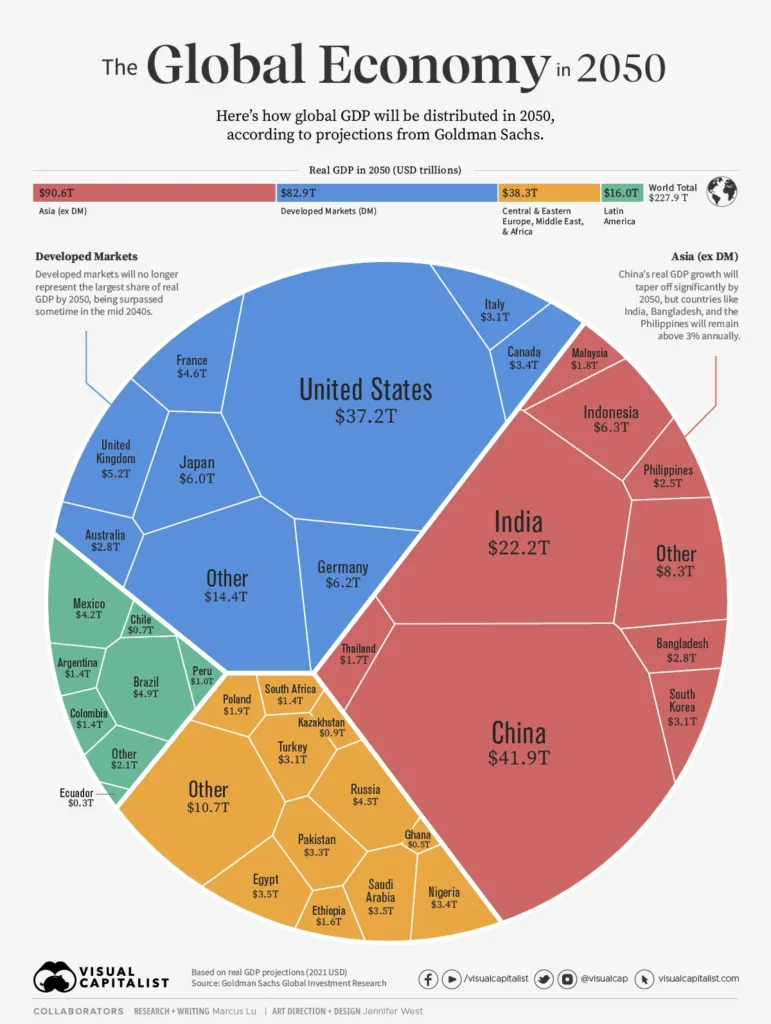

Global Finance 2025 stands at a pivotal crossroads where markets, regulation, and investment choices intersect to shape the year ahead, demanding a clear-eyed view of how Markets 2025 and Regulation changes 2025 will influence portfolios, risk controls, and capital allocation across diverse geographies, sectors, and time horizons in a world of rising data, transparency, and evolving corporate governance. This period offers both challenges and opportunities as economies recalibrate after shocks, technology accelerates adoption across payments and custody, and policymakers adjust to new realities, with a practical emphasis on Investment tips 2025 that can guard against missteps, capitalize on liquidity windows, and strengthen resilience in both defensive and growth-oriented strategies. By unpacking the implications of the Global economy 2025 and observing how macro drivers interact with earnings quality, balance-sheet strength, and productivity gains, we create a practical map for investors, business leaders, and policy observers; one that translates abstract forecasts into concrete decision criteria around asset allocation and time horizons. In this guide, we examine how Fintech and finance trends 2025 are reshaping access to capital, risk pricing, settlement speed, and governance, helping readers connect rapid technology shifts with traditional asset classes, cross-border flows, and the evolving role of non-bank intermediaries in a more connected, competitive market environment. The aim is to offer context, frameworks, and actionable steps that align with current realities and longer horizons, so readers can navigate a volatile but opportunity-rich landscape with discipline, curiosity, and a disciplined approach to risk management.

Viewed through a different lens, the year ahead in global finance unfolds as a shifting market cycle, evolving policy framework, and capital-allocation dynamics that shape risk and opportunity across regions. The regulatory framework is recalibrating in ways that influence credit availability, disclosure standards, and cyber resilience, while technological disruption accelerates cost efficiency, new business models, and the speed of settlement. From a portfolio perspective, readers should translate these macro currents into diversification strategies, liquidity buffers, and scenario planning that account for inflation, growth deceleration, and currency volatility. Additionally, the wave of fintech innovation—ranging from digital wallets to AI-powered analytics—offers new tools for governance, transparency, and access to capital, reinforcing the need for prudent risk oversight. In short, the broader conversation centers on aligning financial objectives with a rapidly changing environment by focusing on fundamentals, resilience, and adaptable execution.

Global Finance 2025: Mastering Markets 2025, Regulation changes 2025, and Investment tips 2025 in a Shifting Global Economy

Global Finance 2025 stands at a pivotal crossroads where markets, policy, and investment choices intersect to shape the year ahead. The Markets 2025 narrative emphasizes normalization after unprecedented stimulus and a growing role for technology in pricing, liquidity, and risk assessment. As the global economy 2025 evolves, asset prices increasingly reflect real growth, productivity, and policy signals rather than speculative fervor. Investors should track sector rotations driven by inflation expectations, interest-rate paths, and the integration of digital platforms into traditional industries. This landscape requires disciplined risk management, diversified exposure, and a focus on fundamentals such as earnings quality, cash flow, and balance sheet strength.

From a practical standpoint, Global Finance 2025 invites a framework that blends core index exposure with selective, research-driven stock picks and high-quality fixed income to weather shifting rates and inflation. The interplay among equities, bonds, and real assets in 2025 calls for nuanced asset allocation, robust governance, and transparent risk reporting. The language of Markets 2025 should guide portfolio reviews, ensuring alignment with time horizons and liquidity needs while recognizing that policy signals, currency movements, and geopolitical developments can redefine risk and opportunity. By incorporating the term investment tips 2025 into planning, investors can build resilient portfolios that balance growth potential with downside protection, positioning themselves to capture value in a more transparent, tech-enabled market environment.

Regulation changes 2025 and Fintech trends 2025: Navigating Compliance, Innovation, and Opportunity in Global Finance 2025

Regulation changes 2025 outline how policymakers are adapting to rapid fintech innovation, data-intensive business models, and evolving risk dynamics. The regulatory landscape is a blend of tighter oversight in some sectors and measured deregulation in others to stimulate investment and innovation, with a strong emphasis on data transparency, cybersecurity, and resilience. For investors and corporate treasuries, understanding Regulation changes 2025 is essential for assessing counterparty risk, governance quality, and the credibility of disclosures. Disclosure standards, capital requirements for systemic entities, and the scrutiny of non-bank financial intermediaries all shape how risks are priced and managed in today’s markets.

In tandem, Fintech and finance trends 2025 are redefining access, speed, and governance. Real-time settlement, digital wallets, algorithmic trading, and enhanced data analytics are lowering barriers to entry while elevating the importance of platform risk and governance structures. Investors should monitor how these technologies affect liquidity, cyber risk, and product transparency, integrating regulatory expectations into investment theses and ESG considerations. The practical takeaway is to couple rigorous due diligence with scenario planning, ensuring that governance frameworks, ESG claims, and contractual protections keep pace with fintech-enabled disruption. Aligning Regulation changes 2025 with Fintech trends 2025 helps build resilient strategies that can adapt to a shifting global economy 2025 while safeguarding long-term value.

Frequently Asked Questions

What does Global Finance 2025 imply for investors, and how should Markets 2025 dynamics influence portfolio decisions?

Global Finance 2025 signals a period of normalized volatility complemented by technology-driven shifts in capital flow and risk pricing. In Markets 2025, investors should anchor portfolios with diversified core exposures, add selective stock ideas backed by earnings quality, and maintain high-quality fixed income to navigate rate moves. Emphasize disciplined risk management, liquidity, and transparent performance reporting, while watching sector rotations driven by inflation expectations and policy signals. Consider Fintech and finance trends 2025 as drivers of efficiency, access, and new risk-aware opportunities.

How do Regulation changes 2025 impact strategy within Global Finance 2025, and what role do Fintech trends 2025 play in Investment tips 2025?

Regulation changes 2025 reshape data transparency, capital requirements, disclosures, and cyber risk oversight. For Global Finance 2025, weave these rules into due diligence, governance assessment, and counterparty risk analysis, ensuring credible ESG claims. In Investment tips 2025, adapt by balancing core index exposure with tactical tilts, preserving liquidity for policy-driven moves, and integrating Fintech trends 2025 to enhance data access, settlement speed, and risk analytics.

| Theme | Key Points | Practical Takeaways |

|---|---|---|

| Markets 2025 |

|

|

| Regulation changes 2025 |

|

|

| Investment tips 2025 |

|

|

| Global economy 2025 dynamics |

|

|

| Fintech and finance trends 2025 |

|

|

Summary

Table summarizes key themes for Markets 2025, Regulation changes 2025, Investment tips 2025, Global economy 2025 dynamics, and Fintech and finance trends 2025 with practical takeaways.