NPS equity returns have become a focal point for investors seeking a robust strategy within the National Pension System (NPS). As pension fund managers navigate market fluctuations, the equity investment segment offers the potential for lucrative gains, particularly over the recent three-year period. Understanding the dynamics of NPS investment returns is essential for making informed decisions about one’s financial future. With seven pension fund managers showing varied performance in equity returns, it’s imperative to analyze their strategies and market placements. This overview provides insights into how these fund managers have performed, highlighting the best and worst performers in the competitive landscape of NPS.

The returns generated from NPS equity investments are pivotal for retirement planning for many individuals. As one explores their options within the National Pension System, it is crucial to consider the performance metrics of various asset managers. The past few years have seen fluctuations in equity investment performance, compelling investors to closely track their chosen pension management firms. Analyzing the three-year equity returns has revealed significant variances among pension fund managers, making it essential for investors to reevaluate their investment choices. This exploration will shed light on how different fund managers stack up against each other, allowing for a more strategic approach to retirement investments.

Overview of NPS and Its Pension Fund Managers

The National Pension System (NPS) provides a robust and flexible retirement savings option for individuals, allowing them to tailor their investment strategies based on personal financial goals and risk tolerance. With the ability to choose from various pension fund managers (PFMs), investors can optimize their portfolios to maximize their returns. Currently, seven PFMs are actively managing NPS contributions and delivering competitive market-linked returns across different asset classes, including equities.

Investors looking to participate in NPS should understand the advantage of selecting the right PFM. Each manager has a unique approach to equity investments, which significantly influences overall performance. This diversity in management styles offers opportunities for higher returns but also comes with varying levels of risk. The role of PFM selection is critical, and a thorough review of their performance history over the past three years provides insights into which fund might be best aligned with an investor’s financial objectives.

Frequently Asked Questions

What are the 3-year NPS equity returns from different pension fund managers?

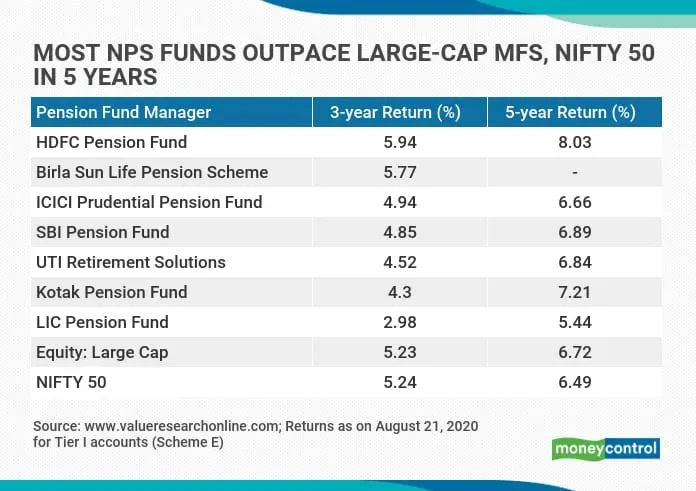

Over the past three years, the NPS equity returns from various pension fund managers have shown significant variation. ICICI Pension Fund Manager delivered the highest return at 18.97%, followed closely by Kotak PFM at 18.90%, and UTI PFM with 18.61%. On the lower end, SBI PFM recorded a return of 15.76%. This data illustrates the importance of selecting the right pension fund manager for maximizing NPS investment returns.

How can NPS investors maximize their equity investment returns?

NPS investors can maximize their equity investment returns by carefully selecting their pension fund managers. Regularly reviewing the performance of these managers is crucial, especially considering that, as of the past three years, ICICI PFM has delivered the highest returns on equity investments at 18.97%. Diversifying among the asset classes within NPS and adjusting their equity allocation based on market conditions can also enhance overall investment returns.

Which pension fund manager has provided the best NPS performance in equity investments?

As of the latest review, ICICI Pension Fund Manager has provided the best NPS performance in equity investments, with a remarkable 3-year return of 18.97%. It’s essential for investors to follow such performance metrics closely to make informed decisions about their NPS equity investments.

What factors should NPS investors consider when evaluating pension fund managers for equity investment?

When evaluating pension fund managers for NPS equity investment, investors should consider the 3-year returns, the manager’s historical performance, investment strategies, and risk profiles. Recent data shows a range of returns, with ICICI PFM leading at 18.97%, demonstrating the significance of performance history in guiding investment choices.

Are NPS investment returns fixed or market-linked?

NPS investment returns are market-linked, meaning they fluctuate based on market conditions. This structure allows for potentially higher returns on equity investments. For example, pension fund managers like HDFC and ICICI have shown competitive returns ranging from 17% to nearly 19% over the past three years, highlighting the dynamic nature of NPS returns.

| Equity (Tier I) | Pension Fund Managers | 3-Year Returns (%) |

|---|---|---|

| Aditya Birla | PFM | 17.01% |

| HDFC PFM | 17.47% | |

| ICICI PFM | 18.97% | |

| Kotak PFM | 18.90% | |

| LIC PFM | 17.28% | |

| SBI PFM | 15.76% | |

| UTI PFM | 18.61% |

Summary

NPS equity returns are significant for investors who are considering their options under the National Pension System. The data highlights the varying performance of different pension fund managers over the past three years, showing that ICICI PFM has led with the highest returns of 18.97%, while SBI PFM lagged with the lowest at 15.76%. Investors must weigh these returns alongside their investment strategies and risk tolerance when selecting a PFM for equity investments within the NPS framework.