Global Markets 101 is your gateway to understanding how goods and services move across borders in today’s connected economy, and it reframes cross-border trade as a practical opportunity rather than a regulatory maze. This concise guide blends core concepts with real-world steps, helping startups, manufacturers, and investors turn macro signals into actionable plans. By tracking global market trends, you’ll learn to spot demand shifts, price dynamics, and regulatory cues that shape competitive strategies. You’ll also see how rules, risk, and finance intersect, so your expansion stays aligned with timelines and customer needs. Whether you’re testing a new market or refining an international growth blueprint, Global Markets 101 equips you to move boldly yet responsibly.

From a broader vantage, this primer on international commerce outlines the same ideas under different labels—a global trade ecosystem, cross-border operations, and the signals that guide decision-making. It emphasizes how regulatory oversight and international trade compliance shape decision-making across borders. Think of this as a practical framework for planning market entry, risk assessment, and compliance across diverse jurisdictions. By describing the same topic with varied terminology, the guide taps into related searches and user intents, supporting search visibility while remaining informative. Together with the first paragraph, this second section reinforces a cohesive narrative about navigating the global market landscape with clarity and confidence.

Global Markets 101: A Practical Framework for Cross-Border Trade and Compliance

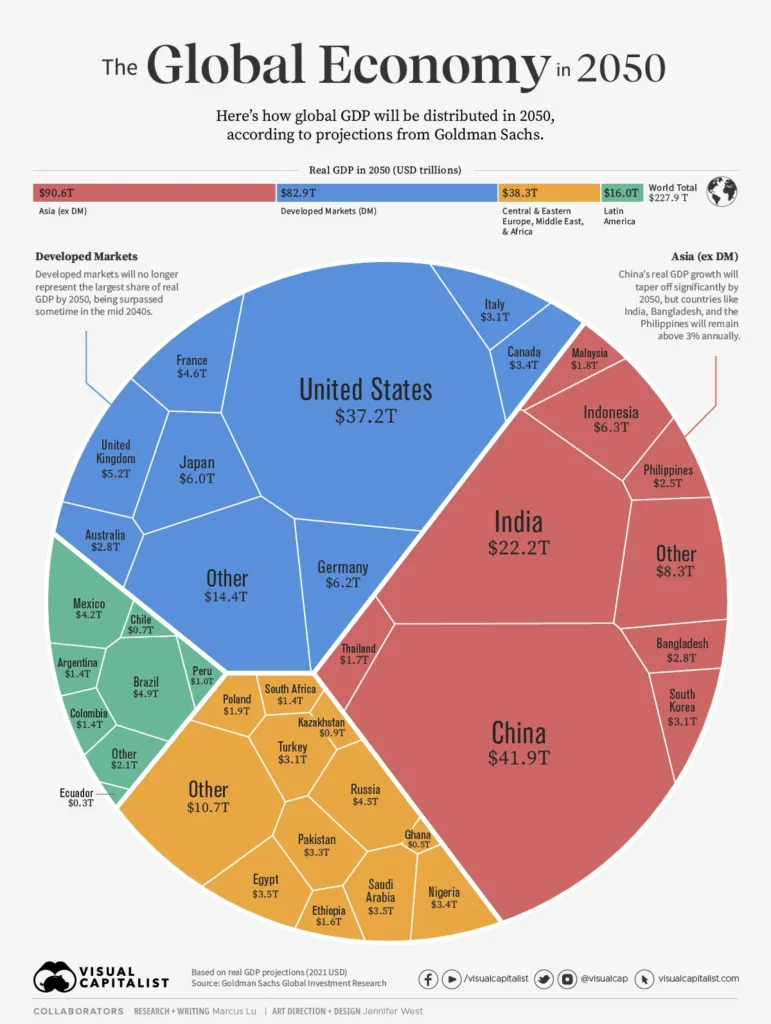

Global Markets 101 goes beyond a dry primer. It offers a practical framework for understanding how goods and services move across borders in today’s connected economy. For startups testing an international sales channel, a mid-sized manufacturer expanding into new regions, or an investor tracking opportunities, this guide links macro indicators—global market trends, GDP growth, inflation, and trade balances—with concrete actions you can implement today to optimize cross-border trade.

By combining risk-aware planning with actionable steps, Global Markets 101 helps translate global market trends into clear market-entry plans. You’ll map opportunities, assess regulatory feasibility, and build a centralized foundation for export-import regulations, labeling standards, and other international trade compliance obligations. Coupled with currency-awareness and smarter international trade finance choices—such as letters of credit, documentary collections, or open account with risk mitigation—you can protect margins and accelerate time-to-market across multiple regions.

Mastering Export-Import Regulations and International Trade Finance for Global Growth

Export-import regulations define what you can move across borders, how you document shipments, and which agencies must review or approve your activities. Keeping a centralized regulatory calendar and assigning ownership helps you stay current as rules evolve with trade negotiations, new security concerns, and shifting political priorities. This disciplined approach is central to international trade compliance and minimizes friction in cross-border operations.

On the financing side, international trade finance options bridge order-to-cash gaps while protecting margins. Tools like letters of credit, documentary collections, and risk-mitigated open accounts enable you to manage currency risk and maintain liquidity. Aligning your finance strategy with market entry plans, pricing, and channel choices supports sustainable growth in a volatile global economy while helping you reduce DSO in international environments.

Frequently Asked Questions

What is Global Markets 101, and how can it help with cross-border trade and global market trends?

Global Markets 101 is a practical framework for understanding how goods and services move across borders in today’s connected economy. It translates global market trends into actionable plans for entering new markets, managing cross-border trade, and building compliant operations. The guide highlights key drivers, regulatory needs, and ongoing international trade compliance to help you navigate cross-border complexities with confidence.

How does Global Markets 101 address international trade finance and export-import regulations to support compliant cross-border expansion?

Global Markets 101 covers essential international trade finance tools—such as letters of credit, documentary collections, and hedging—to bridge order-to-cash gaps while managing currency risk. It also emphasizes understanding export-import regulations and maintaining a proactive compliance calendar to stay aligned with evolving rules. By pairing finance options with regulatory readiness, the guide helps you scale across regions with better cash flow and lower compliance risk.

| Aspect | Core Idea | Key Points | Practical Action |

|---|---|---|---|

| Understanding the global landscape | Macro indicators inform cross-border strategy | Exchange rates, tariffs, supply chains, and regional/demand shifts; connect macro trends to business model | Map GDP growth, inflation, and trade balances; translate into competitive moves |

| Value proposition & market entry | Clarify what you’re selling and to whom | Tailor product specs, pricing, and packaging; create a market entry plan; assess feasibility across regions | Define target market value proposition; develop market entry mapping and feasibility assessments |

| Compliance & regulatory environment | Foundational ongoing compliance | Export controls, sanctions, labeling, and product standards; due diligence and ongoing monitoring | Centralize regulations; assign owners; establish review cycles; implement regular regulatory checks |

| Trade finance & currency risk | Finance as a bridge from order to payment and risk management | Letters of credit, documentary collections, open account with risk mitigation; hedging and currency exposure management | Select instruments; implement a hedging plan; manage currency exposure tied to risk tolerance |

| Data-driven decision making | Use data to optimize pricing, sourcing, and channels | KPIs: on-time delivery, order accuracy, DSO in international contexts, post-currency margin; feedback loops | Build dashboards; run regular reviews; adjust pricing, suppliers, and channels based on insights |

| Market entry & scalability | Staged approach reduces risk | Pilot tests, refine product, ensure regulatory readiness, and build a scalable framework | Start with pilots; refine; scale with lessons learned |

| Relationships & compliance culture | Build partner networks and maintain compliance discipline | Trusted logistics, banks, distributors; clear expectations; transparency; KPIs | Establish partner agreements; set KPIs; maintain ongoing communication |

| Regulatory risk management | Proactive monitoring and cross-functional collaboration | Sanctions updates; export control changes; cross-functional coordination | Integrate regulatory monitoring into operations; execute proactive updates |

| Data-informed improvement | Continuous improvement from market trends and performance data | Market trends, customer feedback, shipment performance; KPI-driven adjustments | Establish KPI dashboards; conduct regular reviews; adapt strategies accordingly |

Summary

Global Markets 101 is a practical framework for understanding how cross-border trade works in today’s connected economy. The guide blends macro awareness with actionable steps—defining value propositions for target markets, navigating export controls, and deploying finance tools to manage currency risk. It emphasizes building a strong compliance backbone, mapping supply chains, and choosing entry modes wisely to balance risk and control. By turning market signals such as GDP growth, inflation, and trade balances into concrete actions, Global Markets 101 helps startups, manufacturers, and investors translate global trends into competitive advantage. A successful global strategy rests on clear customer value, rigorous regulatory monitoring, disciplined data-driven decision making, and scalable processes for order processing, documentation, and shipment tracking. The playbook advocates staged market entry, ongoing partner relationships, and proactive risk management to reduce friction at borders. Ultimately, the emphasis on planning, measurement, and alignment across sales, logistics, and finance enables international growth with confidence. If you commit to a structured, data-informed approach, you’ll be better positioned to capture opportunities in the long arc of global market trends while minimizing risk and maximizing impact.