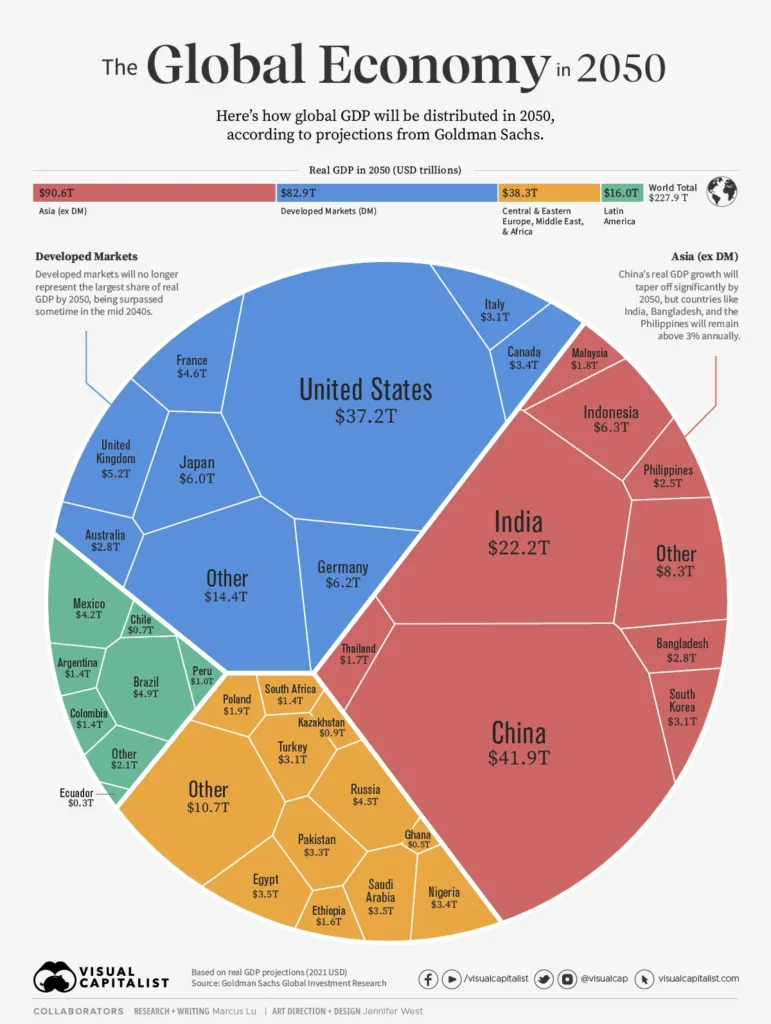

Global Finance Essentials opens the door to understanding how capital moves beyond borders in today’s interconnected markets. In a world of geopolitical shifts, inflation, and policy uncertainty, investors benefit from a framework that emphasizes disciplined planning and strategic execution. The guide highlights investing across borders as a pathway to diversify across geographies and sectors to smooth volatility. Key concepts cover cross-border investing strategies, currency risk management, international investment strategies, and global diversification to balance potential growth with prudent risk controls. By combining clear goals with low-cost vehicles and transparent cost structures, readers can translate these insights into a resilient, long-term plan.

Beyond the explicit terms, a broader lens highlights global finance fundamentals—how money moves through international markets and how macro trends shape risk and opportunity. Latent Semantic Indexing (LSI) principles suggest using related terms such as international markets basics, cross-border capital flows, currency exposure management, global investment themes, and regional diversification to signal relevance without repetition. This framing helps readers connect concepts like cost efficiency, governance, and regulatory diligence to the same objective: building a durable, globally informed portfolio.

Global Finance Essentials: A Practical Guide to Cross-Border Investing and Global Diversification

Global Finance Essentials provides a practical framework for investing across borders. By pursuing global diversification and disciplined asset allocation, investors can access growth across regions and currencies, reducing dependence on a single market. Implementing robust international investment strategies helps transform market noise into a structured plan that aligns with long-term goals while embracing cross-border opportunities.

Currency risk management becomes a core component of cross-border investing strategies. Hedging options such as forward contracts or currency-hedged funds can mitigate FX swings, but they come with costs and potential upside limiting effects. Balancing hedged and unhedged exposures, and regularly measuring net currency exposure, supports resilient performance and helps keep fees and tracking error in check as you pursue global diversification.

Mastering Currency Risk Management Within International Investment Strategies

Currency risk management is central to international investment strategies. Understanding how exchange rate movements affect portfolio returns helps you plan hedging policy, select suitable instruments, and gauge the cost of protection against volatility. Integrating currency risk tools with cross-border investing strategies supports steadier outcomes even when geopolitical events or policy shifts create short-term swings in FX markets.

Effective currency risk management also benefits from scenario planning and disciplined governance. Set hedging targets, monitor changes in net exposure, and rebalance as markets move. When combined with thoughtful cost control and tax considerations in foreign investments, currency risk management strengthens the overall resilience of your international investment strategies and enhances your capacity for global diversification.

Frequently Asked Questions

What is Global Finance Essentials and how does it guide investing across borders using international investment strategies and currency risk management?

Global Finance Essentials provides a disciplined framework for investing across borders. It combines international investment strategies with diversified global exposure and currency risk management to balance risk and opportunity. By emphasizing global diversification across geographies, asset classes, and currencies, it helps you build a resilient portfolio. The approach supports cross-border investing strategies through a mix of low-cost index exposure and selective active choices, while clearly addressing hedging decisions for currency risk. In practice, you define goals, choose hedging policy, and maintain costs and liquidity controls so your cross-border portfolio aligns with long-term objectives.

How do currency risk management and cross-border investing strategies support global diversification and robust international investment strategies?

Within the Global Finance Essentials framework, currency risk management is a core element of cross-border investing strategies and international investment strategies. By measuring net currency exposure and choosing hedging or unhedged approaches, you can reduce volatility while maintaining upside potential. Currency hedges—via forwards, currency-hedged funds, or hedged ETFs—can be used selectively based on costs and outlook. When integrated with global diversification across regions and asset classes, this discipline helps stabilize long-term returns and improve risk-adjusted outcomes, ensuring your portfolio reflects a balanced mix of international opportunities and home-country considerations.

| Topic | Key Points |

|---|---|

| Introduction | Global Finance Essentials frames cross-border investing in a turbulent world; emphasizes discipline, diversification, risk management, currency risk, cost awareness, and compliant planning. |

| The Global Financial Landscape Today | Macro factors drive cross-border flows: monetary policy cycles, currency movements, geopolitics, and commodity price volatility influence returns; diversification across geographies, asset classes, and currencies smooths results. |

| Why Invest Across Borders: Benefits | Diversification reduces idiosyncratic risk; access to different economic cycles can improve risk-adjusted returns; currency diversification cushions shocks; challenges include political risk, regulatory variance, taxes, and costs. |

| Core International Investment Strategies | Clear asset-allocation plan with passive/active mix; global/regional index exposure via low-cost ETFs/funds; regional tilts; currency-hedged vs unhedged decisions; emphasis on low fees, liquidity, and transparent holdings. |

| Currency Risk Management | Hedging options include forwards and currency-hedged funds/ETFs; hedging reduces FX volatility but adds cost and can dampen upside; unhedged exposure allows participation in currency trends; regularly measure net exposure and rebalance. |

| Regulatory, Tax, and Cost Considerations | Tax efficiency, reporting requirements, custody/settlement costs, and regulatory risk; monitor trading fees, fund expense ratios, custody costs, and currency conversion costs; perform cost-benefit analyses. |

| Building a Resilient Global Portfolio | Diversify across assets and regions; align geography with macro cycles; maintain liquidity; implement risk budgeting; incorporate ESG/themes; rebalance periodically; plan for scenario analysis. |

| Getting Started: Practical Roadmap | Define goals and risk tolerance; map baseline exposure; choose global/regional vehicles; set hedging policy; build a diversified initial portfolio; establish governance and review cadence; seek professional guidance when needed; stay informed. |

| Conclusion | Global Finance Essentials provide a robust blueprint for investing across borders in a turbulent world. By combining broad diversification with currency risk management, cost awareness, and regulatory diligence, you can capture international opportunities while controlling downside risk. |

Summary

Global Finance Essentials presents a structured approach to cross-border investing, emphasizing diversification, currency risk management, cost controls, and regulatory diligence to navigate a complex, interconnected global market.