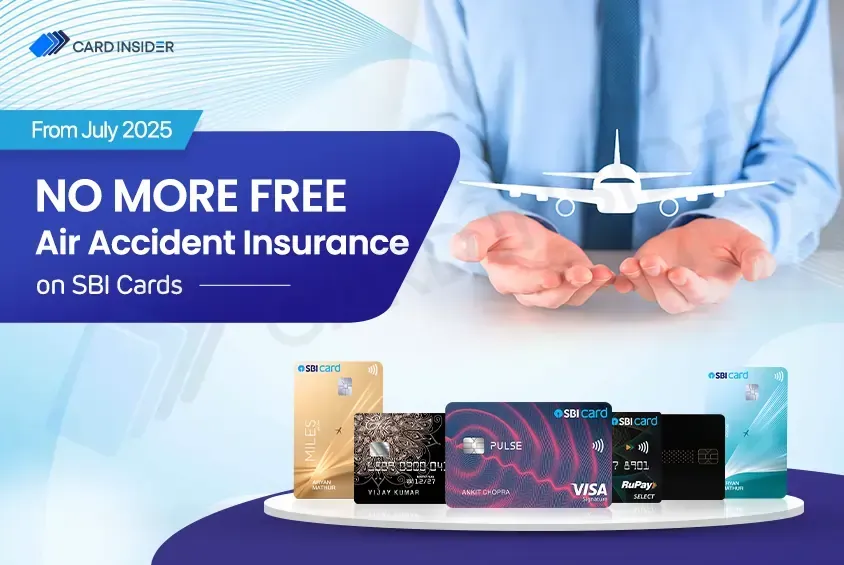

The recent SBI Air Accident Insurance Discontinuation marks a significant shift for select SBI credit cardholders who previously enjoyed complimentary air accident insurance coverage of up to ₹1 crore. Starting July 15, 2025, this appealing benefit will cease, leaving many current and potential cardholders reevaluating their travel insurance options. This policy update from SBI Card not only affects premium cards like Elite, Miles Elite, and Miles Prime but also introduces changes to payment settlement rules and Minimum Amount Due calculations, reinforcing the need for awareness among users. As the landscape of SBI insurance benefits shifts, it’s crucial for cardholders to stay informed about their coverage and alternatives, especially when it comes to air travel. Understanding these SBI credit card changes can help users navigate financial planning better and ensure they are equipped with the right information as July approaches.

In light of SBI’s recent announcement, many users of its premium credit cards will need to adjust their expectations regarding complimentary travel benefits. The cessation of air accident insurance for cardholders such as those with SBI Elite and Miles Prime cards represents a crucial transition in the credit card insurance landscape. As these benefits fade, so do the security assurances that many travelers have relied on for their flights. Furthermore, updated policies on payment hierarchies and the computation of Minimum Amount Due could substantially alter the financial landscape for SBI Card users, necessitating careful consideration and proactive adjustments to their financial strategies. Given the evolving nature of SBI Card policy updates, it’s essential to stay informed and explore new insurance avenues to maintain adequate protection during air travel.

Understanding SBI Air Accident Insurance Discontinuation

The discontinuation of the ₹1 crore air accident insurance coverage by SBI Card, effective July 15, 2025, marks a substantial shift for premium credit card users. Previously, select cardholders, including those wielding the Elite, Miles Elite, and Miles Prime variants, enjoyed this complimentary coverage as part of the bank’s generous insurance benefits. However, with this policy update, those relying on the air accident insurance will need to seek alternative personal insurance plans to ensure they have adequate coverage during air travel.

Beyond the loss of air accident insurance, it is essential to note how this change dovetails with the broader SBI Card policy update. This overhaul reflects SBI’s commitment to reassessing its offerings and adapting to market dynamics while restructuring the benefits and services provided to cardholders. Individuals should be proactive in understanding how these nuances will affect their travel plans and overall financial management.

Frequently Asked Questions

What is the reason for SBI Air Accident Insurance Discontinuation starting July 15, 2025?

SBI is discontinuing the ₹1 crore air accident insurance coverage as part of a broader policy update, which affects select SBI credit cardholders including those with Elite, Miles Elite, and Miles Prime cards.

How will the discontinuation of SBI Air Accident Insurance impact premium SBI credit cardholders?

Premium SBI credit cardholders, particularly those relying on air travel insurance, will need to seek alternative personal coverage as the ₹1 crore air accident insurance benefit will no longer be available from July 15, 2025.

Which SBI credit cards are affected by the air accident insurance discontinuation?

The SBI Air Accident Insurance Discontinuation impacts cardholders of the SBI Card Elite, SBI Card Miles Elite, and SBI Card Miles Prime. Additionally, cards like SBI Card Prime and SBI Card Pulse will also see the removal of ₹50 lakh coverage.

What are the new changes regarding the Minimum Amount Due SBI after the air accident insurance benefit is discontinued?

Alongside the discontinuation of SBI Air Accident Insurance, SBI has introduced a revised calculation for the Minimum Amount Due (MAD), which will now be higher and include additional components like GST, EMI amounts, and finance charges.

What should I consider if I previously relied on SBI’s air accident insurance coverage for travel?

With the SBI Air Accident Insurance Discontinuation effective July 15, 2025, individuals should explore alternative insurance options to ensure coverage during air travel, as existing benefits will no longer apply.

Will there be other benefits updated along with SBI Air Accident Insurance Discontinuation?

Yes, alongside the SBI Air Accident Insurance Discontinuation effective July 15, 2025, there will be updates to payment settlement rules and revisions to how the Minimum Amount Due is calculated for SBI credit cards.

How does the discontinuation of SBI Air Accident Insurance affect my credit card usage?

The discontinuation may prompt cardholders to reassess their reliance on the air accident benefit while also impacting budgeting decisions due to changes in the Minimum Amount Due and revised payment settlement hierarchy.

What are my options for air travel insurance after the SBI Air Accident Insurance benefit ends?

After the SBI Air Accident Insurance Discontinuation, cardholders should consider purchasing separate travel insurance policies from insurance companies that cover air accidents and related incidents.

When is the last day I can benefit from the SBI Air Accident Insurance?

The last day to benefit from the complimentary SBI Air Accident Insurance coverage is July 14, 2025, after which the coverage will no longer be in effect for affected cardholders.

How can I stay informed about further SBI credit card policy updates besides the air accident insurance changes?

To stay updated on any changes regarding SBI credit card policies, including insurance benefits and payment structures, regularly check the official SBI Card website or sign up for their customer notifications.

| Key Points | Details |

|---|---|

| Discontinuation of Insurance | Free air accident insurance of ₹1 crore for select SBI credit cardholders (Elite, Miles Elite, Miles Prime) will end on July 15, 2025. |

| ₹50 Lakh Coverage Removal | Coverage of ₹50 lakh for SBI Card Prime and SBI Card Pulse will also be discontinued. |

| Payment Settlement Changes | SBI will revise the hierarchy of payment allocation for credit card dues starting July 15, 2025. |

| Revised Minimum Amount Due | New rules will increase the Minimum Amount Due calculation, affecting monthly payments and potentially increasing interest costs. |

Summary

The SBI Air Accident Insurance Discontinuation marks a significant shift in the benefits offered to select SBI credit cardholders. Starting July 15, 2025, users of certain premium SBI cards will lose their complimentary coverage, which has been a valued component of their card package. In addition, changes to payment allocation and the Minimum Amount Due calculations will further impact the cardholder experience. Those who relied heavily on these insurance features should explore alternative personal insurance options to ensure they are covered during air travel.