impact on retirement planning and savings.

From a different angle, the topic can be framed through the lens of the macroeconomic environment shaping personal wealth planning. The cost-of-living trajectory, currency conditions, and financial market cycles influence how households budget, save, and plan withdrawals. Policy developments and tax rules color retirement income streams and long-term security. Using terms such as inflation pressures, rate environments, and risk-managed portfolios aligns content with search intent while staying true to the core idea. By reframing the discussion around these related concepts, readers understand that prudent preparation is about adapting to changing prices, while maintaining flexibility and discipline in saving.

Economic impact on retirement planning and savings: Adapting to inflation, rates, and market cycles

Inflation reshapes the value of money over time, making it a central economic factor affecting retirement. When prices rise faster than earnings, the purchasing power of fixed income and traditional savings can erode, underscoring the need for an inflation-aware approach to asset allocation. In practical terms, this means building a portfolio that offers modest real returns, incorporating instruments that tend to keep pace with price growth, and adjusting withdrawal rules to reflect ongoing cost changes. By understanding inflation’s pull on purchasing power, you can design a plan that preserves livability in retirement while guarding against creeping cost pressures.

Interest rates and retirement planning are tightly connected, influencing both the income you can generate from savings and the affordability of housing and healthcare. Higher rates tend to push up yields on new fixed-income investments while lowering the price of existing bonds, shaping income streams and sequencing risks. A resilient strategy considers a mix of assets, including income-generating securities, inflation-linked options, and growth ballast, aligned with your risk tolerance and time horizon. Regular portfolio rebalancing and scenario testing help ensure that rate movements don’t derail long-term goals or force disruptive withdrawals during downturns.

Economic impact on retirement planning and savings: Navigating market volatility, demographics, and policy shifts

Market volatility tests retirement plans because cycles of gains and losses affect how much you can safely withdraw and how quickly your assets grow. A portfolio overly concentrated in equities is vulnerable to drawdowns that can trigger emotional or forced changes in spending. Describing the problem in terms of market volatility and retirement savings highlights the value of diversification, a disciplined rebalancing schedule, and clear withdrawal rules that reduce the risk of depleting capital in a downturn. By building resilience into your plan—balancing growth with risk management—you can maintain progress toward your goals even when markets swing.

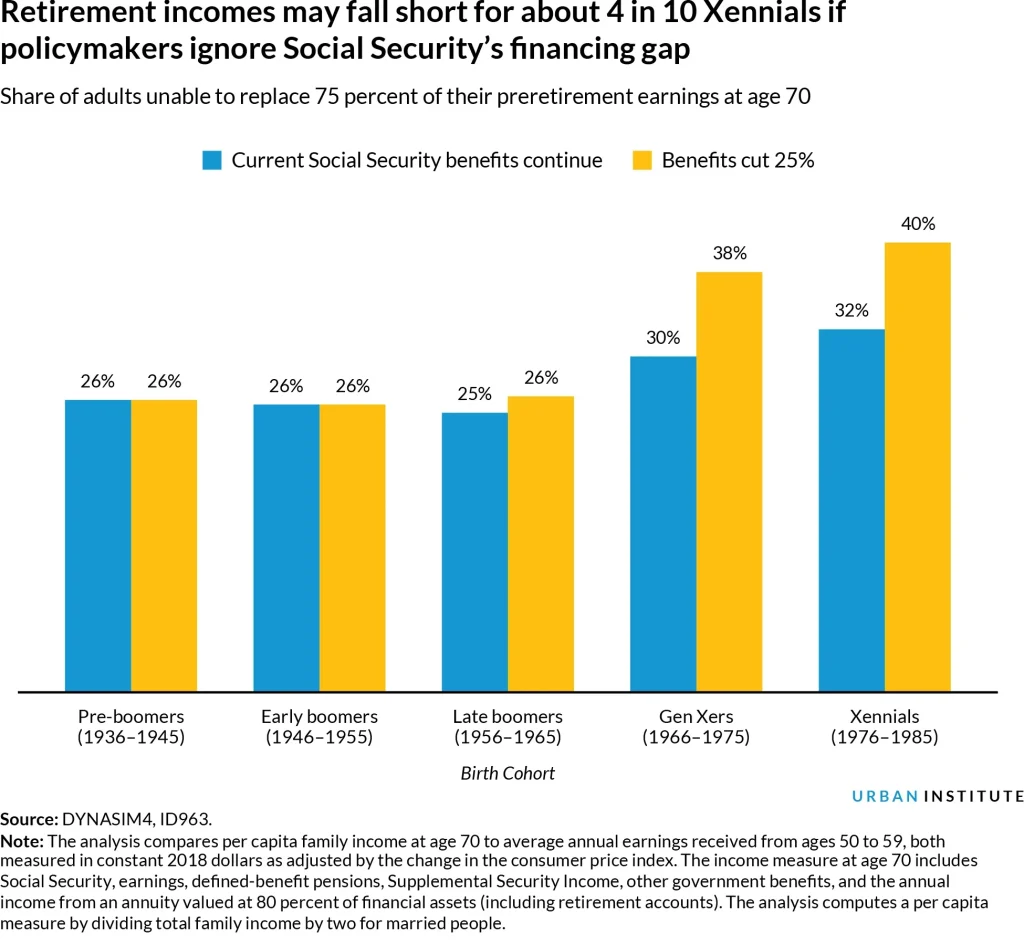

Policy shifts and Social Security/pensions further shape lifetime income and tax burdens. Changes to retirement benefits, tax rules, or healthcare costs can alter your retirement trajectory, making proactive monitoring essential. This is where retirement savings strategies during economic downturn come into play: stress-testing options, planning for different claiming scenarios, and aligning tax planning with anticipated policy changes. Understanding how policy developments interact with your savings approach helps you adapt quickly and protect your standard of living through various economic environments.

Frequently Asked Questions

What is the economic impact on retirement planning and savings, and how do inflation and rising costs affect my retirement strategy?

The economic impact on retirement planning and savings shows that inflation and rising costs erode purchasing power over time. To protect your plan, design an inflation-aware portfolio with a mix of growth assets and inflation-sensitive components, such as inflation-linked bonds or real assets. Revisit withdrawal rules and consider adjusting Social Security claiming to improve lifetime income. Maintain discipline with automatic contributions and tax-advantaged accounts, and stress-test your plan against different inflation scenarios.

How can I manage market volatility and interest rates within retirement savings strategies during an economic downturn?

To navigate market volatility and shifting interest rates during an economic downturn, maintain a well-diversified portfolio and a clear withdrawal plan. Use a dynamic withdrawal strategy with guardrails, rebalance regularly, and keep a liquidity buffer to avoid forced selling in downturns. Consider bond laddering and inflation-protected securities to mitigate rate risk, and adjust asset mix based on time horizon and risk tolerance. Stay informed on policy changes and tax planning, and seek professional guidance to tailor strategy to your situation.

| Economic Factor | What It Means | Impact on Retirement Planning |

|---|---|---|

| Inflation and purchasing power | Inflation erodes purchasing power; when inflation runs above wage growth, the real value of money saved for retirement declines. Retirees on fixed income may see living standards squeezed. | Design an inflation-aware portfolio and adjust withdrawal rates to reflect ongoing price changes; plan for rising costs over time. |

| Interest rates and the cost of money | Interest rates influence borrowing costs, fixed-income returns, and discount rates for future cash flows. Rising rates typically push bond prices down; low rates push investors toward higher-yielding assets. | Income from savings, housing affordability, and withdrawal strategies are affected; consider asset mix, duration, and income-generation potential. |

| Market volatility and retirement savings | Markets move in cycles; volatility can stress retirement plans. A portfolio heavy in equities can experience drawdowns; diversification helps. | Use diversification, regular rebalancing, and clear withdrawal rules to smooth outcomes during swings. |

| Demographics and longer life expectancy | Longer retirements require planning for more years of expenses; longer horizons raise sequence of returns risk and healthcare cost concerns. | Plan for longevity, healthcare buffers, and timing effects of Social Security and pensions. |

| Policy shifts and Social Security/pensions | Policy changes can significantly affect lifetime income and taxes, including Social Security and pension provisions. | Stay informed and adjust savings strategies and tax planning accordingly. |

Summary

Economic impact on retirement planning and savings is pervasive, shaping every stage of the journey—from the day you start saving to the decisions you make in retirement. The economy’s main factors—inflation, interest rates, market volatility, demographics, and policy changes—set the context for how much you can save, how your portfolio performs, and when you should claim Social Security. By staying informed, building a resilient plan, and applying flexible withdrawal strategies, you can adapt to changing conditions without losing sight of personal goals. Practical steps include inflation-aware investing, regular portfolio rebalancing, budgeting for healthcare and long-term care, and seeking professional guidance when needed. With disciplined saving and cost-management, you can navigate uncertainty and pursue a secure, fulfilling retirement.