Global Market Cycles shape how economies grow, slow, and adjust, guiding businesses, investors, and policymakers. Understanding these cycles through cycle analysis reveals where the global economy cycles are likely to turn, helping readers grasp business cycle stages and macro trends. By watching economic indicators such as inflation, employment, and production, readers can spot turning points within the cycle. This SEO-friendly overview links cycle dynamics with cross-border impacts, showing how global markets respond to policy shifts and demand changes. The practical lens makes the topic accessible for leaders and analysts seeking smarter allocation of resources across regions.

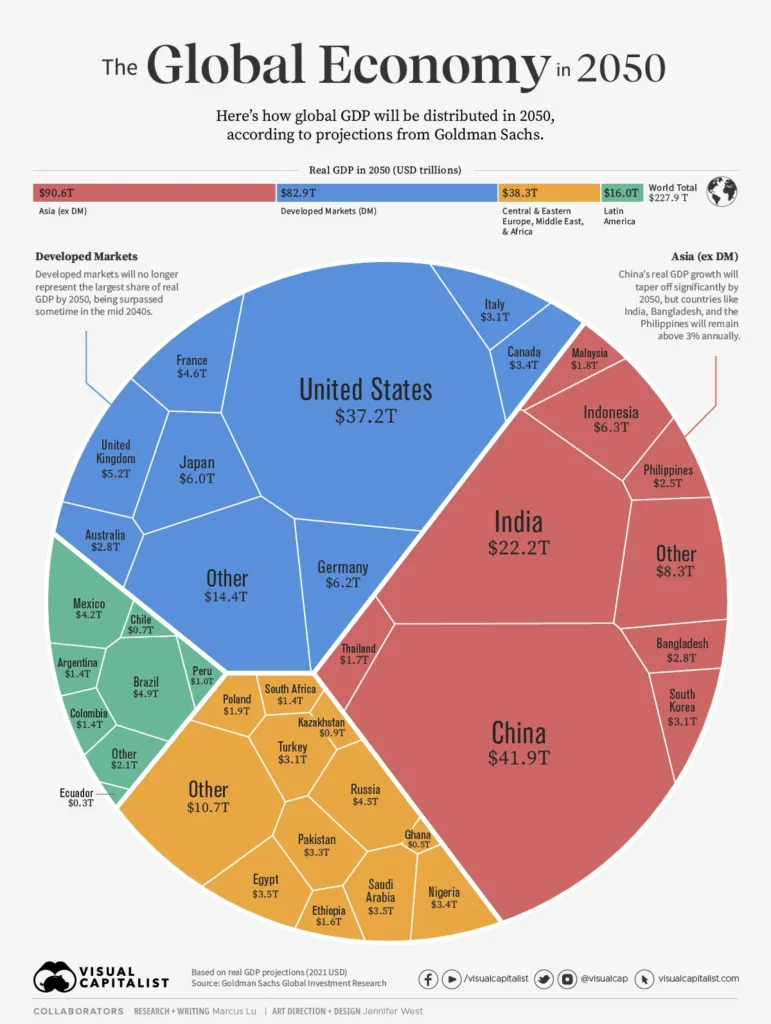

Across borders, these recurring macroeconomic rhythms shape how growth accelerates and slows, influencing investment decisions. Instead of a single country focus, readers glimpse the global business cycle phases and the interplay of policy, credit, and demand. LSI-friendly terms like cyclical dynamics, economic indicators, and macro trends appear as related signals readers watch. This framing helps analysts connect regional patterns with commodity cycles, exchange rates, and geopolitical developments. By mapping these patterns to likely scenarios, businesses and investors can prepare for shifts without needing perfect precision.

Global Market Cycles: Reading the Global Economy Cycles to Anticipate Turning Points

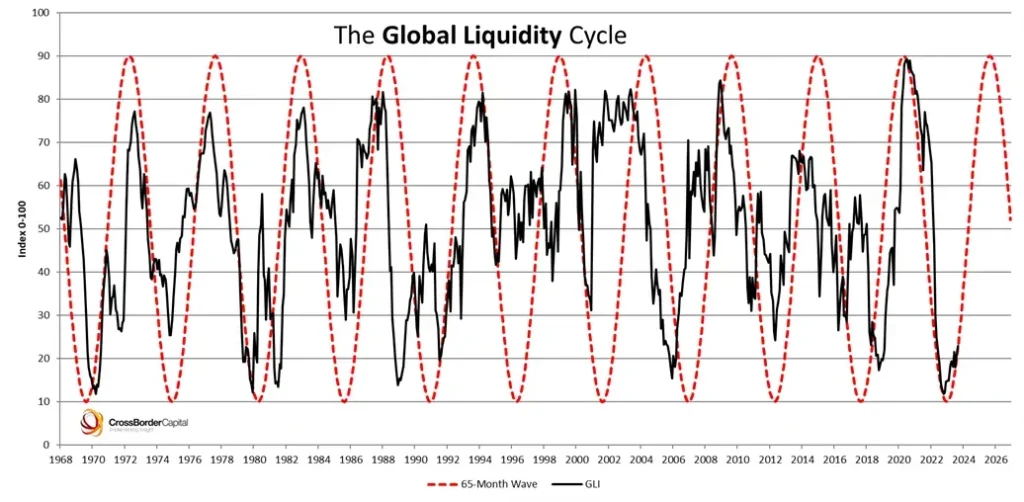

Global Market Cycles describe the recurring patterns of growth, slowdown, and adjustment that cross borders. To read these cycles, focus on the signals that emerge from global economy cycles, linking demand and supply with policy and sentiment. Cycle analysis helps you identify where expansion is strongest, where momentum is waning, and how macro trends are shaping the trajectory across regions. By grounding decisions in economic indicators and cross-regional dynamics, you can anticipate turning points rather than chase every short-term fluctuation.

In practice, watch for the interplay between leading indicators (such as new orders, confidence surveys, and financial signals) and regional growth patterns. These signals, when framed by macro trends like productivity gains or debt dynamics, reveal how close we are to a peak or a trough. Understanding global market cycles means recognizing that cycles operate at multiple scales—from regional and sectoral shifts to global patterns—so your strategy aligns with the broader rhythm rather than a single country’s volatility.

Cycle Analysis in Practice: Navigating Business Cycle Stages with Economic Indicators and Macro Trends

The four stages of the business cycle—expansion, peak, contraction, and trough—form the backbone of how Global Market Cycles unfold across economies. Cycle analysis translates these stages into actionable insights by monitoring real-time data on inflation, employment, productivity, and investment. As growth accelerates, profits widen and asset prices adjust; in a contraction, unemployment rises and risk is reassessed. Linking these observations to macro trends helps explain why some regions outpace others and how policy responses may extend or shorten a cycle.

To apply this framework, gather data across key pillars—real GDP growth, inflation, unemployment, productivity, and consumer spending—while also tracking external indicators like export orders and capital expenditure plans. Compare cross-regional patterns and consider policy trajectories from central banks and governments. Build scenarios (base, bull, bear) that account for external shocks such as geopolitical events or technology breakthroughs, and stress-test portfolios or business plans against changing cycle stages and macro trends to stay resilient through the inevitable ebbs and flows of the market.

Frequently Asked Questions

How do Global Market Cycles interact with macro trends and economic indicators to influence investment decisions?

Global Market Cycles describe the rhythm of expansions and contractions in the world economy. Macro trends—such as productivity gains, demographics, and technology—and policy dynamics can extend or shorten cycle phases, while economic indicators help you read turning points. In cycle analysis, early expansion often favors cyclical sectors, while approaching peak or contraction calls for more balance with defensive assets; monitoring cross-regional indicators helps assess synchronization and risk.

What practical framework do Global Market Cycles provide for businesses to read the global economy cycles and anticipate turning points using cycle analysis and business cycle stages?

A practical framework starts with gathering data on real GDP, inflation, unemployment, productivity, and consumption, plus external indicators like export orders and capex. Then identify turning points by shifts in growth momentum and policy stance, compare regional patterns, and consider policy responses. Use cycle analysis to build base/bull/bear scenarios and stress-test strategies, anchored in the four business cycle stages—expansion, peak, contraction, and trough—and mindful of how global linkages can accelerate or dampen moves.

| Aspect | Key Points | Practical Takeaway |

|---|---|---|

| Global Market Cycles | Recurring fluctuations in global economic activity that cross borders and affect financial markets, trade, investment, and employment. | Read the signals to inform decisions for businesses, investors, and policymakers. |

| Scales of Cycles | Global patterns spanning years; regional patterns across the Americas, Europe, Asia, and emerging markets; sectoral patterns (manufacturing vs. services, etc.). | Read cross-regional and sectoral signals to gauge cycle position. |

| Core Concepts | Two intertwined ideas: the evolution of the real economy and the response of financial markets; expansions and contractions; asset prices reflect growth expectations. | Consider macro dynamics and market pricing together to interpret cycles. |

| Indicators | Leading indicators (new orders for durable goods, consumer confidence, certain financial signals); Coincident indicators (real GDP, employment, industrial production); Lagging indicators (unemployment duration, inflation, corporate profits). | Use a mix of indicators and compare regions to spot turning points. |

| Four Stages | Expansion, Peak, Contraction, and Trough; cross-border linkages can affect synchronization. | Identify current stage and how regional linkages influence global timing. |

| Practical Framework | Pillars: real GDP growth, inflation, unemployment, productivity, and consumer spending; Identify turning points; Cross-regional patterns; Policy responses; Scenario planning; Stress testing. | Follow a structured process to analyze cycles and test resilience. |

| Applications | Businesses align inventory, pricing, and hiring with anticipated demand; Investors align portfolios with the cycle stage; Simple three-step framework for individuals. | Adopt cycle-aware strategies for resilience and growth. |

| Risks & Limitations | Cycles are influenced by complex, multi-layered forces; risks of over-relying on a single indicator; imperfect synchronization across regions; policy surprises and shocks. | Use diversified, scenario-based planning and ongoing reassessment. |

| Case in Point | The 2008 financial crisis and the 2020 COVID-19 shock show how quickly global market dynamics can shift; rapid policy responses and re-pricing of risk across markets; macro trends like digital acceleration and energy transitions can redefine cycles for years. | Learn from past cycles to adapt to evolving macro forces. |

Summary

Global Market Cycles offer a practical lens for interpreting the ebbs and flows of the global economy. This descriptive overview highlights how the broad economy and financial markets interact, how turning points emerge, and how a cycle-focused framework can inform strategy across businesses, investments, and policy-making. By recognizing patterns across global, regional, and sectoral dimensions, readers can better anticipate shifts in demand, prices, and policy stances. The framework emphasizes reading leading, coincident, and lagging indicators, analyzing cross-regional dynamics, and stress-testing plans against diverse scenarios. While uncertainty remains, disciplined cycle analysis helps navigate expansions and slowdowns with greater resilience and foresight. In short, Global Market Cycles are a toolkit for interpretation and decision-making in a complex and interconnected world.