In August 2025, investors have a unique chance to explore a variety of Mutual Funds NFOs, as approximately ten new fund offers open for subscription. These new fund offers encompass diverse categories, providing a wealth of investment opportunities for both seasoned and novice investors alike. With options ranging from multi-asset allocation to specialized equity savings, investors can tailor their portfolios to match their financial goals. As NFOs gain traction in August mutual funds, understanding these new options is vital for making informed investment decisions. Explore the potential of these NFOs investment avenues and consider how they can enhance your financial strategy.

This month, the investment landscape is illuminated by a selection of New Fund Offers (NFOs), providing fresh avenues for asset allocation and growth. August’s offerings highlight a blend of hybrid schemes and index funds, each catering to distinct investment strategies and risk appetites. As you navigate the array of August mutual funds, grasping the nuances of these new subscriptions can significantly impact your portfolio’s performance. Whether you’re viewing them as opportunity-rich deals or as strategic entrances into specific markets, the importance of these NFOs cannot be overstated. Dive into the details of these funds to uncover how they align with your investment objectives.

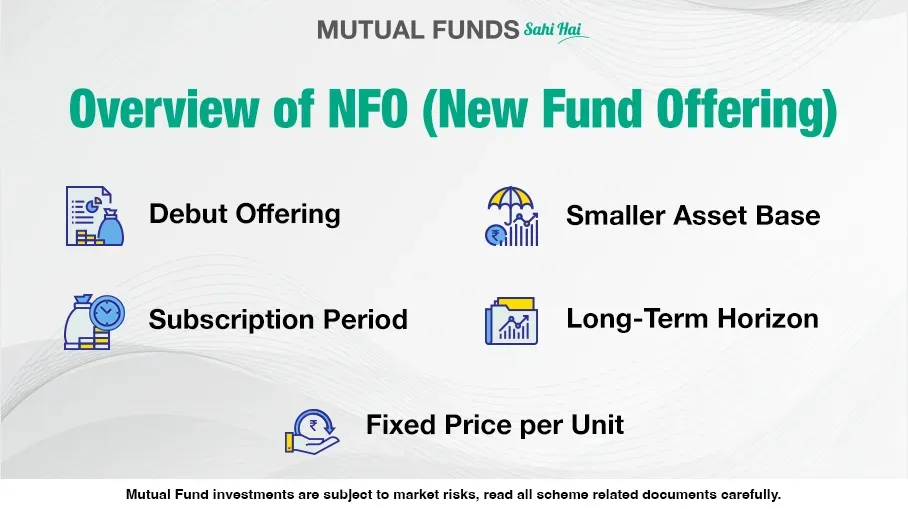

Understanding New Fund Offers (NFOs) and Their Importance

New Fund Offers (NFOs) represent an essential avenue for investors looking to diversify their portfolios. During August 2025, the launch of ten new mutual fund schemes opens myriad opportunities for both seasoned and novice investors. As these funds operate under different categories such as equity, hybrid, or index, they cater to varying risk appetites and investment goals. Investors must understand the unique features of these NFOs to align them with their financial objectives.

With the launch of these NFOs, investors can consider various strategies—from broad market exposure through index funds to more targeted risk exposure using thematic schemes. Furthermore, the investment minimums vary, allowing flexibility for those with different capital amounts to explore mutual funds subscription without significant financial barriers. Exploring the implications of these new funds can guide the investment journey and help in making informed choices.

Investment Opportunities in Mutual Funds for August 2025

August 2025 presents a significant window for investment opportunities in mutual funds, with several enticing New Fund Offers (NFOs) now available. Among them are the hybrid schemes like the 360 One Multi Asset Allocation Fund, which targets those seeking balanced growth with flexible asset distribution. Additionally, the index funds like the ABSL BSE 500 Momentum 50 Index Fund offer a systematic and passive investment strategy that tracks market performance, making it suitable for risk-averse investors.

The diversity in this month’s offerings reflects the evolving landscape of mutual funds. New products like the Kotak Active Momentum Fund emphasize sectoral strategies, allowing potential higher returns for those interested in specific market trends. Thus, investors should consider their financial goals and current market conditions while seizing these investment opportunities, particularly when subscribing to funds during their NFO period.

Key Considerations for NFOs Investment

When considering an investment in NFOs, several key factors can aid investors in making prudent choices. Firstly, understanding the fund’s objective and strategy is critical. For instance, the Kotak Nifty Alpha 50 Index Fund focuses on capturing returns from the Nifty segment, which may appeal to those looking for potential exposure to large-cap equities. Similarly, funds that emphasize special opportunities, such as the Motilal Oswal Special Opportunities Fund, may attract investors with a higher risk tolerance.

Another vital component is the minimum subscription requirement, which varies significantly across different funds. For instance, while some NFOs allow entry at ₹500, others may require a higher threshold like the Bank of India Mid Cap Fund at ₹5,000. Assessing one’s financial condition against these requirements can help in determining appropriateness and ensuring that the investment aligns with cash flow needs.

Detailed Breakdown of August 2025 Mutual Fund NFOs

In August 2025, investors can explore a variety of new fund offers, each with distinct features and investment styles. The hybrid schemes, such as Bajaj Finserv Equity Savings Fund, provide a blend of equity and debt investments, making them ideal for those seeking stable growth with manageable risk. Meanwhile, thematic and sectoral funds like the Kotak Active Momentum Fund specifically target market segments that are trending positively, offering a chance for heightened returns.

Moreover, index funds such as the ABSL BSE 500 Quality 50 Index Fund present an opportunity for passive investment, committing capital to replicate the performance of benchmark indices. For those new to mutual funds, these options provide a clearer understanding of potential returns and associated risks. Therefore, a comprehensive breakdown of these NFOs empowers investors to make informed choices that suit their financial strategies.

Tips for Investing in Mutual Funds during the August NFO Window

Investing during the NFO window can be a strategic move if approached with care and knowledge. First, potential investors should perform thorough due diligence on each fund’s performance history and management credibility, even if these NFOs are newly launched. Fund documents and prospectuses often detail the investment philosophy and expected returns based on historical market data, which can significantly inform investment choices.

Additionally, considering the timing of subscription is essential: often, those who invest during the initial period may benefit from favorable pricing. Investors should also create a diversification strategy by balancing investments across different categories and risk profiles, thus mitigating possible downside during market fluctuations. Through these tips, subscribers can maximize the potential benefits derived from August 2025’s mutual fund NFO offerings.

How to Approach Mutual Funds Subscription in 2025

As 2025 unfolds, the mutual funds landscape continues to adapt, reflecting broader economic conditions and investor behavior. When approaching mutual fund subscriptions, particularly the new offerings in August, it is important to take a systematic investment approach. Investors can consider SIPs (Systematic Investment Plans) as a way to pyramid their investments over time, which can be less intimidating than a lump sum investment, especially in volatile markets.

Moreover, staying updated on market trends and economic indicators provides investors with insights crucial for making strategic decisions regarding their mutual fund subscriptions. Utilizing resources like financial advisors or investment platforms can also reinforce your understanding and foster better decision-making throughout the investment process.

The Role of SIPs in Investing in New Fund Offers

One effective strategy employed by investors during the NFO period is the systematic investment plan (SIP). This approach allows individuals to invest a fixed amount regularly, making it less daunting to enter new funds, particularly amid market volatility. For the August 2025 NFOs, opting for SIPs can help investors spread their investment over time, allowing for potential dollar-cost averaging, which can mitigate the impact of market fluctuations.

Incorporating SIPs into one’s investment strategy not only empowers investors to participate in the new offerings with lower entry barriers but also encourages disciplined savings. This is especially valuable in the context of mutual funds where timing the market can be challenging. Therefore, for those looking at the August mutual funds NFOs, adopting a SIP approach may facilitate a more stable and structured entry into the mutual fund arena.

Evaluating Risk Levels in August 2025 Mutual Fund NFOs

Risk evaluation is a crucial factor when deciding to invest in mutual funds, including the new NFOs launched in August 2025. Each fund comes with its risk profile, which is influenced largely by its investment focus. For instance, equity-focused NFOs generally carry higher risk compared to debt or hybrid schemes, which may attract conservative investors looking for stability.

Understanding the risk attached to each new fund offer is essential for making informed decisions. For example, while an index fund may present relatively lower risk due to its passive investment strategy, a thematic fund, like the Kotak Active Momentum Fund, might pose a greater risk-reward scenario. Investors are encouraged to assess their own risk tolerance before committing to any NFO, ensuring alignment with their overall investment strategy and financial goals.

Upcoming Trends in Mutual Funds Post-August 2025

As we move past August 2025, emerging trends in mutual funds will likely redefine future investment strategies and approaches. With technological advancements and data analytics gaining traction, financial advisors and fund managers are now better equipped to tailor investment options that cater to specific investor needs. New Fund Offers like those launched in August might set the stage for subsequent offerings focusing on innovative strategies that leverage market dynamics.

Furthermore, investors can expect a continued emphasis on sustainability and socially responsible investing, as more fund houses adapt their strategies to reflect global concerns. This could lead to a rise in NFOs that focus on ethical investing practices, offering investors not just financial returns but also fulfilling social responsibilities. The landscape of mutual funds is evolving, and prospective investors will have a wealth of options aligned with contemporary values.

Frequently Asked Questions

What are the Mutual Funds NFOs available for August 2025?

In August 2025, there are around 10 Mutual Funds NFOs open for subscription including the 360 One Multi Asset Allocation Fund, ABSL BSE 500 Momentum 50 Index Fund, and Kotak Nifty Alpha 50 Index Fund, among others.

How can I participate in the Mutual Funds subscription for NFOs in August 2025?

To invest in the Mutual Funds NFOs for August 2025, you can approach various mutual fund houses or financial advisors. Most NFOs allow online subscriptions through their respective websites or through mobile applications.

What is the minimum subscription for Mutual Funds NFOs in August 2025?

The minimum subscription varies among different Mutual Funds NFOs in August 2025, with amounts ranging from ₹100 for the Kotak Nifty Alpha 50 Index Fund to ₹5,000 for the Bank of India Mid Cap Fund.

Are there specific categories of Mutual Fund NFOs in August 2025?

Yes, the Mutual Fund NFOs in August 2025 cover various categories such as hybrid schemes, index funds, and mid-cap funds, providing diverse investment opportunities for different risk appetites.

What should I consider before investing in the Mutual Funds NFOs for August 2025?

Before investing in the Mutual Funds NFOs for August 2025, consider factors such as your investment goals, risk tolerance, expense ratios, and the past performance of similar funds in the same category.

When do the Mutual Funds NFOs in August 2025 close?

The closing dates for the Mutual Funds NFOs in August 2025 vary, with some closing as early as August 1, 2025, like the Groww BSE Power ETF, while others remain open until mid-August, such as the 360 One Multi Asset Allocation Fund closing on August 13, 2025.

What are the benefits of investing in Mutual Funds NFOs in August 2025?

Investing in Mutual Funds NFOs in August 2025 provides an opportunity to participate in new funds that may offer fresh strategies, diversification, and potential growth based on the prevailing market conditions.

How often are new Mutual Funds NFOs introduced during the year?

New Mutual Funds NFOs are generally introduced throughout the year; however, specific months like August may feature a significant number of offerings depending on market dynamics and fund house strategies.

| Fund Name | Type | Opened / Launched | Closes | Minimum Subscription |

|---|---|---|---|---|

| 360 One Multi Asset Allocation Fund | Hybrid scheme | 30 July 2025 | 13 August 2025 | ₹ 1,000 |

| ABSL BSE 500 Momentum 50 Index Fund | Index fund | 21 July 2025 | 4 August 2025 | ₹ 500 |

| ABSL BSE 500 Quality 50 Index Fund | Index fund | 21 July 2025 | 4 August 2025 | ₹ 500 |

| Bajaj Finserv Equity Savings Fund | Hybrid scheme | 28 July 2025 | 11 August 2025 | ₹ 500 |

| Bank of India Mid Cap Fund | Mid-cap scheme | 31 July 2025 | 14 August 2025 | ₹ 5,000 |

| Groww BSE Power ETF | N/A | 18 July 2025 | 1 August 2025 | N/A |

| Kotak Active Momentum Fund | Equity scheme (Sectoral/Thematic) | 29 July 2025 | 12 August 2025 | ₹ 5,000 |

| Kotak Nifty Alpha 50 Index Fund | Index mutual fund | 28 July 2025 | 11 August 2025 | ₹ 100 |

| Motilal Oswal Special Opportunities Fund | N/A | 25 July 2025 | 8 August 2025 | ₹ 500 |

| Zerodha Multi Asset Passive FOF | FOF Domestic | 25 July 2025 | 8 August 2025 | N/A |

Summary

Mutual Funds NFOs August 2025 present a variety of investment opportunities for investors seeking growth and diversification. With ten newly launched funds spanning different categories such as hybrid schemes, index funds, and mid-cap funds, investors have an array of options to choose from. Each fund varies in terms of its minimum subscription requirement and investment strategy, catering to diverse investor profiles. It is essential to evaluate these options carefully, considering individual financial goals and risk appetite, and consult with a SEBI-registered investment advisor to make informed investment decisions.