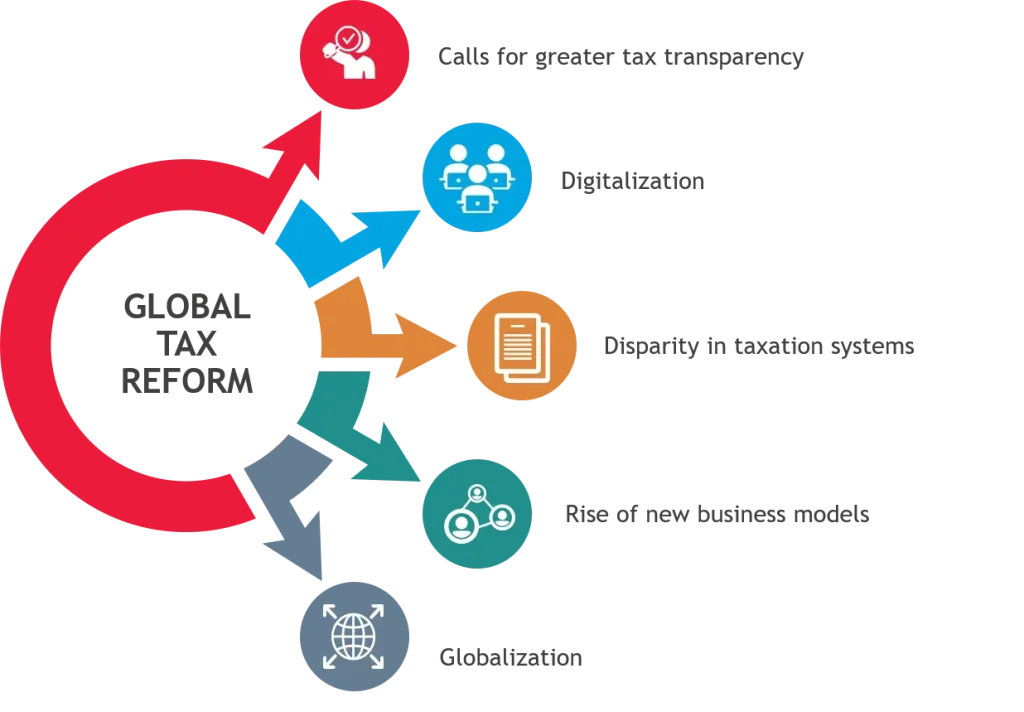

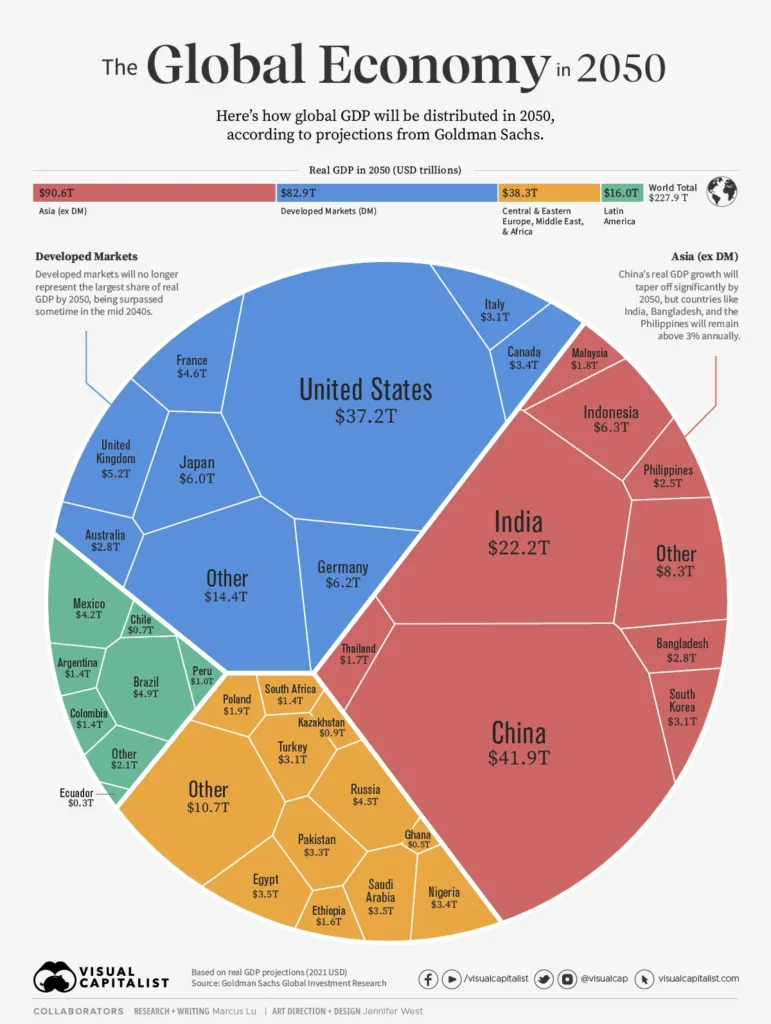

Global Taxation and Regulation is reshaping how businesses plan, report, and optimize across borders. As globalization accelerates, international tax compliance moves from a local concern to a global discipline. Policymakers push for greater transparency and the consistent application of global tax regulations across jurisdictions. Cross-border taxation considerations now require data-driven approaches to value creation, including digital services tax regimes, while aligning with the OECD BEPS framework. This introductory overview shows how tax strategy must balance compliance with growth, leveraging technology, governance, and stakeholder trust.

Seen through a different lens, the international fiscal regime is a connected web of rules that coordinate how profits are allocated and reported across borders. Rather than isolated statutes, the tax ecosystem now rests on shared principles, governance frameworks, and cooperative information exchange that support fair competition. Under this LSI-informed perspective, regulators and companies map obligations across jurisdictions, focusing on value creation, substance, and consistent reporting. Multinational enterprises must align governance, technology, and data to the evolving framework, balancing risk management with strategic growth. Taken together, the landscape invites a proactive, integrated approach to tax planning that emphasizes transparency, collaboration, and intelligent use of analytics.

Global Taxation and Regulation: Aligning International Tax Compliance with a Converging Global Tax Regime

Global Taxation and Regulation is no longer a set of isolated national rules; it has become a dynamic, interconnected system shaped by globalization, digitalization, and a rising demand for transparency. For organizations, international tax compliance should be understood as a strategic capability that intersects with global tax regulations and cross-border taxation considerations. By aligning tax data, reporting, and governance with converging standards, companies can reduce risk, allocate resources more effectively, and seize opportunities across multiple jurisdictions while remaining compliant with evolving OECD BEPS framework guidance.

To operationalize this, finance and tax leaders should invest in data quality, country-by-country reporting, and transfer pricing documentation that reflects true value creation. The OECD BEPS framework, including Pillar One and Pillar Two, shapes nexus and minimum tax expectations, influencing how multinational enterprises structure intercompany arrangements and document their global activities. A robust tax governance framework, combined with automation and analytics, enables faster response to policy shifts and supports compliant, resilient operations in a complex regulatory landscape.

Cross-Border Taxation in a Digital Economy: Navigating OECD BEPS, Digital Services Tax, and Global Tax Regulations

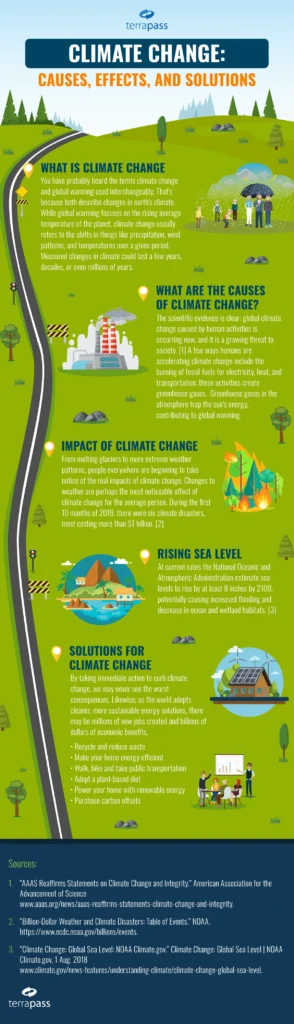

As businesses operate across borders, cross-border taxation presents complexities in profit allocation, nexus determination, and withholding regimes. The rise of the digital economy has amplified these challenges, with digital services tax (DST) regimes and other digital economy measures intersecting with the OECD BEPS framework to align where value is created and taxed. This evolving environment requires a coordinated approach to data, risk management, and regulatory alignment so that global tax regulations are consistently applied across jurisdictions while minimizing double taxation.

Practical steps include implementing a consistent transfer pricing policy that reflects actual value creation, monitoring DST developments in key markets, and modeling potential Pillar Two impacts on effective tax rates. By integrating international tax compliance with cross-border planning and a technology-enabled tax function, organizations can maintain agility, ensure consistent policy application across regions, and communicate clearly with regulators and stakeholders about risk, compliance, and strategic value.

Frequently Asked Questions

In the context of Global Taxation and Regulation, how does the OECD BEPS framework shape global tax regulations and international tax compliance for multinational enterprises?

The OECD BEPS framework, including Pillar One and Pillar Two, is reshaping global tax regulations by reallocating taxing rights to market jurisdictions and introducing a global minimum tax. This strengthens international tax compliance by demanding consistent transfer pricing, enhanced documentation, and country-by-country reporting across jurisdictions. It also affects how digital services tax considerations are integrated within the BEPS framework, guiding convergence with digital economy measures and reducing opportunities for profit shifting. For multinational enterprises, the result is a need for anticipatory tax planning, robust governance, and data-driven processes to manage nexus rules, ensure transparency, and minimize double taxation while meeting evolving global tax regulations.

What practical steps can leaders take to navigate cross-border taxation and digital services tax under current global tax regulations?

To navigate cross-border taxation within the evolving global tax regulations, leaders should: map the global tax profile and jurisdiction nexus; build a dynamic transfer pricing framework aligned with value creation; invest in data and analytics for accurate tax determinations; establish governance for tax risk and stay updated on OECD BEPS developments; monitor digital services tax regimes and integrate DST considerations into nexus and transfer pricing; leverage tax technology to automate data collection, reporting, and scenario planning; and engage early with tax authorities, including exploring advance pricing agreements where possible. This approach aligns with international tax compliance goals and prepares for Pillar Two minimum tax, helping organizations manage risk and sustain growth in a changing cross-border taxation landscape.

| Aspect | Key Points | Implications / What It Means |

|---|---|---|

| Global Taxation and Regulation landscape | Dynamic, interconnected system shaped by globalization, digitalization, and a rising demand for transparency. | Requires anticipatory, data-driven, and adaptable tax planning; balance compliance with commercial viability; build trust with regulators, investors, and the public. |

| Foundational framework | OECD BEPS as a blueprint; Pillar One and Pillar Two proposals | Rethink transfer pricing, nexus rules, and global reporting; align with BEPS objectives and ensure minimum taxation where profits are booked. |

| Pillars of Change | Pillar One reallocates taxing rights to market jurisdictions; Pillar Two introduces a global minimum tax. | Data, country-by-country reporting, updated transfer pricing documentation, and a robust tax governance framework across multiple jurisdictions. |

| Global Tax Regulations | Convergence toward cohesive rules; increased information sharing and standardized reporting across jurisdictions. | Invest in technology-enabled tax functions, ensure governance and ethics, and maintain accurate, shareable tax data. |

| Cross-Border Taxation | Complexities in allocating profits, determining nexus, and navigating varying withholding taxes; anti-avoidance rules rising. | Implement robust transfer pricing, maintain auditable data, and engage early with tax authorities (e.g., APAs) to reduce disputes. |

| Digital Services Tax & Digital Economy | DST regimes and digital economy measures to tax online value creation; alignment with BEPS remains in progress. | Monitor DST developments, integrate into transfer pricing and nexus analyses, and adapt timelines as rules evolve. |

| Compliance, Data, and Technology | Accurate data, strong governance, and technology to automate tax processes; data mapping across sources and regulatory mapping. | Develop tax technology, centralized data models, and governance controls to respond quickly to regulatory changes. |

| Practical Guidance | Map global tax profile; build dynamic transfer pricing; invest in data/analytics; establish tax risk governance; stay ahead of policy shifts; plan for minimum tax regimes; align with regulatory expectations. | Apply a structured, proactive approach to navigate the evolving landscape and achieve sustainable, compliant growth. |

| Case Studies & Lessons | Real-world efficiency gains from standardized processes and data consolidation; challenges from fragmented data and limited regulator engagement. | Learn from industry experiences to reinforce data governance, cross-border coordination, and stakeholder engagement. |

| Emerging Trends & Path Forward | Greater transparency, BEPS-influenced rules, and ongoing digital economy refinements; potential for faster information sharing and harmonized reporting. | Agility in interpreting guidance, responsible tax position updates, and clear stakeholder communication will shape future success. |

Summary

Global Taxation and Regulation landscape is evolving into a dynamic, interconnected system shaped by globalization, digitalization, and rising transparency. This table outlines the key points across the framework, pillars, cross-border considerations, digital economy, compliance technology, practical guidance, case studies, and emerging trends. The overarching message is that tax planning must be proactive, data-driven, and governance-driven to manage risk and support sustainable growth in a converging global regime.