Economic indicators are the compass professionals use to gauge the health of an economy. By tracking data on production, spending, jobs, prices, and confidence, you can form a clear picture of whether growth is underway. Leading economic indicators reveal early clues about turning points, while Economic health signals help frame the momentum for policymakers and businesses. GDP growth and unemployment are core benchmarks that tie the data to real-world outcomes. This primer shows How to read economic indicators so you can turn headlines into decisions.

To fit Latent Semantic Indexing principles, the discussion uses related terms such as macro data signals, economic barometers, and market health metrics to describe the same dynamics. This approach mirrors how search engines group related concepts around growth, inflation, employment, and demand, helping readers connect ideas without repetition. Alternative phrases like economic barometers, the climate of the economy, or the health of the business cycle broaden understanding while staying on topic. In practice, these LSI-aligned terms help investors and planners interpret shifts in activity, inflation, and labor trends alongside GDP and spending data.

Economic indicators for investors: reading leading indicators, GDP growth, and unemployment

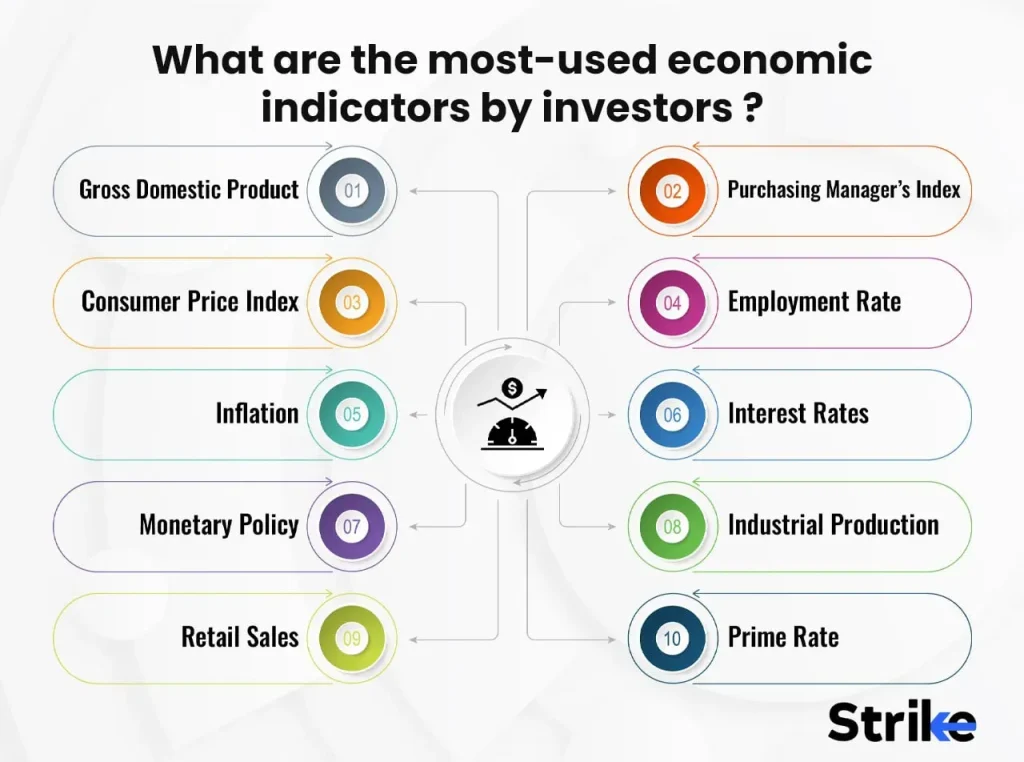

Economic indicators serve as a compass for investors, helping you sense the economy’s trajectory before headlines confirm it. By watching leading indicators such as stock market performance, consumer confidence, new orders for durable goods, housing permits, and shifts in interest rate expectations, you catch early clues about where demand and production are headed. These signals often foreshadow the pace of GDP growth and the direction of unemployment, letting you position portfolios or plans ahead of the crowd.

To apply this insight, create a compact dashboard that blends leading indicators with official measures of GDP growth and unemployment. Source data from BEA and BLS, track sentiment surveys, manufacturing orders, and housing activity, and compare them with early trends in GDP and the job market. This practical approach aligns with Economic indicators for investors and follows how to read economic indicators by linking early signals to likely outcomes rather than reacting to a single data point.

Economic health signals: interpreting coincident and lagging indicators for informed decisions

Beyond the early clues, coincident indicators reveal the economy’s current tempo and overall health signals. GDP, total employment, personal income, consumer spending, industrial production, and retail sales provide a ground-level read on whether activity is expanding or cooling. Analyzing these indicators together helps you gauge current momentum and assess whether the economy is holding steady amid shocks or showing stress in real-time.

Lagging indicators offer confirmation after a trend has begun, such as the unemployment rate, inflation measures like the CPI, corporate profits, and productivity costs. These metrics help validate whether a soft landing is holding or a downturn is gathering speed, supporting policy analysis and business risk management. Used in concert with leading and coincident signals, they form a robust check on GDP growth and unemployment trends, reinforcing a disciplined decision process for investors and planners.

Frequently Asked Questions

What are leading economic indicators and how can they signal future changes in GDP growth and unemployment?

Leading economic indicators are statistics that tend to change before the broader economy does. They provide early clues about turning points and help anticipate shifts in GDP growth and unemployment. Common examples include stock market performance, consumer confidence, new orders for durable goods, building permits, and shifts in interest rate expectations. By monitoring several leading indicators together, you can gauge whether growth may pick up or slow down before a trend is visible in GDP or unemployment.

How to read economic indicators for investors and business planning to assess economic health signals?

A practical approach is to build a dashboard of 4–6 indicators across leading, coincident, and lagging categories. Track releases on a schedule and compare related indicators to form a coherent trend, with GDP growth and unemployment as key benchmarks. For investors, these economic indicators for investors help time entries and manage risk; for businesses, coincident and lagging signals guide hiring, pricing, and expansion plans. Don’t rely on a single data point; look for consistent movements over several periods.

| Topic | Key Points |

|---|---|

| What are Economic Indicators? | Statistics about economic activity; cover production, employment, prices, and confidence; indicate expansion, stagnation, or downturn; guide investing, planning, and policy. |

| Why They Matter | Help policymakers calibrate monetary and fiscal policy; inform investors and businesses about timing and risk management; translate macro trends into implications for employment, living costs, and growth prospects. |

| Types of Indicators | Indicators are categorized into three groups—leading, coincident, and lagging—each signaling different phases of the economic cycle. |

| Leading Indicators (examples) |

|

| Coincident Indicators (examples) |

|

| Lagging Indicators (examples) |

|

| How to Read Indicators in Context |

|

| Investors and Business Planning |

|

| Practical Monitoring Approach |

|

| Limitations |

|

Summary

Economic indicators are essential tools for understanding the health of the economy. By differentiating leading indicators, coincident indicators, and lagging indicators, you can anticipate shifts, gauge current momentum, and confirm trends. Whether you’re an investor, a business leader, or a policy analyst, a balanced indicators framework translates macro signals into informed decisions, risk management, and strategic planning. As the economy evolves, staying attuned to these signals helps you navigate headlines with clarity and confidence.