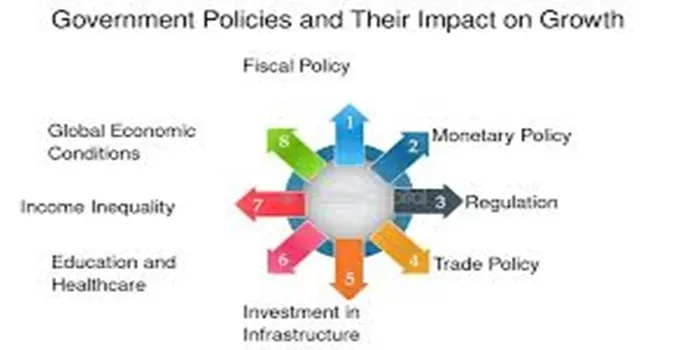

Policy Changes Shape the Economy is a core idea in macroeconomics, illustrating how government decisions on taxes, spending, and regulation rewire incentives and steer broad indicators of activity. When policymakers adjust fiscal levers or set new rules, households reallocate consumption, firms alter investment plans, and the lagged effects unfold across employment, prices, and productivity. The economic impact of policy changes becomes visible in the evolving mix of demand and supply, in how borrowers price risk, and in the benchmarks economists use to gauge progress toward long-run goals. By tracing transmission channels—from fiscal impulses to monetary signals and credit conditions—readers can connect abstract shifts to concrete outcomes in everyday life. This guide emphasizes practical takeaways, offering a framework to interpret policy moves and their potential consequences for growth, inflation, and living standards.

Alternative framing uses terms such as policy shifts, fiscal moves, regulatory decisions, and central-bank actions to describe how the economic landscape evolves. These synonyms reflect the same transmission channels—spending, taxation, credit access, and expectations—without repeating the headline. Understanding these connections can help readers assess how choices by government and finance authorities influence growth, inflation, and employment over time.

Policy Changes Shape the Economy: Transmission Through Fiscal, Monetary, and Regulatory Levers

Policy changes travel through the economy via transmission channels that affect demand, incentives, and expectations. When policymakers alter taxes, spending, or regulatory rules, households and firms adjust behavior—raising or restraining spending, hiring, and investment. Understanding the economic impact of policy changes helps explain why these shifts unfold across workplaces, neighborhoods, and markets over months and years, and why government policy effects on the economy matter for everyday life.

Fiscal policy and monetary policy each shape growth through distinct channels, and the ultimate outcomes hinge on timing, credibility, and how policy is financed. How fiscal policy affects growth depends on multipliers, the state of the economy, debt dynamics, and whether spending is productive. On the monetary side, monetary policy and economic outcomes are mediated by credit conditions, interest rates, and financial conditions that influence investment and hiring. Viewed together, policy levers and economic indicators help explain why the same policy move can have different effects in recessions versus expansions.

Interpreting Signals: Reading Economic Indicators and Policy Levers for Households and Firms

Interpreting signals requires looking beyond headlines to a broad set of data: GDP growth, unemployment, inflation, productivity, and labor-force participation. Linking these indicators to policy moves helps illuminate the economic impact of policy changes on households and firms, and shows how government policy effects on the economy play out in real time.

Market readers and households weigh credibility, expectations, and global conditions as they respond to policy shifts. Investors and lenders monitor policy levers and economic indicators to gauge future opportunities and risks, while households adjust spending and saving based on anticipated tax, subsidy, or regulatory changes. By tying fiscal, monetary, and regulatory signals to concrete outcomes—like hiring, inflation, and investment—readers can better anticipate how policy changes will shape the broader economy.

Frequently Asked Questions

Policy Changes Shape the Economy: what are the main transmission channels and how do fiscal policy and regulation influence growth?

Policy changes travel through demand, incentives, and expectations, shaping hiring, prices, and growth. A tax cut or higher spending raises household income, lifting consumption and investment, while announced changes can move plans before they take full effect. Regulation and trade shifts alter costs and competitiveness, influencing where firms invest and how quickly. The size and duration of the impact depend on the economy’s starting point and how policy is financed, a core part of the economic impact of policy changes and the study of fiscal policy effects on growth. Monitoring GDP, employment, and inflation helps gauge how policy levers translate into outcomes.

Policy Changes Shape the Economy: how monetary policy affects economic outcomes and which indicators should investors watch?

Monetary policy shapes economic outcomes by setting conditions that affect interest rates, credit, and confidence. Lower rates tend to boost borrowing and spending, while tighter policy cools demand to curb inflation. The transmission runs through financial markets, bank balance sheets, exchange rates, and asset prices, so the full effect depends on credit channels and the health of the economy. Key indicators to watch include inflation, unemployment, GDP growth, productivity, credit conditions, and market expectations, all of which reflect policy signals and stance. Understanding how monetary policy and economic outcomes interact with fiscal policy helps households and investors anticipate trade-offs.

| Theme | Key Points | Notes/Examples |

|---|---|---|

| Introduction / Core idea | Policy changes by governments, central banks, and regulators shape incentives, spending, resource allocation, and can influence hiring, prices, and growth over years. | Emphasizes mechanisms, evidence, and real-world examples. |

| Transmission channels | Policy shifts affect demand, incentives, and expectations, shaping household and firm behavior; tax cuts can boost consumption and production; expectations can move markets before full effect. | Includes anticipation effects and market responses. |

| Fiscal policy and growth | Fiscal policy directly influences aggregate demand; multipliers matter; timing, size, and financing affect outcomes; expansion raises output in the short run; deficits/debt risks if not credibly financed. | Multiplier effects; importance of credible funding. |

| Monetary policy and outcomes | Central banks influence rates and inflation expectations; lower rates boost investment and spending; tighter policy dampens demand; transmission via financial markets, credit, and balance sheets; also affects exchange rates and asset prices. | Credit channels and risk-taking influence real outcomes. |

| Regulation, trade, and broader environment | Regulatory shifts alter costs, innovation incentives, and competitiveness; trade policy (tariffs, rules) affects prices and supply chains; domestic structure matters. | Looser regulations can lower costs; stricter rules raise costs; tariffs impact prices. |

| Reading the signals | Monitor a broad set of indicators: GDP growth, unemployment, inflation, labor force participation; include productivity, confidence, and market expectations; consider global conditions and context. | Avoid reliance on a single indicator; a holistic view is essential. |

| Real-world examples and lessons | History shows how credibility and communication shape outcomes; expansionary vs contractionary contexts; policy credibility affects investment and expectations; reversals or ambiguity can undermine effectiveness. | Case studies across recessions and expansions. |

| Implications for households, businesses, and investors | Policies affect take-home pay, job security, housing and education affordability; influence business investment and competitiveness; affect investors’ discount rates and risk assessments. | Stakeholders should monitor policy signals and adjust plans. |

Summary

The table summarizes how policy changes shape the economy by outlining transmission channels, fiscal and monetary policy effects, regulatory and trade factors, indicators to watch, lessons from history, and practical implications for households, businesses, and investors.