Investing in mutual funds during market volatility can be a challenging endeavor for many investors. With fluctuations often causing uncertainty, some fund categories, particularly flexi cap mutual funds and dynamic asset allocation funds, are designed to navigate these turbulent waters effectively. These investments not only provide stability but also offer strategic advantages, helping to mitigate risks associated with market downturns. For those seeking refuge in the stock market, equity mutual funds can yield favorable outcomes even when conditions seem unfavorable. By adopting robust market downturn investment strategies, investors can potentially enhance their returns and safeguard their capital during unpredictable times.

Navigating the landscape of mutual funds in unstable market conditions is crucial for maintaining a healthy investment portfolio. Certain equity funds, such as flexi cap and dynamic asset allocation variants, have gained popularity for their ability to adjust to market dynamics. These types of funds optimize asset distribution and provide flexibility in investment approaches, making them suitable for unpredictable environments. As you explore investment options, understanding the impact of market fluctuations on your financial choices is essential for success. Embracing a diversified investment strategy can empower investors to tackle the uncertainties of volatile markets effectively.

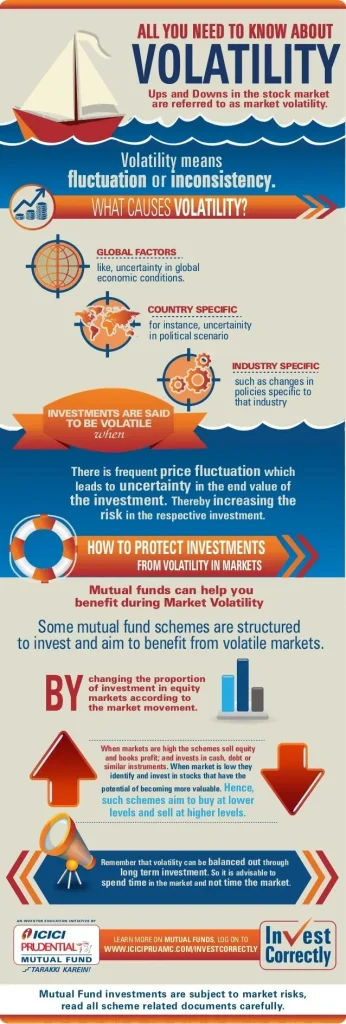

Understanding Market Volatility and Its Impact on Investment Strategies

Market volatility refers to the degree of variation in the trading price of financial instruments over time. In periods of significant fluctuations, it becomes essential for investors to rethink their investment strategies. During such times, many individuals might feel the urge to retreat to safer investments, but this reaction could hinder their long-term financial goals. Research indicates that the most successful investors are those who can remain calm and strategically assess their positions, taking advantage of the unique opportunities that volatile markets present.

One effective strategy during market downturns is to look into specific types of equity mutual funds, particularly flexi cap mutual funds and dynamic asset allocation funds. These funds are designed to adapt to changing market conditions, ensuring that investors have a balanced portfolio even during turbulent times. By understanding how market volatility affects various asset classes, investors can make informed choices that enhance their potential for returns while managing risk.

The Role of Flexi Cap Mutual Funds in Volatile Markets

Flexi cap mutual funds are distinguished by their ability to invest across different market capitalizations—large, mid, and small caps. This inherent flexibility allows portfolio managers to shift their investments based on real-time market analysis and conditions. In situations characterized by volatility, this approach not only mitigates risk but also positions investors to capitalize on potential market recoveries. The adaptability of flexi cap funds enables investors to avoid the pitfalls associated with sticking rigidly to one particular segment of the market.

Moreover, the investment strategies employed by the managers of flexi cap mutual funds often involve quick reallocations among various stocks, responding to market signals like earnings reports, geopolitical changes, and economic indicators. This proactive management style is essential during episodes of market downturns, where the swift decision can help preserve capital and secure returns when the market stabilizes. Therefore, for investors looking to navigate through turbulent times with a focus on equity, flexi cap mutual funds emerge as a thoughtful choice.

Dynamic Asset Allocation Funds: A Tactical Approach to Investing

Dynamic asset allocation funds stand out for their ability to shift between various asset classes, adjusting their exposure based on prevailing market conditions. These funds generally emphasize investments in large-cap stocks, which are known for their liquidity and resilience during economic downturns. As market dynamics evolve, these funds can reduce equity exposure and allocate more into debt or other safer assets to minimize risks for investors. Such strategic adjustments become imperative in maintaining profitability amid uncertainty.

Furthermore, dynamic asset allocation funds are managed by seasoned professionals who analyze trends and market signals, allowing them to optimize returns while reducing exposure to riskier assets. This type of investment is particularly beneficial for individuals who prefer a hands-off approach but still want to achieve solid returns. By opting for dynamic asset allocation funds, investors not only safeguard their investments during market downturns but also have the potential to capture higher returns during market rallies.

Investing in Volatile Markets: Key Considerations

Investing in volatile markets requires a different mindset compared to stable market conditions. It’s important for investors to embrace a long-term perspective when positioning their portfolios during times of uncertainty. Asset preservation and risk management must take priority, which calls for an allocation toward funds like flexi cap and dynamic asset allocation funds that are engineered to navigate market fluctuations. Understanding the fundamental principles of each fund type can lead to wiser investment decisions.

In addition, diversification is a key strategy one must employ while investing during volatile phases. This principle applies not only to the types of securities held but also to the investment vehicles used. By spreading investments among varying asset classes and fund types—such as equity mutual funds and fixed-income securities—investors can weather market downturns with greater ease. This balanced approach can prevent the negative impacts of market swings from affecting an entire investment portfolio.

Market Downturn Investment Strategies and Recommendations

In response to market downturns, experts typically advise reallocating the investment focus to sectors that historically perform better during periods of uncertainty. This includes large-cap equities and funds that adopt dynamic asset allocation strategies. These approaches tend to offer more stability and allow for reallocation when markets improve. Investors are encouraged to stay informed about market trends and adjust strategies accordingly to maintain optimal investment performance.

Regularly consulting with a financial advisor or a SEBI-registered investment professional can further enhance an investor’s strategy during tumultuous times. They can provide tailored recommendations depending on market conditions and individual risk tolerance. By keeping these recommendations in mind and focusing on robust fund options such as flexi cap mutual funds, investors can establish a resilient portfolio. This aids in not only navigating through downturns but also succeeding in the long run.

Conclusion: The Importance of Flexible Investment Options

In conclusion, navigating through market volatility necessitates intelligent choices and flexibility in investment strategies. Flexi cap mutual funds and dynamic asset allocation funds emerge as top options for investors looking to shield their assets during unpredictable market conditions. Their unique functionalities are designed to adapt to shifting landscapes, making them ideal for mitigating risks while pursuing growth.

As always, it’s critical for investors to seek guidance from qualified investment specialists before executing significant investment decisions. This consultation ensures that the investments made align with both the investor’s financial goals and their risk appetite, ultimately fostering a robust strategy that can withstand market volatility and promote long-term financial success.

Frequently Asked Questions

What are the benefits of investing in flexi cap mutual funds during market volatility?

Flexi cap mutual funds offer the advantage of flexibility in investment across large, mid, and small-cap stocks, allowing fund managers to adjust allocations based on market conditions. This adaptability helps to minimize losses and reduce overall volatility, making them a prudent choice during turbulent times.

How do dynamic asset allocation funds help investors during market downturns?

Dynamic asset allocation funds are designed to shift investments among different asset classes based on market conditions. By focusing on large-cap stocks, these funds provide liquidity during downturns and help mitigate risks, allowing investors to potentially earn higher returns while minimizing volatility.

Why should investors consider equity mutual funds during periods of high market volatility?

Equity mutual funds, particularly flexi cap and dynamic asset allocation funds, are recommended during market volatility because they offer diversification and professional management. These funds can adapt to market fluctuations, helping to protect investments while aiming for stable growth in uncertain environments.

What market downturn investment strategies should I consider with mutual funds?

During market downturns, consider strategies such as investing in flexi cap mutual funds to take advantage of market flexibility, or dynamic asset allocation funds, which can easily rebalance across asset classes. These strategies help spread risk and stabilize returns amidst volatility.

How do flexi cap mutual funds adapt to changing market conditions?

Flexi cap mutual funds adapt to changing market conditions by reallocating their investments among various capitalizations—large, mid, and small-cap stocks—based on market performance. This strategy allows fund managers to respond quickly to market shifts, enhancing the potential for mitigating losses during volatile periods.

Are small-cap schemes advisable during market volatility?

Experts generally advise against small-cap schemes during market volatility due to their higher risk profile. Instead, focusing on large-cap, flexi cap, and dynamic asset allocation funds can provide a more balanced investment approach, reducing risk while aiming for returns.

What role do expert recommendations play in investing in mutual funds during market volatility?

Expert recommendations are crucial during market volatility as they guide investors towards safer investment options, such as flexi cap and dynamic asset allocation funds, which have a proven ability to manage risks and enhance returns through diversified strategies.

| Key Point | Description |

|---|---|

| Market Volatility | Investing during market volatility can be daunting, yet certain mutual funds are positioned to weather these conditions. |

| Flexi Cap Mutual Funds | Allow fund managers to invest across large, mid, and small-cap stocks based on market conditions, offering flexibility and quick adjustments to minimize losses. |

| Dynamic Asset Allocation Funds | Adjust portfolios across asset classes, focusing on large-cap stocks that are more liquid during downturns while aiming for increased returns during peaks. |

| Market Context | High market volatility due to external factors like tariff changes and geopolitical tensions calls for adaptable investment strategies. |

| Expert Recommendations | Avoid small-cap schemes in uncertain times; instead, focus on large-cap, flexi cap, and dynamic asset allocation funds for balanced growth. |

Summary

Mutual funds during market volatility can be a strategic choice for investors looking to minimize risk and adapt to changing conditions. Flexi cap mutual funds and dynamic asset allocation funds provide a flexible approach that allows for diverse investment strategies tailored to current market situations. With the current economic environment marked by instability, these funds offer not just potential for growth but also a safeguard against losses. It is essential for investors to consider these options and consult with SEBI-registered professionals to navigate through turbulent market conditions effectively.