Global Sustainability in Action is more than a slogan; it is a practical framework for turning environmental, social, and governance commitments into measurable business results that resonate with investors, customers, and employees alike, guiding daily decisions, strategic planning, and long-term value creation across the enterprise, which translates strategic intent into operational discipline across functions, regions, and markets, for consistent decisions and enduring results, strengthening alignment between strategy and execution across geographies, sectors, and ecosystems. When organizations embed ESG strategies into governance, operations, and culture, they align core strategy with responsible growth, reduce risk, and unlock value upfront, while also accelerating decarbonization efforts and strengthening supply chain resilience through diverse sourcing, supplier collaboration, transparent procurement practices, continuous monitoring, and aligned incentives that reinforce durable progress, which also informs budgeting and capital allocation to reward long-term impact and sustainable investment. A sustainable enterprise communicates with clarity through sustainability reporting, publishes transparent metrics, and strengthens stakeholder engagement in a continuous dialogue that includes root-cause analysis, stakeholder feedback loops, third-party assurance, and ongoing education to align operations with external expectations, maximizing relevance to investors and customers alike, while linking performance to tangible outcomes, the result is clearer accountability, because data and stories from operations translate into a credible narrative. By integrating ESG into everyday choices—from product design to supplier selection and manufacturing processes—organizations can accelerate cleaner transitions, improve resource efficiency, reduce waste, and deliver resilient value across the business ecosystem while demonstrating credibility to investors, regulators, and communities, and integrating governance and risk management into ongoing practice, organizations benefit from practical governance that plays well with regulators, customers, and the communities they serve. This holistic approach culminates in improved financial performance, stronger trust with customers and communities, and a clear, evidence-based path toward long-term resilience that supports sustainable growth, talent development, and competitive differentiation, ultimately delivering ROI and a more resilient organizational culture, the consequence is a culture of trust, adaptability, and sustained value creation.

From another perspective, the topic unfolds as sustainable governance and responsible growth, where environmental, social, and governance priorities are woven into strategy as integrated capabilities, not isolated compliance. This framing emphasizes governance discipline, transparent disclosure, and stakeholder dialogue, while pursuing cleaner energy use, ethical sourcing, and resilient operations. In practice, organizations pursue risk-informed planning, cross-functional collaboration, and data-driven decision making that deliver value for investors, employees, customers, and communities. The emphasis shifts from slogans to repeatable action, using continuous improvement, performance metrics, and credible assurance to sustain trust. Altogether, the path mirrors a modern, responsible business model where purpose aligns with profitability and long-term resilience.

Global Sustainability in Action: Turning ESG into Measurable Business Outcomes

Global Sustainability in Action embodies the practice of turning ESG commitments into tangible business results. By embedding ESG strategies into governance, operations, and culture, organizations align responsible growth with everyday decision-making. This approach strengthens decarbonization efforts, enhances transparency, and elevates stakeholder engagement, delivering measurable outcomes for the company, its people, and the planet.

A robust framework rests on credible sustainability reporting, data-driven metrics, and a clear link between strategy and execution. When ESG considerations are woven into budgeting, risk management, and performance reviews, companies can monitor progress, communicate progress clearly to investors and customers, and continuously improve. This integration helps reduce risk, unlock cost savings through energy efficiency and resource optimization, and elevate brand trust among stakeholders.

Ultimately, Global Sustainability in Action creates a durable competitive advantage by demonstrating that sustainable practices drive value. By aligning ESG strategies with operational priorities and governance, organizations build resilience, attract long-term capital, and foster stakeholder loyalty—showing that sustainability is not just a slogan but a practical pathway to value creation.

Operationalizing ESG: Governance, Decarbonization, Sustainability Reporting, and Stakeholder Engagement

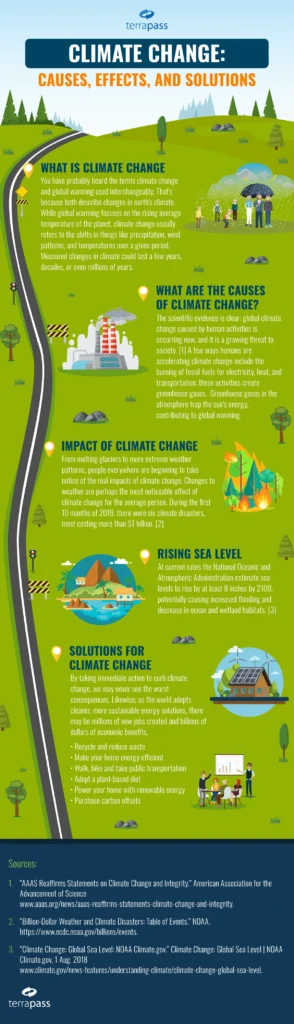

Operationalizing ESG starts with a clear governance structure that assigns accountability, links executive incentives to ESG targets, and embeds environmental, social, and governance metrics into strategic planning. A disciplined focus on decarbonization and energy efficiency, paired with transparent reporting, signals to investors and customers that the company is committed to responsible growth. Strong governance also supports supply chain resilience by ensuring ESG criteria are integrated into procurement and supplier management.

Sustainability reporting becomes a central discipline for transparency and stakeholder engagement. By adopting recognized frameworks and communicating methods, organizations can track emissions, water stewardship, social impact, and governance practices with credibility. Aligning reporting with stakeholder expectations—while collecting consistent data across operations—helps build trust, reduce information gaps, and demonstrate progress toward science-based or industry-aligned targets.

To advance practical, lasting impact, the roadmap should emphasize continuous improvement, data quality, and collaboration with external partners. Piloting high-impact initiatives, expanding successful programs, and maintaining robust risk management support supply chain resilience and broader ESG outcomes. Through active stakeholder engagement and disciplined governance, ESG becomes an ongoing driver of value rather than a one-time compliance exercise.

Frequently Asked Questions

How does Global Sustainability in Action integrate ESG strategies, decarbonization, and sustainability reporting into everyday business decisions?

Global Sustainability in Action is a practical framework that translates ESG commitments into measurable business results. It embeds ESG strategies into governance, operations, and culture, guiding decarbonization through science-based targets, energy efficiency improvements, and increased use of renewables. It also aligns sustainability reporting with recognized frameworks (GRI, SASB, TCFD) to deliver transparent, credible disclosures. By connecting leadership, data systems, and frontline teams, organizations can track progress with robust metrics, reduce risk, lower operating costs, and unlock long‑term value while preserving competitive advantage.

Why are stakeholder engagement and supply chain resilience central to Global Sustainability in Action, and how do they influence governance and reporting?

Stakeholder engagement and supply chain resilience are core to Global Sustainability in Action. Through materiality assessments and ongoing dialogue with investors, customers, employees, and communities, organizations prioritize the ESG issues that matter most. Strengthening governance—such as an ESG committee and incentives tied to ESG targets—ensures these priorities shape strategy and budgets. Building supply chain resilience, with diversified, ESG-aligned suppliers, reduces risk and support robust sustainability reporting. This transparency enhances credibility with stakeholders and can improve access to capital.

| Area | Key Points | Notes / Examples |

|---|---|---|

| Introduction Premise | – Sustainable business is good business; ESG strategies embedded into governance, operations, and culture; not a one-time initiative but an ongoing process of improvement; aims include decarbonization, responsible resource use, better disclosure, and stronger stakeholder engagement; aligns core strategy with responsible growth to reduce risk and unlock value. | Global Sustainability in Action emphasizes integrating ESG into everyday decision-making to deliver tangible outcomes for the company, its people, and the planet. |

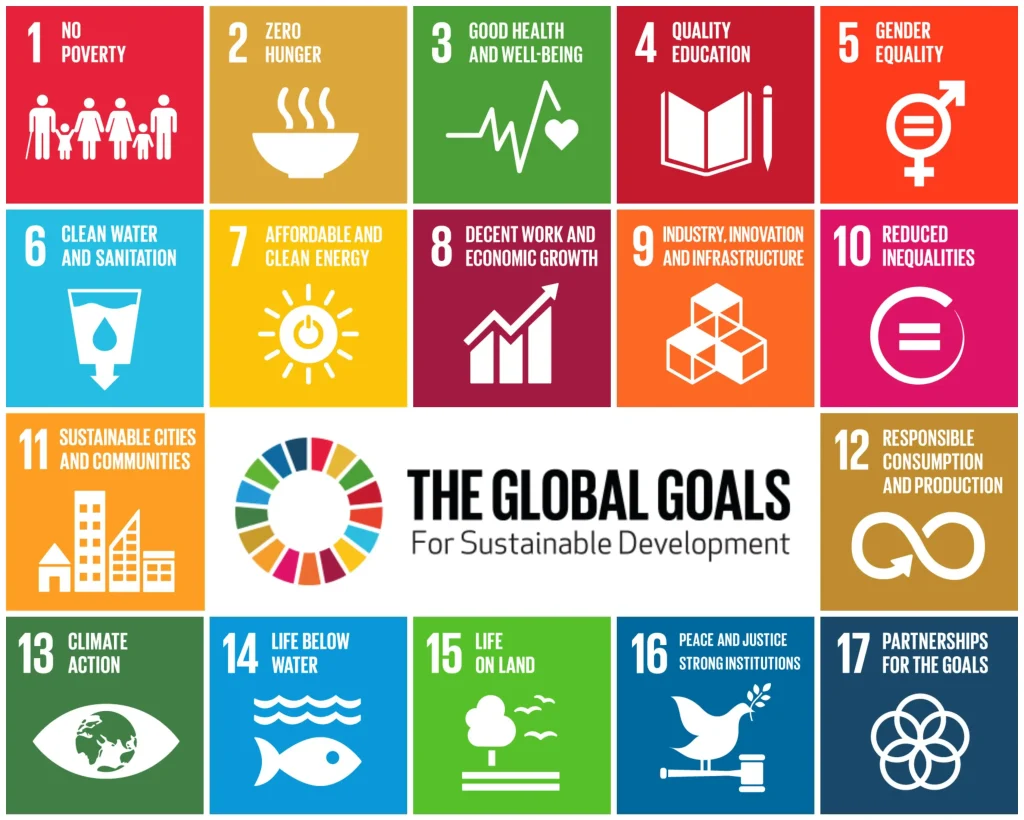

| ESG Foundation | – ESG stands for Environmental, Social, and Governance; helps map risks and opportunities across the lifecycle of products and services; Environmental: carbon footprint, water use, ecosystems; Social: fair labor, community impact, customer well-being, DEI; Governance: board oversight, ethics, risk management, transparent reporting. | Together, these pillars provide a holistic view of value creation beyond short-term financials. |

| ESG Strategies That Deliver | – Decarbonization and energy efficiency; target science-based emissions reductions; upgrade to energy-efficient equipment; increase renewables. – Sustainable supply chain and procurement; embed sustainability in supplier selection, contracts, audits; reduce scope 3 emissions; diversify suppliers. – Circular economy and waste reduction; design for longevity, reuse, recyclability; implement take-back schemes. – Water stewardship and ecosystem protection; minimize usage, treat/reuse water, protect ecosystems. – Social impact and CSR; invest in people, communities, inclusive workplaces. – Governance and transparency; strengthen board ESG oversight, tie incentives to ESG, standardized reporting. | These strategies drive responsible growth and resilience across operations and value chains. |

| Measuring Impact and Reporting | – Build robust data architecture, collect consistent indicators, and report transparently so stakeholders can gauge progress. – Metrics span Environmental (emissions, energy, renewables, water use, waste), Social (engagement, turnover, health/safety, diversity, community investments, customer satisfaction), and Governance (board diversity, ESG-linked pay, risk management, audits). – Align with global frameworks (GRI, SASB/SASB, TCFD) and integrate sustainability reporting with annual reporting for credibility and dialogue. | Credible, comparable data and transparent reporting drive stakeholder trust and informed decision-making. |

| Stakeholder Engagement and Governance | – Materiality assessments identify ESG issues that matter to investors, customers, employees, and communities. – Transparent dialogue, regular updates, and inclusive decision-making enhance risk management and trust. – Governance structures (board or ESG committee) ensure ESG objectives are embedded in strategy, budgets, and performance reviews; leadership commitment boosts engagement and loyalty. | Clear accountability and active leadership foster broad participation and stronger stakeholder relationships. |

| Real-World Pathways: Case Narratives | – Manufacturing: decarbonization, energy efficiency, on-site renewables; improved supplier collaboration reduces costs and strengthens resilience; finance benefits from better risk profiles and green financing; investors gain confidence from transparent targets. – Technology: adaptive governance, ethical data practices, responsible product development; stakeholder engagement enhances trust and brand value. – Services/Consumer goods: sustainable packaging, recycling programs, and community initiatives boost loyalty and market share. | These narratives illustrate tangible value from ESG actions across sectors. |

| Roadmap, Challenges, and Best Practices | – Establish governance and accountability; define targets; build robust data systems; align reporting with stakeholders; foster continuous improvement. – Typical challenges: data gaps, fragmented systems, competing priorities. – Practical approach: start with material issues, pilot programs, then scale; engage external partners (suppliers, NGOs, peers) to accelerate learning and validate progress. | A pragmatic, phased approach helps organizations progress from pilot to enterprise-wide impact. |

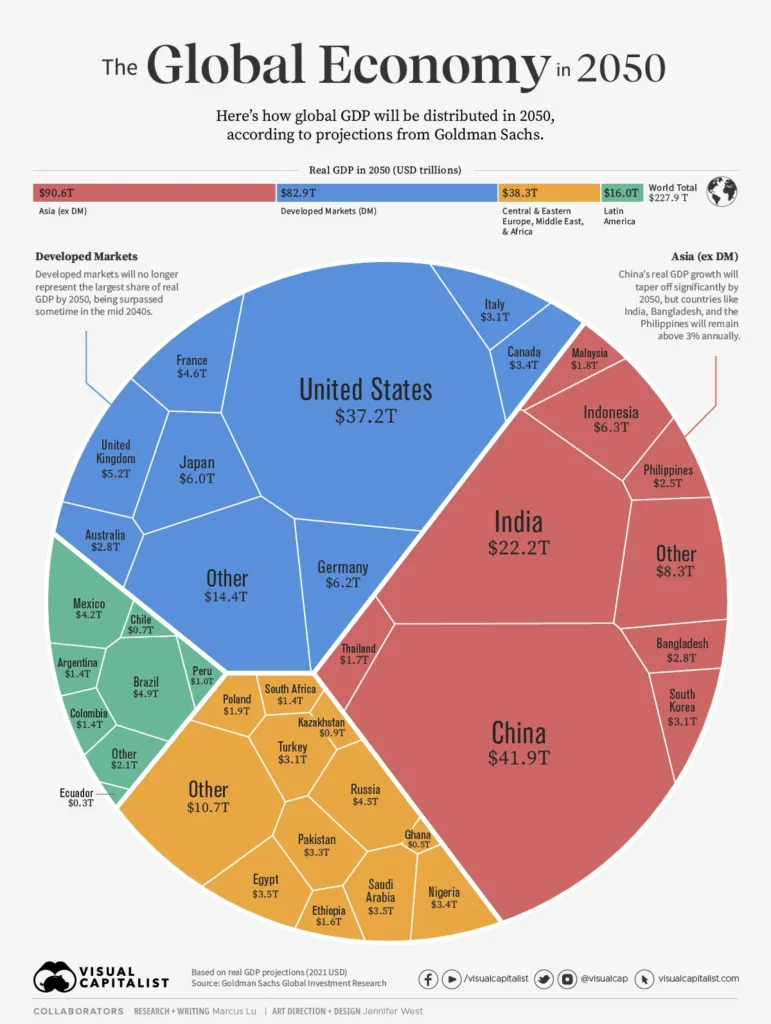

| The Business Case for Global Sustainability in Action | – ESG strategies deliver measurable business value beyond ethics: lower operating costs through efficiency, reduced risk, better access to capital, enhanced brand and loyalty, and long-term growth through innovation. | Linking sustainability to core value drivers strengthens resilience and competitive differentiation. |