Fiscal policy and the economy shape how nations manage demand, allocate resources, and pursue sustainable growth. Two main levers—government spending and economic growth—shape the level and composition of activity. A key signal of policy impact is the fiscal policy effects on GDP, showing how investment choices and revenue design translate into shorter slumps and steadier expansion. Policy trade-offs emerge when budgets are tight, since borrowing, spending, and revenue decisions can boost short-run stabilization while affecting long-run capacity. This introductory overview highlights the channels through which fiscal policy influences growth, resilience, and living standards over time.

In broader terms, the discussion translates into how public spending, revenue policy, and the government’s fiscal stance shape demand, investment, and long-run capacity. Applying Latent Semantic Indexing principles, we frame the topic with related ideas such as budgetary policy, deficits and debt dynamics, stabilization mechanisms, and the productivity effects of public investment. This approach helps readers connect concepts like tax design, open economy spillovers, and macro stability to the same growth objective. By using alternative terms, the explanation remains accessible while aligning with search intent across related topics.

Fiscal policy and the economy: How spending and taxation shape stabilization and growth

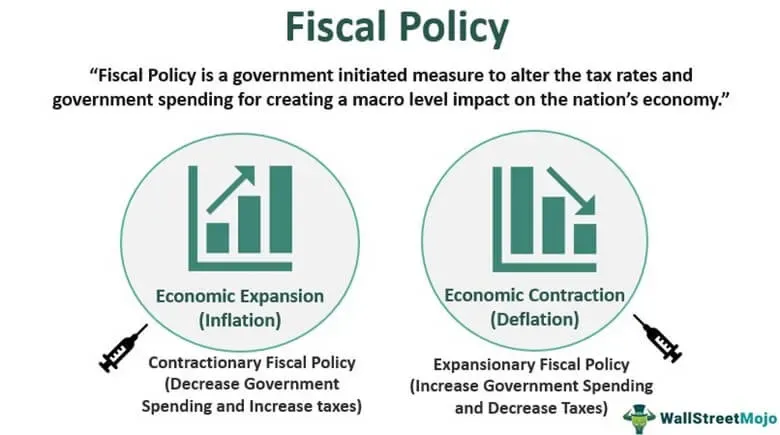

Fiscal policy shapes demand, resource allocation, and living standards by adjusting government spending and taxation. These instruments influence the level and composition of economic activity and interact with automatic stabilizers to cushion shocks while discretionary measures steer cycles. The connection between government spending and economic growth is central to macro outcomes, as is how tax policy and economic growth are affected by changes in revenue use and incentives.

In the long run, growth hinges on productive investments funded by spending—education, health, infrastructure—and on tax design that preserves incentives to work, save, and invest. The fiscal policy effects on GDP depend on how revenue is raised and deployed, and on whether public resources boost productivity rather than crowd out private activity. Well-directed public investment can raise total factor productivity and shift the growth path, underscoring the central link between fiscal policy and the economy.

Budget deficits and macro stability: Balancing debt, credibility, and investment

Deficits can stabilize demand during recessions when monetary policy is constrained or interest rates are low, providing a countercyclical buffer. However, persistent deficits and rising debt relative to GDP raise concerns about macro stability, crowding out of private investment, and higher financing costs. The discussion centers on how budget deficits and macro stability are balanced to support both near-term relief and sustainable growth.

Policy credibility, rules-based budgeting, and well-timed interventions are essential for the macroeconomic impact of fiscal policy. Debates focus on debt sustainability, the efficiency of public investments, and how open-economy spillovers shape growth. A credible framework that aligns deficits with growth-enhancing investments can preserve macro stability and promote GDP growth, illustrating that the macroeconomic impact of fiscal policy hinges on design, sequencing, and governance.

Frequently Asked Questions

How does fiscal policy influence the economy during a recession through government spending and tax policy?

During a downturn, expansionary fiscal policy can bolster the macroeconomy by raising aggregate demand through higher government spending and targeted tax relief. These actions affect the fiscal policy effects on GDP by supporting output and reducing unemployment, with credibility and expenditure efficiency shaping long-run growth and macro stability. When spending is productive and well-timed, the short-run stimulus can translate into higher potential output over time.

What is the relationship between budget deficits, debt, and macro stability within the context of fiscal policy and the economy?

Deficits can stabilize demand when private spending falters, supporting GDP and employment. However, persistent deficits and rising debt threaten macro stability if debt grows faster than the economy and financing costs rise, potentially crowding out private investment. The macroeconomic impact of fiscal policy depends on whether deficits finance high-return investments that raise productivity and growth, versus unproductive spending.

| Theme | Description | Notes |

|---|---|---|

| Short-run stabilization vs. long-run growth | In the short run, fiscal policy stabilizes fluctuations in economic activity: expansionary measures raise aggregate demand and reduce unemployment; contractionary measures cool the economy to prevent inflation. Automatic stabilizers and discretionary policy shape the fiscal stance. | Multiplier effects depend on resource use, openness, monetary stance, and how spending translates into services or infrastructure; near full capacity can reduce impact and raise inflation risk. |

| Government spending and growth: mechanics | Public spending raises demand via a short-run multiplier; in the long run, well-targeted investments (infrastructure, education, R&D, health) raise productivity and potential output. | Efficiency and timing matter; crowding out and investment responses depend on capacity and the policy mix. |

| Tax policy and growth: incentives and outcomes | Tax policy shapes incentives to work, save, invest, and take entrepreneurial risk. Moderate, well-designed taxes fund essential services without unduly distorting decisions; high taxes can dampen growth. | Revenue use matters: supporting productive investments vs. nonessential spending; macro impact hinges on design, timing, and allocation. |

| Budget deficits, debt, macro stability | Deficits can stabilize downturns, especially when monetary policy is constrained. Persistent deficits and high debt raise concerns about sustainability and crowding out; deficits can finance investments with net benefits if growth keeps up. | Credible fiscal rules anchor expectations and determine long-run space for shocks. |

| Policy design, timing, credibility | Time lags blunt impact; automatic stabilizers cushion shocks; credibility matters for expectation-driven behavior. Rules-based frameworks vs discretionary actions affect macro outcomes. | Discretion vs rules balance shapes stability and policy effectiveness. |

| Global considerations and spillovers | Fiscal policy interacts with monetary policy and exchange rate dynamics in open economies; policy in one country can affect others through rates, investment, and currency movements. | Coordination and international context matter; spillovers can amplify or dampen domestic effects. |

| Case illustrations and lessons | Expansionary measures during downturns cushion demand and support employment; debt and inflation risks require careful design and targeting. | Investment quality and alignment with priorities influence outcomes. |

| Towards a balanced perspective | Fiscal policy and the economy operate as a dynamic system where spending and tax incentives, debt management, and credible commitments interact to foster sustainable growth. | A balanced approach emphasizes high-return investments, productivity, and prudent fiscal space. |

Summary

Conclusion content generated separately.