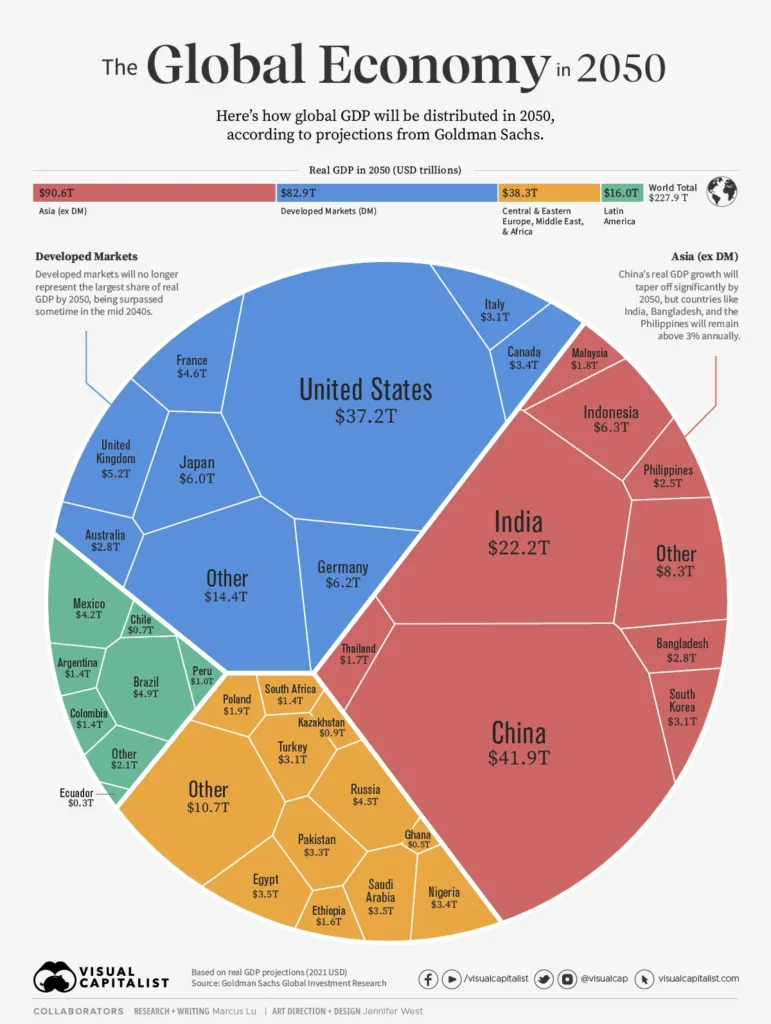

Global Market Insights illuminate how executives map strategy in today’s interconnected economy. In an era of rapid digital adoption, geopolitical shifts, and changing consumer behavior, understanding global economy trends helps leaders prioritize investments. This brief outlines the core drivers behind market dynamics and shows how data translates into practical action for boards, policymakers, and investors. By tracking the cross-border outlook, firms can calibrate plans to growth, risk, and capital allocation. The goal is to turn insight into resilient execution that sustains value even when disruption accelerates.

Viewed through a broader lens, this analysis reframes market insights as a compass for cross-border strategy, macro patterns, and stakeholder value. Beyond the numbers, the discussion highlights how macro phenomena and policy signals interact to shape risk and opportunity across regions. By weaving together regional cycles, supply chain dynamics, and currency trends, the narrative links signals, scenarios, and strategic responses. An LSI-informed framing helps practitioners see connections such as volatility management, resilience-building, and agile governance without relying on a single metric. In practice, this approach translates into diversified sourcing arrangements, flexible budgeting, and timely intelligence that sustain performance through cycles. Ultimately, the goal is to equip leaders with a robust, adaptable playbook that remains effective whether markets swing up or down.

Global Market Insights: Navigating Global Economy Trends and Economic Indicators 2025

Global Market Insights inform strategic planning by translating market signals into a focused map of macro risks and opportunities. By examining global economy trends and economic indicators 2025—such as inflation trajectories, wage dynamics, unemployment trends, and manufacturing activity offsets—leaders can calibrate forecasts, align investment priorities, and set realistic performance targets. This lens also helps identify which regions and sectors are likely to lead growth, which supply chains are most vulnerable, and where policy shifts could alter demand patterns.

With Global Market Insights, leadership in volatile markets gains a framework for disciplined decision-making. Monitoring monetary and fiscal signals alongside labor market momentum enables scenario planning that accounts for base and downside outcomes. The aim is to balance diversification across geographies and sectors with a modular portfolio approach, ensuring resilience while preserving upside opportunities. In practice, executives embed these insights into governance rituals, dashboards, and agile capital allocation processes to maintain a proactive stance amid changing conditions.

International Market Outlook and Risk Factors for Global Markets: A Playbook for Leadership in Volatile Markets

The international market outlook varies by region, guiding regional go-to-market plans and risk controls. From the Americas to Europe and Asia Pacific, different cycles require tailored strategies that reflect currency exposure, regulatory dynamics, and competitiveness trends. Leaders can translate the regional outlook into actionable choices—selecting high-potential markets, securing resilient supply chains, and prioritizing partnerships that deliver reliability and cost efficiency.

Risk factors for global markets remain multi-faceted and evolving. Currency volatility, elevated debt levels, geopolitical shocks, and climate-related events can disrupt plans, while supply chain fragility in strategic minerals and semiconductors can ripple through prices and growth. Transform these risks into proactive capabilities through robust scenario planning, diversified suppliers, financial buffers, and flexible cost structures. The leadership imperative for volatile markets is clear: embed risk management in every planning cycle and foster governance that enables rapid pivots when conditions change.

Frequently Asked Questions

How can Global Market Insights help executives interpret global economy trends and the international market outlook to guide strategic planning?

Global Market Insights translates macro signals into actionable strategy. By monitoring global economy trends and the international market outlook, executives can identify high-potential regions, currency exposures, and supply-chain priorities. Utilize dashboards and scenario planning to test bets under different growth and policy conditions, calibrate capital allocation to risk tolerance, and diversify across geographies and sectors. Stay informed with ongoing updates on inflation, labor markets, and consumer demand—anchoring planning to economic indicators 2025—so leaders can act quickly when conditions shift.

What leadership in volatile markets guidance does Global Market Insights offer for managing risk factors for global markets and tracking economic indicators 2025?

Global Market Insights guides leadership in volatile markets by embedding risk management into governance and planning. It emphasizes scenario planning, robust risk controls, and a modular portfolio approach to keep options open. Leaders should monitor risk factors for global markets and use early warning indicators to adjust strategy before stress points. Maintain diversified suppliers, flexible cost structures, and clear accountability through cross-functional reviews to sustain resilient growth amid turbulence and currency swings. Regular updates on economic indicators 2025 help keep decisions aligned with changing fundamentals.

| Focus Area | Key Points | Implications for Leaders |

|---|---|---|

| Global Market Insights | Backbone of strategic planning; aligns with macro trends; informs executives, policymakers, and investors. | Guides holistic decision making, enhances scenario planning, and enables proactive responses to disruption. |

| Global Economy Trends | Growth will be uneven; inflation dynamics, supply chain normalization, and digital transformation shape investments. | Encourage diversification across geographies/sectors and tie to scenario planning to manage risk-adjusted opportunities. |

| International Market Outlook | Regional cycles vary; identify high-potential markets, assess currency exposure, and align supply chains for reliability and cost efficiency. | Translate global perspectives into regional playbooks and informed capital budgeting under risk tolerance. |

| Economic Indicators 2025 | Monitor inflation, wages, unemployment, consumer confidence, PMI; central banks’ policy timing matters for costs and investments. | Calibrate forecasts, differentiate temporary volatility from long-term shifts, and align financial planning with strategy. |

| Risk Factors for Global Markets | Policy synchronization, currency volatility, debt levels, external shocks, and supply chain fragility can disrupt markets. | Embed robust risk management, diversify, build buffers, and maintain flexible cost structures to navigate stress points. |

| Turning Insights into Strategy | Couple data with disciplined governance; use dashboards and scenario planning; build modular portfolios and strengthen market intelligence. | Ensure governance rhythms, cross-functional accountability, and agile pivots to translate insights into sustainable growth. |

Summary

Global Market Insights table summarizes how macro themes, regional dynamics, and timely indicators drive strategic planning and resilience across organizations.