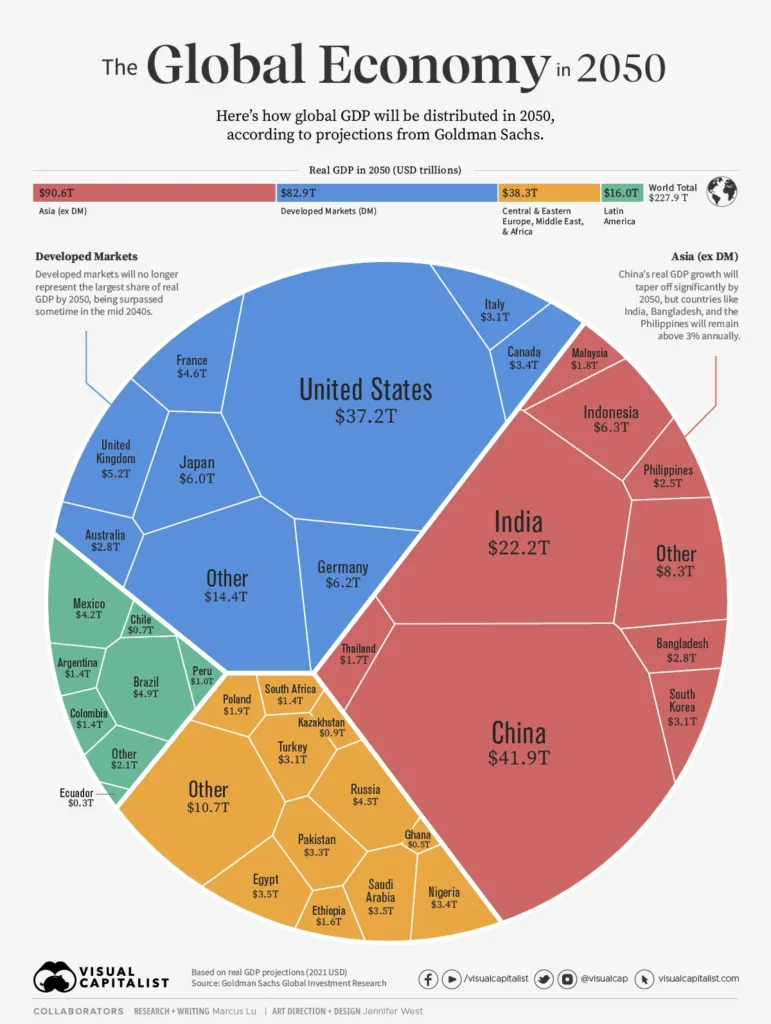

Global Market Entry decisions stand at the crossroads of opportunity and risk, guiding how a business moves beyond its home market to compete in a more interconnected world. In today’s global economy, a deliberate plan turns ambition into a practical road map, aligning product strategy, regulatory readiness, and local engagement to win new customers. Expanding thoughtfully into additional regions can unlock revenue streams, diversify resilience, and sharpen the brand’s appeal across diverse consumer landscapes. This guide translates complexity into a clear sequence of steps—thorough market research, regulatory screening, localization, pricing considerations, and a go-to-market plan designed to scale across multiple markets. By articulating objectives, sequencing commitments, and maintaining disciplined execution, your organization can move from idea to impact with confidence and measurable momentum.

Viewed through a broader lens, cross-cultural and cross-border growth can be framed as a deliberate march into foreign markets where local preferences and rules shape the value you offer. A practical way to honor this framing is to treat cross-border market entry as a shared journey—balancing speed with governance, and adapting products and messages to fit regional realities. By highlighting the same objective with different labels, you enable teams to speak a common language while focusing on customers, compliance, and channel strategy. This semantic flexing also supports SEO and user comprehension by mapping related concepts to the same underlying goal of sustainable, scalable growth beyond the home market.

Global Market Entry Strategy for Regional Expansion: Planning, Risk, and Sustainable Growth

To design an effective global market entry strategy for regional expansion, begin with clear objectives aligned to growth targets, risk tolerance, and resource planning. Identify regions with the strongest market size and fastest growth, and decide whether to pursue a staged regional expansion to manage capital outlay and learning curves. This approach turns ambition into action by embedding cross-border market entry considerations into a coherent plan that guides entry mode, localization priorities, and timing.

Thorough market research and regulatory screening form the backbone of a successful global market entry strategy. Deep dives into customer needs, price sensitivity, distribution channels, and the competitive set illuminate regional expansion opportunities, while regulatory due diligence, including tariffs, labeling, data privacy, and registrations, reduces post-launch risk. Map entry modes—export, license, joint venture, or direct investment—to objectives and timelines, recognizing that each path shapes cost, control, and speed to market within the broader international market entry framework.

Cross-Border Market Entry Fundamentals: From Research to Localized GTM for International Market Entry

Cross-Border Market Entry requires a disciplined blend of research, localization, and partner-enabled channels to succeed across borders. Start with rigorous due diligence on regulatory environments, currency considerations, and local demand signals to inform a practical international market entry plan. Align product features, pricing, and messaging with regional preferences while preserving core brand value, enabling a mindful cross-border market entry that scales with confidence.

Operational readiness, local capabilities, and a robust GTM are essential for sustainable cross-border success. Build local teams or partners who understand customer needs, establish scalable processes for order management and compliance, and deploy technology that supports multilingual support and localized pricing. Create dashboards to monitor revenue, customer acquisition, churn, and delivery performance, using these insights to drive a learning-driven iteration cycle for international market entry and to support ongoing regional expansion.

Frequently Asked Questions

What is Global Market Entry and how does it guide regional expansion and cross-border market entry decisions?

Global Market Entry is the deliberate process of moving a business beyond its home market to serve customers in other regions. It combines market research, regulatory screening, localization, and go-to-market execution to establish sustainable, scalable operations. A sound Global Market Entry plan informs regional expansion and cross-border market entry decisions by defining clear objectives, conducting thorough market research, selecting appropriate entry modes, assessing competitive dynamics, building local capabilities, and implementing a localized GTM—then monitoring results and iterating based on learning.

Which entry modes are recommended in a Global Market Entry strategy for successful international market entry?

Entry modes under a Global Market Entry strategy should align with objectives, risk tolerance, capital, and speed to market. Options include exporting, licensing or franchising for rapid scaling, joint ventures to share local know-how, and wholly owned subsidiaries for maximum control. The right mix depends on market potential and regulatory context; tailor the approach to regional realities, leverage local partners when beneficial, and integrate the chosen mode with a localized GTM and regional expansion plan to ensure a cohesive international market entry.

| Step | Focus | Key Takeaways | Strategic Impact |

|---|---|---|---|

| 1. Define Objectives & Scope | Objectives & Scope | • Identify regions with high potential (market size, growth, competition, access to customers). • Define success metrics (revenue, market share, CAC). • Decide between single-sweep vs staged rollout. • Provides a clear foundation for resource allocation and decision-making. | Sets the strategic direction and resource plan for entry mode choices and localization priorities. |

| 2. Market Research & Regulatory Screening | Market Research & Due Diligence | • Conduct deep market research on customer needs, behavior, price sensitivity, channels, and competition. • Perform regulatory due diligence (tariffs, labeling, data privacy, labor laws, product registrations). • Use local partners/consultants for actionable insights. | Reduces compliance risk and pivots post-launch; enables informed regulatory and market decisions. |

| 3. Entry Mode Selection | Choose Entry Mode | • Choose from exports, licensing/franchising, joint ventures, or wholly owned subsidiaries. • Align mode with objectives, control needs, capital, and speed to market. • Consider cost, timelines, and long-term flexibility. | Directs cost structure, timelines, risk exposure, and long-term strategic control. |

| 4. Competitive Landscape & Product-Market Fit | Competitive Positioning & PMF | • Analyze price points, value propositions, and customer expectations. • Adjust product features, packaging, or service models for regional preferences without sacrificing core brand. • Achieve product-market fit to enable scalable cross-border entry. | Supports sustainable growth and smoother expansion as you scale regions. |

| 5. Regional Expansion Plan & Localized GTM | Localized GTM Planning | • Localize messaging, pricing, support, and channels. • Select partners (distributors, resellers, co-marketing) to fill market access gaps. • Align product-market fit with local demand, regulations, and channel economics. | Enhances market relevance and predictability of performance across regions. |

| 6. Local Capabilities | People, Processes, Technology | • Hire or partner with local talent who understand local needs and rules. • Build scalable processes for order management, compliance, and support. • Implement multilingual, localized pricing, and secure data handling tech stacks. | Improves execution quality and customer experience in each region. |

| 7. GTM Channel Strategy & Distribution | Channel & Distribution Design | • Decide between direct sales, channel partners, e-commerce, or hybrids per region. • Plan last-mile logistics, delivery timelines, and after-sales service. • Define channel incentives and onboarding; align marketing, sales, and service for a consistent brand. | Delivers reliable reach, monetization, and a cohesive customer experience across borders. |

| 8. Launch, Monitor & Scale | Iteration & Performance Monitoring | • Establish dashboards for revenue, CAC, churn, compliance, and ops metrics. • Use insights to iterate messaging, pricing, channels, and localization. • Decide when to deepen investments or pause expansion. | Creates a disciplined, learning-driven process that scales reliably across regions. |