Economy explained: This guide breaks down a big topic into plain language so you can understand how inflation, growth, and other forces move the economy. From there, we focus on the main drivers—inflation, growth, unemployment, and policy—so you can see what truly shapes daily life. This introduction uses plain language economics to translate difficult terms into ideas you can relate to your budget, job prospects, and prices, including inflation and growth explained as a guiding concept. By the end, you should have a clear sense of how the economy works and why policy choices matter for the future. Think of the economy as a web of demand and supply where decisions by households, firms, and governments show how the economy works.

In this follow-up, the topic is introduced with alternative terms to fit an LSI-friendly framing. Instead of inflation alone, we talk about price motion, value changes, and the cost of living to describe the same dynamics. We also shift from “growth” to ideas like expansion of production, rising productivity, and new opportunities, linking to related phrases such as ‘how the economy grows’ and ‘inflation affects growth.’ Together, these terms help search engines and readers connect related concepts and build a broader semantic map of the economy.

Economy explained: How inflation and growth interact in plain language economics

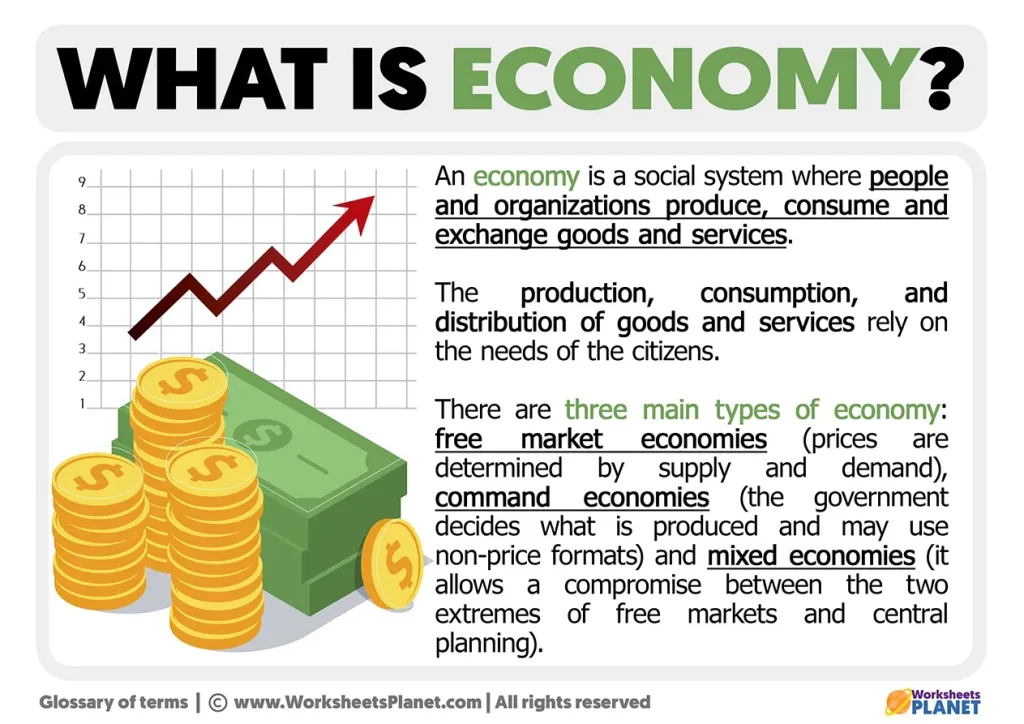

In plain language economics, ‘Economy explained’ means understanding two big forces: inflation and growth. Inflation is the pace at which the average prices for goods and services rise, and growth is the expansion of the economy’s output. When people hear ‘inflation and growth explained,’ they’re getting a simple view of how price changes connect to how much the economy produces.

These forces hinge on demand versus supply. When demand rises faster than supply, prices go up—that’s inflation in action. When supply catches up or productivity improves, growth can continue without a runaway price surge. Seeing it this way helps you grasp the everyday implications of policy choices and business cycles—the core idea in plain language economics.

How the economy works: Drivers, cycles, and policy levers that shape inflation affects growth

The economy works as a living system of spending and production. Households buy, firms hire and invest, and governments spend or tax. The core drivers are employment, productivity, investment, technology, and policy. By connecting these pieces, you can understand how inflation and growth fit into the big picture—a practical view aligned with how the economy works in real life.

Policy levers—monetary policy (interest rates and credit conditions) and fiscal policy (spending and taxes)—shape demand, expectations, and risk. Their decisions influence inflation affects growth along the business cycle: higher rates can cool demand and reduce inflation but may slow growth; lower rates can boost growth but risk higher inflation. In plain language economics, this helps explain why budgets, central banks, and markets move together.

Frequently Asked Questions

Economy explained: How does inflation affect growth in plain language economics?

In Economy explained using plain language economics, inflation is the rate at which prices rise over time, while growth means the economy is producing more over time. Inflation affects growth by changing purchasing power and costs for households and firms, which can influence hiring, investment, and how much people spend. Policy aims to keep inflation at a predictable pace while supporting sustainable growth, so that everyday budgets and job opportunities stay more certain.

How the economy works: inflation and growth explained, and why policy matters in Economy explained?

The economy works as a balance of spending and production: households buy, firms produce, and governments buy or fund programs. Growth comes from more workers, higher productivity, and investment, while inflation rises when demand outpaces supply or costs rise. Policy—monetary and fiscal—shapes this balance by influencing demand and prices, helping to stabilize inflation and support steady job creation, all explained in plain language economics to make the ideas easy to follow.

| Topic | Key Points | Real-world Relevance |

|---|---|---|

| What is the economy? | The economy is a system of spending, production, and policy. It blends demand and supply, with business cycles driven by shifts in inflation, productivity, and policy. | Understanding the basics helps explain prices, jobs, and budgets people face every day. |

| Inflation explained | Inflation is the rate at which the general price level rises. It can be driven by strong demand, rising costs, supply shocks, and expectations. | Affects purchasing power and saving; central banks aim for stable, predictable inflation. |

| Growth explained | Growth means higher output (GDP) from more workers, better productivity, investment, and innovation. It occurs in cycles. | Links living standards to investment and jobs; sustainable growth requires balance with inflation. |

| Policy levers | Monetary policy (rates, credit conditions) and fiscal policy (spending, taxes) influence demand and inflation. Policy credibility matters. | Policy shapes inflation and growth outcomes and how households and firms plan. |

| Interactions and framework | Inflation and growth interact; demand vs supply, expectations, and policy responses matter for outcomes. | Helps explain headlines and everyday price and job changes. |

| Common misunderstandings | Inflation isn’t uniform across prices; growth distribution matters; they are interdependent but not identical. | Promotes clearer interpretation of news and data. |

Summary

Economy explained table above outlines the core ideas: the economy is a system of spending, production, and policy; inflation and growth are driven by demand, supply, productivity, and policy; and policy tools influence outcomes. The table highlights why prices move, how growth happens, and how policy decisions shape everyday life.