If you’re looking to **download HDFC Securities dividend statement**, you’ve come to the right place! Obtaining your dividend statement is crucial for accurate income tax filing and effective financial planning. HDFC Securities simplifies this process by integrating dividend information within the Consolidated Account Statement (CAS) as well as the Profit and Loss statement. This comprehensive approach ensures that you have all the necessary information in one place, making tax compliance and financial management a breeze. In this guide, we’ll walk you through the easy steps to access your dividend statement so you can stay organized and informed.

When it comes to managing your investments with HDFC Securities, knowing how to retrieve your **dividend information** is essential. Many investors seek ways to obtain their **income reports** and **financial documentation** to facilitate their taxation processes and enhance their financial strategies. By utilizing tools such as the **CAS** and the **Profit and Loss statement**, you can access crucial insights concerning your dividend earnings and overall investment health. In this context, having a clear understanding of how to access these documents not only aids in compliance but also enhances your capacity for informed decision-making in your financial journey.

Understanding HDFC Securities and Dividend Statements

HDFC Securities serves as a vital hub for investors in India, enabling them to enhance their financial management through insightful tools and services. Among the essential documents investors need to maintain accurate financial records are the dividend statements, which detail the income received from investments in various financial instruments. By systematically tracking your dividends, you can ensure compliance with income tax regulations and support robust financial planning. Understanding how these statements integrate into the Consolidated Account Statement (CAS) is crucial for a comprehensive view of your investment activities.

The dividend statement, while not a standalone document from HDFC Securities, is amalgamated with the CAS and Profit & Loss statements. This integration allows investors to quickly assess their total dividends received over the financial year. With dividend income playing a significant role in financial planning, utilizing these consolidated resources is beneficial for strategic investments and tax efficiency. By regularly downloading these statements, you can keep a vigilant track of your investment performance and tax obligations.

How to Download HDFC Securities Dividend Statement

To download the HDFC Securities dividend statement seamlessly, investors must navigate through the process of obtaining their Consolidated Account Statement (CAS). By visiting the CAMS online portal, you can access your CAS, which encompasses all dividend information in a unified format. The steps are straightforward: from selecting the ‘Investor Services’ section to entering your registered details for verification, HDFC Securities ensures a user-friendly experience while enhancing the investors’ ability to manage their documentation effectively.

Once you have requested your CAS, the statement is sent directly to your registered email. This document will not only provide detailed dividend information but also offer insights into your entire financial landscape, including transactions and mutual fund details. Properly maintaining these records is paramount for efficient income tax filing, aligning with the advocated practice of organized financial planning. Remember to confirm that your email is correctly registered to receive your statements without delay.

Accessing Dividend Information Through HDFC Securities

When it comes to managing your investments, understanding how to access dividend information is essential. HDFC Securities integrates dividend details within the CAS and Profit & Loss statements. This means that while you may not see a separate dividend document, the information you need is readily available in these comprehensive reports. This setup allows for a clearer understanding of your financial landscape, reinforcing the importance of reviewing these statements regularly to see your dividend earnings.

Investors should familiarize themselves with accessing the Profit & Loss statement via their HDFC Securities account. This statement will outline all trading activities, including exact dividends received during selected periods. By analyzing this data, you can make informed decisions about future investments, enhancing your overall financial strategy. Therefore, leveraging these integrated statements becomes crucial in your journey towards effective financial management and compliance with tax obligations.

Step-by-Step Guide to Downloading CAS from HDFC Securities

Downloading the Consolidated Account Statement (CAS) from HDFC Securities is a straightforward process designed to empower investors in managing their dividend income efficiently. Start by visiting the CAMS portal and selecting ‘Investor Services,’ where you’ll find the option to request your CAS. By providing your necessary information, such as email and PAN, this step makes it simple for you to gain access to all your investment details, including vital dividend transactions.

Once the request is processed, your CAS will be emailed directly to you, showcasing a complete overview of your investments, including dividends received across various instruments. This document serves an essential role in your financial planning, giving a comprehensive understanding of your investment performance and what to expect during tax season. Ensure your email registration is always current to avoid missing any critical updates or statements.

Utilizing the Profit and Loss Statement for Financial Insights

The Profit and Loss statement is another invaluable tool provided by HDFC Securities that captures a detailed account of your trading activities, including all dividend earnings. By logging into your HDFC securities account and selecting ‘Profit & Loss Statement,’ you can gain insights into your financial performance over a chosen period. This functionality not only allows you to view dividends but also helps you analyze overall gains or losses from your investment portfolio.

By adjusting parameters such as financial year and asset type, investors can tailor their Profit and Loss statement to deliver the most relevant information for their financial scenarios. The ability to export this document in desired formats allows for easy sharing with financial advisors or accountants, reinforcing sound financial planning practices. Analyzing this information regularly ensures proactive adjustments in investment strategies and keeps you aligned with your financial goals.

Requesting an Alternative Dividend Statement from HDFC Mutual Fund

Investors also have the option to request a dividend statement directly from HDFC Mutual Fund, especially if mutual funds are a significant part of their portfolio. By visiting the HDFC Mutual Fund website and navigating to the request page, you can easily obtain your dividend statement. This alternative method complements the efforts made to keep track of overall financial performance and simplify income tax preparation.

It is important to have updated contact details when requesting these statements to ensure punctual delivery. Inputting your folio number and selecting the appropriate delivery method, whether via email or direct download, adds flexibility to how you receive your financial information. This choice not only aids in attaining timely access to needed documentation but also enhances your ability to file taxes accurately and plan financially.

The Importance of Accurate Dividend Tracking for Financial Planning

Tracking dividend income accurately is crucial for investors aiming to maintain sound financial health. By consistently reviewing your dividend statements from HDFC Securities, you empower yourself to make informed decisions based on realized income. This proactive approach positively contributes to effective income tax filing, ensuring you are not just compliant but also optimizing your tax obligations. Knowing the specifics of your dividends allows for greater insights into your investment performance.

Incorporating this information into broader financial planning enhances your overall strategy, allowing you to set realistic goals based on past earnings. The more familiar you are with how dividends impact your financial situation, the better prepared you will be to adapt your investment strategies to evolving market conditions. Ultimately, having accurate and easy access to your dividend statements can significantly improve your financial outlook.

Best Practices for Downloading Your Dividend Statement

To ensure a hassle-free experience when downloading your HDFC Securities dividend statement, it’s crucial to follow best practices. Start by regularly checking your registered email to confirm the timely receipt of your statements. Keeping your personal and contact details updated in both HDFC Securities and CAMS is essential for receiving all pertinent information without unnecessary delays. This preventive measure can help mitigate complications during tax season.

Additionally, take the time to familiarize yourself with the various reporting options available within your HDFC account. By knowing how to explore your CAS and Profit & Loss statements, you can streamline the download process, making it quicker and more efficient. Regularly downloading your statements enables you to keep tabs on your income, thereby supporting responsible financial planning and ensuring you are well-prepared for any tax obligations that arise.

Consulting with HDFC Securities for Personal Financial Guidance

Investors often benefit from seeking personalized advice, especially when dealing with complex financial scenarios involving dividends. HDFC Securities offers resources and customer support to help clients navigate their investment journeys effectively. Consulting with a financial professional or representative can provide valuable insights tailored to your specific financial situation, particularly regarding income from dividends and its implications on tax filing.

These consultations can guide you on best practices for managing your investments and enhancing your overall financial strategy. With access to expertise within HDFC Securities, investors can make data-driven decisions, reinforcing their commitment to sound financial management. Ultimately, engaging with knowledgeable professionals not only adds to your understanding of dividend statements but also aligns your financial actions with your broader investment goals.

Frequently Asked Questions

How can I download my HDFC Securities dividend statement for tax filing?

To download your HDFC Securities dividend statement for income tax filing, you can access the Consolidated Account Statement (CAS) through the CAMS online portal. Follow these steps: Visit the CAMS portal, select ‘Investor Services’, request your CAS by entering necessary details, set a password for your PDF, and check your email for the statement which includes all dividends and transactions.

Where can I find my dividend details from HDFC Securities?

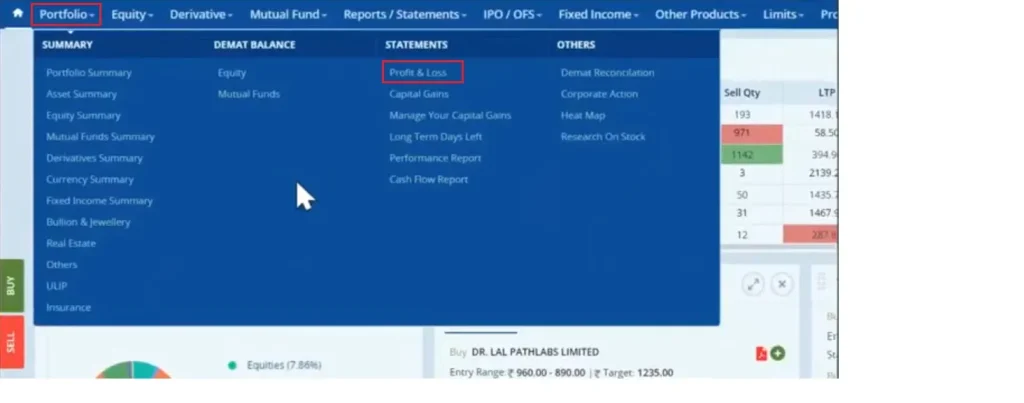

Dividend details from HDFC Securities can be found in the Profit and Loss (P&L) statement. Log into your HDFC Securities account, navigate to ‘Portfolio’, select ‘Profit & Loss Statement’, and choose the desired parameters such as financial year and asset type. Then, download your P&L statement to view your dividend information.

What is the Consolidated Account Statement (CAS) in HDFC Securities?

The Consolidated Account Statement (CAS) in HDFC Securities provides a holistic view of your investments, including mutual funds and depository transactions. It integrates dividend information, making it easier for you to track your total dividends received during a financial year, which is essential for income tax filing.

Can I download my HDFC Securities dividend statement through HDFC Mutual Fund?

Yes, if you have invested in mutual funds through HDFC, you can request a dividend statement directly from HDFC Mutual Fund’s official website. Enter your folio number, select ‘Dividend Statement’, and choose your delivery method to download or receive it by mail.

What should I do if I encounter issues downloading my HDFC Securities dividend statement?

If you face issues downloading your HDFC Securities dividend statement, ensure your email and contact details are up-to-date in your account. You can also contact HDFC customer service for assistance or consult their FAQs for additional guidance.

Is it necessary to download the dividend statement for financial planning?

Yes, downloading your HDFC Securities dividend statement is crucial for effective financial planning and income tax compliance. The statement provides an accurate record of your dividend income, which is necessary for calculating taxes and assessing your investment performance.

| Step | Description |

|---|---|

| 1 | Visit the CAMS online portal |

| 2 | Select ‘Investor Services’ section |

| 3 | Click on ‘CAS – CAMS, Karvy, FT, or SBFS’ tab |

| 4 | Enter your registered email, mobile number, and PAN |

| 5 | Set a new password for your statement PDF |

| 6 | Receive your CAS via email containing dividend details |

| 7 | Log in to HDFC Securities for P&L statement |

| 8 | Select the ‘Portfolio’ option, then ‘Profit & Loss Statement’ |

| 9 | Choose year and asset type, then export the statement |

Summary

To download your HDFC Securities dividend statement, you can easily follow the steps outlined above for an efficient income tax filing process. This guide provides you with methods to obtain your statements through HDFC’s online resources, ensuring you have all necessary financial documentation ready for tax compliance. Whether you choose to download the consolidated account statement or access the profit and loss statement, staying on top of your dividend records is an integral part of prudent financial management.