Global Economy 2025 is shaping a pivotal era for policymakers, businesses, and investors, as the world recalibrates after recent shocks. Viewed through the global economic outlook 2025, stakeholders must weigh macroeconomic trends 2025 that are redefining investment horizons. Growth drivers 2025 now hinge on technology-enabled productivity, energy transition, and a more resilient but redistributed trade architecture, while economic risks 2025 demand vigilant risk management. Opportunities in global markets 2025 are expanding in renewable infrastructure, digital services, and climate-smart industries that can boost long-run returns. Strategic planning and disciplined capital allocation will determine which regions and sectors capture the upside while navigating potential headwinds.

Beyond the headline outlook, the world growth landscape in the mid-2020s points to a mixed but resilient expansion driven by tech-enabled productivity and sustainability bets. The international economy of the period is shaped by evolving policy frameworks, diversified supply chains, and the rise of high-value services. This macro backdrop favors investors and firms that prioritize adaptability, workforce development, and prudent risk management. In practice, translating the big-picture theme into strategy means aligning capital with secular growth themes and regional opportunities while monitoring inflation, debt dynamics, and geopolitical shifts.

Global Economy 2025: Key Growth Drivers and the Macro Trends Shaping the Global Economic Outlook 2025

Global Economy 2025 is unfolding with an uneven recovery, where technology-enabled productivity, energy transition, and smarter trade architectures shape competitive advantage. The global economic outlook 2025 emphasizes sectors that leverage data, cloud, AI, and platform-enabled services to lift margins and create new value, even as input costs rise. Growth drivers 2025 are increasingly anchored in intangible assets, digital ecosystems, and energy-transition investments that open new growth channels in services, manufacturing, and green infrastructure. This lens helps policymakers, investors, and corporate leaders identify where capital and talent should flow to capture opportunities in global markets 2025.

Alongside the upside, macroeconomic trends 2025 bring inflation pockets, debt dynamics, and normalization of monetary and fiscal policy into focus. Economic risks 2025 require disciplined risk management, diversified sourcing, and credible policy frameworks that anchor expectations. The path forward calls for strategic collaboration across regions to exploit digital trade, climate-smart investment, and resilient supply chains—exactly the kinds of opportunities in global markets 2025 that can sustain growth while mitigating downside.

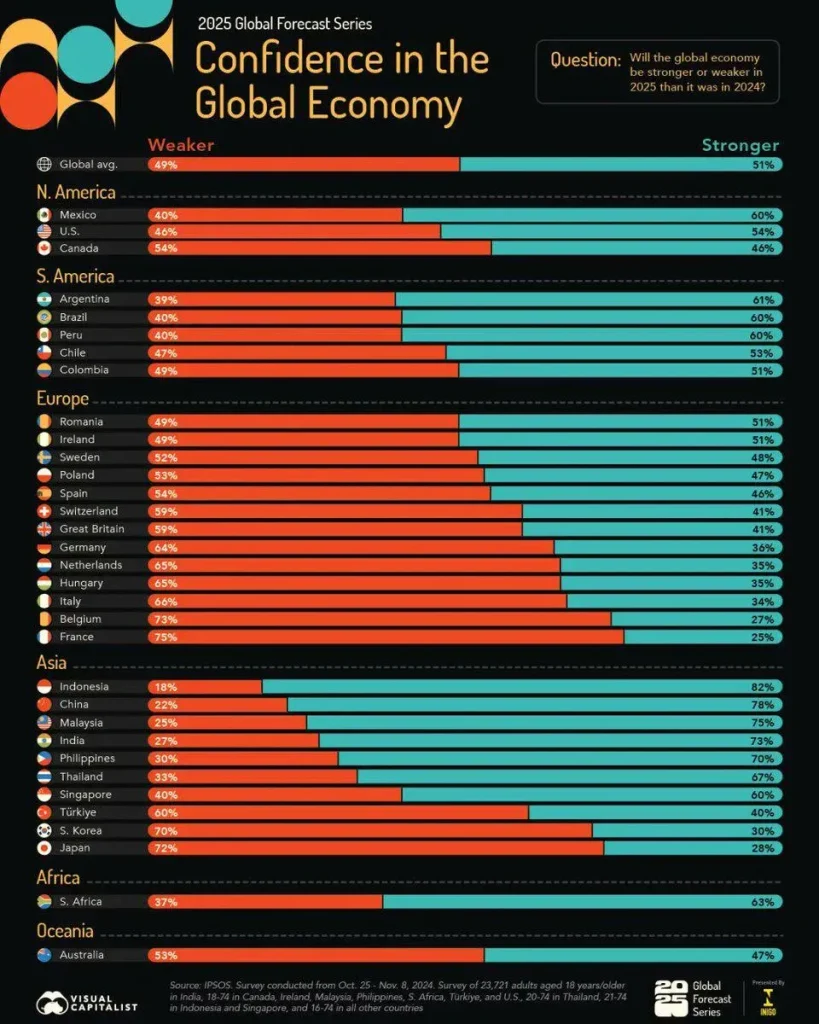

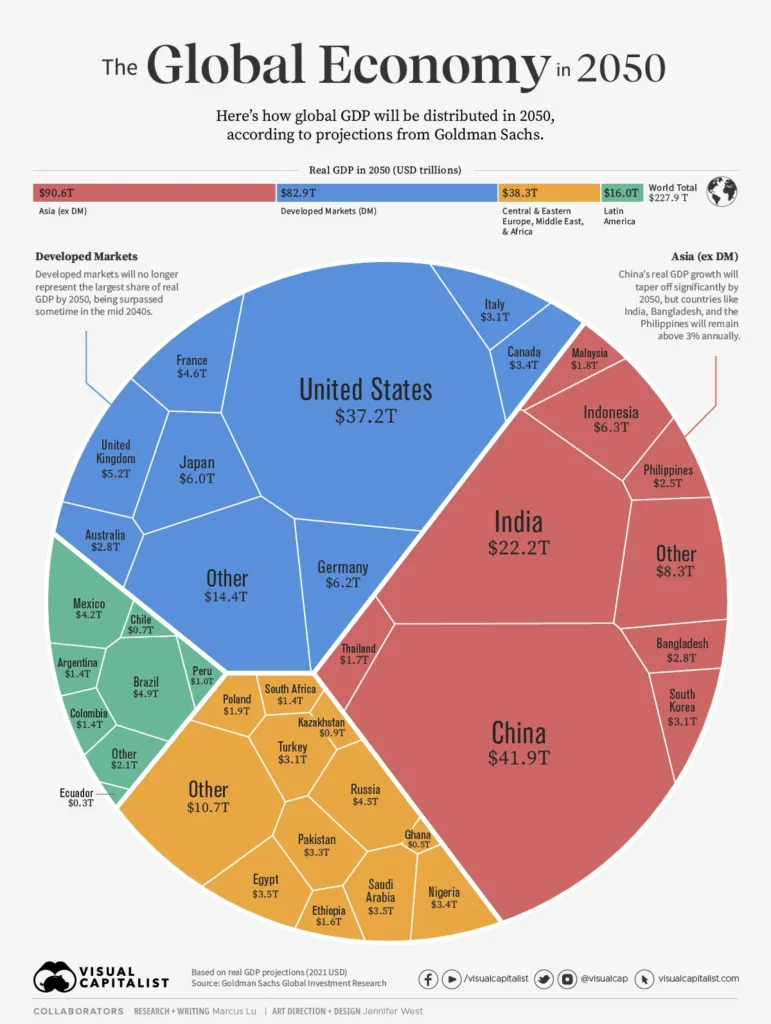

Regional heterogeneity means some economies will accelerate on the back of reform momentum and skilled labor, while others face headwinds from demographics and debt. This reality underscores the need for targeted investment, reform packages, and international cooperation to spread the benefits of growth drivers 2025 and to unlock the opportunities in global markets 2025 across geographies.

Strategies for Capitalizing on Opportunities in Global Markets 2025: Navigating Economic Risks 2025 and Macroeconomic Trends 2025

To translate the global economic outlook 2025 into practical gains, firms should diversify across regions, invest in technology-enabled capabilities, and accelerate infrastructure modernization. Growth drivers 2025 point to cloud platforms, data governance, cybersecurity, and climate-tech solutions that scale, enabling new revenue streams in opportunities in global markets 2025 for early movers who couple capital with talent.

Proactive portfolio and project execution also means aligning with macroeconomic trends 2025 while monitoring economic risks 2025. Firms should build resilient supply chains, reskill workforces, and pursue energy-transition partnerships that reduce exposure to single-source shocks and price swings.

On the policy side, credible fiscal frameworks, investment in education, and transparent governance can unlock private capital and accelerate the adoption of digital and green infrastructure. By combining these levers, stakeholders can navigate the complexities of 2025 and realize the opportunities in global markets 2025 with stronger resilience.

Frequently Asked Questions

What are the key macroeconomic trends 2025 in the Global Economy 2025 and how could they shape investment and business strategy?

Global Economy 2025 is shaped by macroeconomic trends 2025 such as digital productivity, the energy transition, and redistributed trade. Growth drivers 2025 include technology-enabled services, renewable capacity expansion, and upgraded infrastructure, supported by gradual monetary normalization. For investors and firms, this means diversifying across tech, climate tech, and infrastructure while monitoring debt dynamics and inflation to preserve resilience, with opportunities in global markets 2025 where digitalization and the green transition can generate sustainable returns.

What economic risks 2025 should policymakers and businesses monitor in the Global Economy 2025, and where do opportunities in global markets 2025 lie?

Economic risks 2025 to watch include inflation persistence, policy missteps in major economies, elevated debt levels, geopolitical tensions, commodity price shocks, and climate-related disruptions. These risks could slow growth or tighten financial conditions, prompting stronger risk management, diversified supply chains, and investments in reskilling and inclusive growth. Opportunities in global markets 2025 lie in renewable energy, grid modernization and energy storage, the digital economy (cloud, cybersecurity, AI), healthcare innovation, and targeted infrastructure, especially where policy clarity and governance attract private capital.

| Area | Key Points | Strategic Takeaways |

|---|---|---|

| Key Driver: Technology-enabled productivity (digital/data-intensive sectors) | Digital and data-intensive sectors lift efficiency, reduce marginal costs, and make intangible assets central to growth. | Invest in data analytics, cloud, and interoperable ecosystems to expand margins even when input costs rise. |

| Key Driver: Energy transition and policy | Investment in renewables, storage, and grid modernization boosts productivity and reduces energy-price volatility; creates new sectors (green metals, electrified transport, climate-tech). | Enact coherent energy policies, streamline permitting, and incentivize private investment to sustain long-term growth. |

| Key Driver: Demographics and labor markets | Regions with favorable demographics and strong skills pipelines attract investment and sustain consumption; aging and skill mismatches can constrain potential output. | Invest in training, immigration policies, and automation to maintain labor force participation and shift the industry mix. |

| Key Driver: Supply-chain resilience and diversification | Firms rethink risk concentration and build geographically distributed networks, potentially boosting regional capex and reshoring. | Diversify suppliers, build regional hubs, and recalibrate industrial policy to balance openness with resilience. |

| Key Driver: Monetary policy normalization & fiscal coordination | Monetary normalization and fiscal coordination will shape inflation trajectories and credit conditions; price pressures persistent in some sectors require careful policy. | Adopt prudent fiscal frameworks and credible monetary rules to anchor expectations and support investment. |

| Risks to Watch | Inflation persistence, policy missteps, geopolitical tensions; high debt levels; commodity shocks; tech adoption and inequality; climate-related events. | Strengthen risk management, diversify supplier bases, invest in workforce reskilling, and maintain fiscal space. |

| Opportunities in Global Markets | Expansion of the digital economy, renewable energy infrastructure, healthcare innovations, and modernized infrastructure; growth in emerging markets via digital payments. | Invest in data governance, cybersecurity, climate tech, and public-private partnerships to capture scalable growth; expand financial inclusion tools in emerging markets. |

| Regional & Sectoral Outlook | US: tech-driven growth and consumer demand; EU: resilient domestic demand with energy-transition investments; Asia: China/India trajectories shaping global demand and trade. | Develop region-specific strategies and target sectors leading regional demand; align supply chains with regional dynamics. |

| Investor & Policy Implications | Diversified, resilient portfolios; policy credibility; investment in education and energy transition. | Balance risk, pursue secular growth themes, and align strategies with sustainable and inclusive growth. |

Summary

Global Economy 2025 is a tapestry of opportunities and risks that will shape investment horizons, corporate strategy, and public policy. The era will be defined by technology-enabled productivity, the energy transition, and more resilient yet redistributed global trade, alongside challenges from inflation pressures, debt burdens, and geopolitical tensions. Stakeholders should pursue diversified, resilient strategies, invest in skills and digital infrastructure, and support credible policy frameworks to capitalize on the upside of Global Economy 2025 while mitigating downside risks. By focusing on growth drivers such as digital transformation and sustainable investment, and by strengthening supply chains and governance, Global Economy 2025 can offer durable, inclusive growth for investors, firms, and societies alike.