Inflation and interest rates are central to how households plan budgets, borrow, and invest. As policymakers monitor inflation trends, they adjust central bank rates to cool or stimulate demand. This loop—policy moves, demand shifts, and price changes—embodies the monetary policy impact on the economy. Such adjustments affect the cost of living and steer economic growth over the medium term. By understanding these forces, readers can make smarter decisions about debt, savings, and long-term planning.

In other words, price pressures and the cost of credit walk together, hinting at where the economy is headed. Analysts describe these dynamics with terms such as price stability, monetary stance, and the policy rate, which together shape borrowing conditions. Movements in liquidity, demand, and expectations influence how households spend, save, and invest. These financial conditions, exchange rates, and wage prospects form a web that guides growth trajectories and living standards. By framing the topic with related ideas—price evolution, funding costs, and market expectations—readers gain a broader sense of how monetary policy steers the economy.

Inflation and interest rates: how policy changes affect prices, debt, and growth

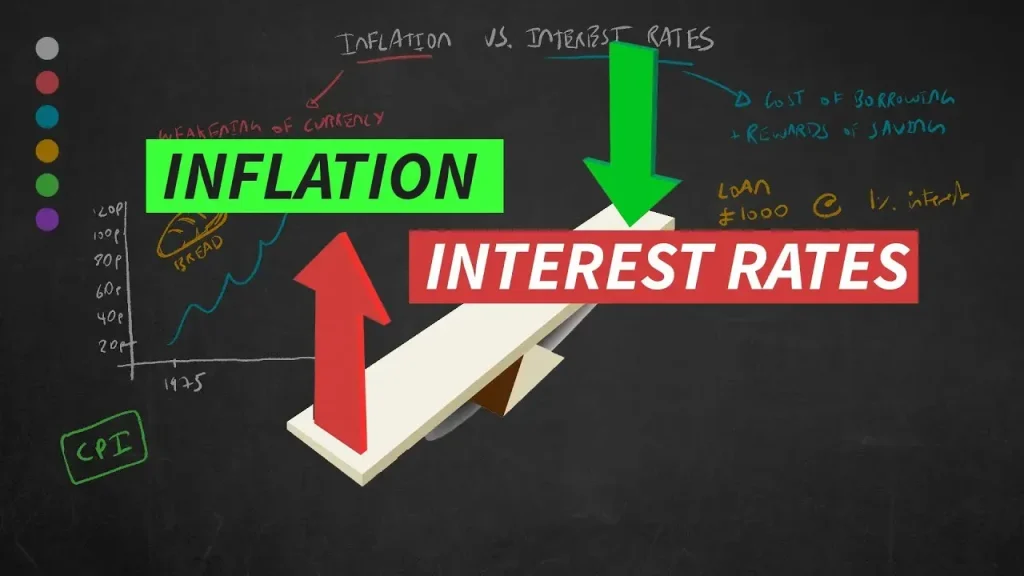

Inflation and interest rates are tightly linked: when inflation trends pick up, central banks typically raise central bank rates to cool demand. This monetary policy impact slows credit growth and helps stabilize prices over time, guiding the path of economic growth. By following policy signals and rate moves, households and businesses can anticipate changes in borrowing costs and price pressures.

For households, higher borrowing costs affect mortgage payments and disposable income, shaping the cost of living. For businesses, financing costs influence investment, hiring, and expansion plans. Tracking inflation trends alongside rate trajectories supports smarter savings, debt management, and long-term planning in a shifting monetary environment that affects economic growth.

Inflation trends and policy levers: central bank rates, monetary policy impact, and cost of living

Inflation trends arise from demand shifts, supply constraints, and expectations, and central banks respond with policy rates as a primary lever. This central bank rates action is a key channel of monetary policy impact on prices, growth, and the cost of living. Understanding how these policy levers influence inflation expectations helps explain why price changes can accelerate or cool, and how that shapes economic growth.

As policymakers calibrate the balance between price stability and employment, the monetary policy impact becomes visible in credit conditions, wage dynamics, and investment viability. Analyzing inflation trends alongside policy moves helps households and businesses adjust budgets, pricing strategies, and capital allocation to support resilient economic growth and maintain real incomes even when rates are higher or expectations shift.

Frequently Asked Questions

How do inflation trends and central bank rates shape the monetary policy impact on my loans and budgets?

Inflation trends guide how policymakers set central bank rates as part of the monetary policy impact. When inflation accelerates, central banks typically raise policy rates to cool demand, pushing up borrowing costs for mortgages, loans, and credit cards and potentially increasing the cost of living. If inflation slows toward the target, rates may be cut or kept steady to support growth, easing debt service and improving savings prospects. This dynamic helps you plan debt, budgets, and long-term goals in a rate-changing environment.

What is the relationship between inflation and interest rates, and how does it affect economic growth and the cost of living?

Inflation and interest rates are intertwined through monetary policy. Central banks adjust policy rates to keep inflation near target, which influences borrowing costs and demand in the economy. Higher rates can slow economic growth by making mortgages and business loans more expensive, while lower rates can stimulate activity. At the same time, inflation trends and expectations affect wages and prices, shaping the cost of living. Understanding this policy impact helps households plan budgets, savings, and investments to navigate rate cycles.

| Key Point | What it Means | Implications/Examples |

|---|---|---|

| Relationship between inflation and rates | Inflation and policy rates are interdependent; policy rates influence demand and inflation through a monetary policy feedback loop. | Understanding this linkage helps anticipate policy moves and how borrowing costs and price levels may respond. |

| Inflation drivers | Inflation is shaped by demand pressures, supply constraints, and expectations. | Shifts in demand, costs, or expectations alter pricing power and wage dynamics. |

| Central bank policy role | Policy rates are used to manage inflation and support growth; raising rates cools borrowing and demand, lowering rates stimulates activity. | Stabilizes prices, guides growth, and affects mortgages, loans, and investment decisions. |

| Transmission channels | Rate changes affect households, businesses, exchange rates, asset prices, and inflation expectations. | Impacts on debt service, investment choices, currency value, wealth, and price dynamics. |

| Practical considerations/outlook | Inflation is influenced by shocks; policy aims to anchor around a target with credible communication. | Policy credibility reduces uncertainty and supports planning in financing and spending. |

| Inflation-growth relationship | Stable inflation and moderate rates tend to support sustainable growth; high inflation or high rates can slow expansion. | Policymakers seek a balance to avoid stifling growth or letting prices spiral. |

| Cost of living and real incomes | Inflation erodes purchasing power; rising rates increase debt costs, pressuring disposable income. | Wage dynamics and debt levels determine real income trends and budgetary pressure. |

| What this means for consumers and businesses | Monitoring trends and adjusting debt, saving, and spending is important; diversification and prudent financing help. | Informed budgeting, hedging, and flexible pricing/financing support resilience. |

| Strategies to navigate inflation and rising rates | Tactically manage debt, build emergency funds, review budgets, consider inflation-aware investments, and monitor indicators. | Practical steps build resilience against rate shocks and price volatility. |

| The practical takeaway: staying informed and flexible | Continuously learn how monetary policy affects borrowing, spending, and investment decisions. | Fosters prudent budgeting, diversified saving, and risk-informed planning. |