Senior Citizen Fixed Deposit Rates play a crucial role in providing financial security for retirees, especially with interest rates reaching as high as 7.95% in June 2025. With various banks rolling out attractive schemes, senior citizens can enjoy the benefits of exceptionally high FD rates for seniors, ensuring peace of mind during their retirement years. As these fixed deposit plans include additional interest premiums, they stand out among the best banks for senior citizens looking for reliable investment options. Whether you’re aiming to secure funds for future medical expenses or simply to bolster your savings, fixed deposits present a solid and low-risk strategy. Dive into the world of senior citizen bank offers to discover how these investments can significantly enhance your financial journey post-retirement.

For retirees, understanding the landscape of fixed deposits can be invaluable, particularly when considering the best options available for older adults. Senior citizen fixed deposit schemes offer a unique combination of safety and returns, tailored specifically for those over sixty. This financial instrument provides an opportunity for seniors to take advantage of competitive FD interest rates in June 2025, with various banks vying for their attention through special offers. With the assurance of steady income and additional perks for senior depositors, these fixed deposits serve as a smart choice for managing finances effectively in one’s later years. Explore the landscape of retirement investment options and see how high-yield fixed deposits can play an essential role in your financial stability.

Understanding Senior Citizen Fixed Deposit Rates

Senior citizens are entitled to special fixed deposit (FD) interest rates which generally exceed those offered to the general public. In June 2025, many banks, particularly public sector banks, are offering senior citizen FD rates that can go as high as 7.95%. This premium on rates encourages seniors to invest their savings securely while ensuring a steady income for their retirement years. The need for a stable financial base post-retirement makes these attractive rates beneficial for seniors who are planning their finances carefully.

Besides the attractive interest rates, senior citizens benefit from features like a guaranteed return with minimal risk, making FDs a secure investment option. Many banks are also providing additional interest of 0.25% to 0.75% specifically for senior citizens, further enhancing the appeal of these financial products. Depending on individual financial needs, seniors can select tenures that range from a few months to several years, making it easy to strategize their investment plan according to cash flow requirements.

Top Banks Offering High FD Rates for Seniors in June 2025

Leading public sector banks such as the State Bank of India, Punjab & Sind Bank, and Bank of Maharashtra are currently among the best options for senior citizens looking for high fixed deposit rates. These banks have specially curated FD schemes that provide interest rates above 7.25%, appealing greatly to senior depositors. Moreover, with several banks offering limited-period promotions that lock in higher interest rates, seniors need to act quickly to secure favorable conditions that are likely to change with fluctuating monetary policies.

When assessing the best banking options for senior citizens, it’s crucial to consider not just the headline rates but the additional benefits provided. Banks like the Bank of Maharashtra often feature ongoing senior citizen bonuses, ensuring that the returns remain attractive over time. For seniors focused on maximizing their investments, choosing the right bank becomes essential, and thorough comparison and research can help them find the most beneficial terms tailored to their financial goals.

Benefits of Fixed Deposits for Senior Citizens

Fixed deposits present a myriad of benefits for senior citizens, which include capital security, assured returns, and liquidity management. Given that many seniors are living on retirement funds and savings, the predictability of fixed deposit returns allows for better budgeting and financial planning. Furthermore, since FDs are insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC), each depositor’s amount is secure up to ₹5 lakh, providing an added layer of confidence.

Additionally, fixed deposits require minimal maintenance once they are set up, a characteristic that suits senior citizens who may prefer less financial management burden. By establishing a fixed deposit portfolio, seniors can ensure that their income needs are met while also taking advantage of the higher FD rates being offered by various banks. This makes FDs especially suited for those seeking hassle-free, secure investment options as they navigate their financial landscape.

FD Interest Rates for Seniors – What to Expect in June 2025?

For the month of June 2025, senior citizens can look forward to FD interest rates that are competitive, with options ranging roughly from 7.00% to 7.95%. The top banks such as Central Bank of India and Punjab & Sind Bank are leading with offers that cater specifically to the senior demographic, reflecting the banks’ commitment to supporting their retirement financial planning. As interest rates are subject to change, it’s important for seniors to stay informed on current rates and any promotional offers that may arise.

Moreover, changing economic conditions and monetary policies can significantly impact FD rates, which is why staying updated on market trends can be crucial for seniors. As rates are likely to see adjustments in the coming months, seniors should take the opportunity to lock in the best possible rates early in June 2025. Consulting with a financial advisor to explore the optimal tenure and terms customized to individual financial situations can also be beneficial, ensuring that their investments yield maximum returns.

Smarter Investments: Laddering Fixed Deposits

Creating a laddered fixed deposit portfolio is becoming increasingly popular among senior citizens, serving to maximize returns while ensuring liquidity. This strategy involves spreading investments across multiple fixed deposits with varying maturity dates. For example, a senior citizen could invest in deposits maturing at different intervals such as 6 months, 1 year, and 2 years. This approach not only allows for higher interest accumulation over time but also grants easier access to funds when needed, thereby sustaining day-to-day requirements.

Furthermore, laddering helps seniors take advantage of varying interest rates as they change throughout the deposit terms. By regularly reinvesting maturing FDs into new accounts at potentially higher rates, seniors can strategically increase their earnings over time. It also reduces the risks associated with interest rate fluctuations, ensuring that they have a safe and ongoing income stream that aligns with their financial objectives and lifestyle requirements.

Comparing Senior Citizen Bank Offers

When it comes to securing fixed deposits, comparing different bank offers is essential for senior citizens. Each bank provides unique benefits, interest rates, and promotional terms that can significantly affect overall returns. For instance, banks like Union Bank of India and Indian Bank, while slightly less known, may offer competitive rates that can be more beneficial than those provided by larger institutions. Understanding the nuances of each offer can empower seniors to choose the one that best fits their needs.

Additional features such as flexible withdrawal options, online banking facilities, and customer service support should also be factored into the decision-making process. Since many seniors prefer simplicity and convenience in transactions, evaluating these criteria can enhance their banking experience. Ultimately, thorough research can help them make informed decisions while maximizing their returns on fixed deposits, contributing positively to their financial health and stability.

The Importance of Financial Consultation for Seniors

Senior citizens often face unique financial challenges, making it crucial for them to seek advice from certified financial consultants. A financial advisor can help seniors navigate the complexities of fixed deposit investments, guiding them through the right choices based on their risk tolerance, financial goals, and current market conditions. This personalized advice not only enhances the decision-making process but also equips seniors with knowledge about maximizing their returns on fixed deposits.

Additionally, a financial consultant can help seniors assess their overall portfolio, ensuring that their investments align with their income needs and retirement plans. With the fluctuating interest rates and changes in banking offers, having expert guidance can significantly bolster their financial strategy, making sure that they are making the most of their assets while addressing any concerns about future financial security.

Understanding Fixed Deposit Variants for Seniors

Not all fixed deposits are created equal, especially when it comes to senior citizens. Several banks offer variants such as reinvestment FDs, regular income FDs, and monthly income schemes, each tailored to meet specific financial needs. Senior citizens can choose a plan that offers regular payouts or one that compounds interest over time, thus allowing them to strategize according to their financial requirements. Variants such as these provide flexible options in managing funds, alleviating the stress associated with uncertain income after retirement.

Moreover, by understanding the differences in fixed deposit variants, seniors can optimize their investment efficiently. For example, if a senior citizen wishes to maintain a steady cash flow, opting for monthly income schemes can be beneficial. In contrast, those looking to maximize returns over time may prefer reinvestment plans that compound their interest. Thus, having a comprehensive insight into available deposit types can assist in making prudent investment decisions aligned with their life stage and financial aspirations.

Staying Updated with FD Interest Trends for Seniors

In the rapidly changing financial landscape, being informed of the latest FD interest trends is vital for senior citizens. As we move forward into 2025 and beyond, keeping an eye on effective interest rates and market conditions can help seniors take advantage of opportunities to secure their investments. Engaging with reliable financial news sources, subscribing to bank updates, and reviewing interest rate changes on a regular basis can significantly impact their overall financial strategy.

Additionally, participating in financial literacy programs specifically designed for seniors can enhance their knowledge of banking and investment options. This awareness will not only boost confidence in managing personal finances but also empower them to make choices that align with their financial goals. As interest rates may fluctuate based on various economic indicators, seniors should invest time in understanding these trends, helping them position their savings effectively in fixed deposits that yield the best possible returns.

Frequently Asked Questions

What are the current Senior Citizen Fixed Deposit Rates in June 2025?

As of June 2025, senior citizens can enjoy fixed deposit rates ranging from 7.00% to 7.95% across leading public sector banks. Notably, banks like the Bank of Maharashtra and Punjab & Sind Bank offer some of the highest fixed deposit rates specifically tailored for seniors.

Which banks offer the best rates for senior citizens’ fixed deposits?

Top banks known for offering high FD rates for seniors include the Central Bank of India, Punjab & Sind Bank, and Bank of Maharashtra, with rates nearing 8% for select tenures. It’s advisable to compare these banks to find the best options for your fixed deposit investments.

What are the benefits of choosing fixed deposits as a senior citizen?

Fixed deposits provide numerous benefits for seniors, including guaranteed returns with minimal risk, additional interest of 0.25% to 0.75% over standard rates, and insurance coverage under DICGC up to ₹5 lakh. This makes fixed deposits an ideal choice for stable post-retirement income.

How does the additional interest for senior citizen bank offers work?

Senior citizens typically receive an additional interest premium on fixed deposits, which can range from 0.25% to 0.75% compared to regular rates. This makes senior citizen fixed deposits more attractive, helping to maximize returns on their investments.

What tenure options are available for senior citizen fixed deposits?

Seniors can select various tenures for fixed deposits, commonly ranging from 1 year to up to 10 years, with many banks offering special schemes for mid-term tenures of around 400 to 555 days providing competitive rates.

Why should senior citizens consider fixed deposits in their financial strategy?

Fixed deposits are a secure investment option for seniors, ensuring fixed, assured returns which help in managing their finances post-retirement. They are also less volatile compared to other investment avenues, making them suitable for conservative risk profiles.

What factors should seniors look into when choosing fixed deposits?

When selecting fixed deposits, senior citizens should consider the interest rates offered, the tenure and liquidity options, any applicable fees, and the financial stability of the lending bank. Additionally, understanding the terms of withdrawal and the effects of inflation on savings is essential.

Are fixed deposits the best option for senior citizens planning retirement income?

While fixed deposits are a safe and reliable option for generating post-retirement income due to their predictable returns, seniors should also explore other investment vehicles in conjunction with FDs to diversify their portfolios and optimize returns.

| Bank | Senior Citizen FD Rate Range | Common Key Tenure |

|---|---|---|

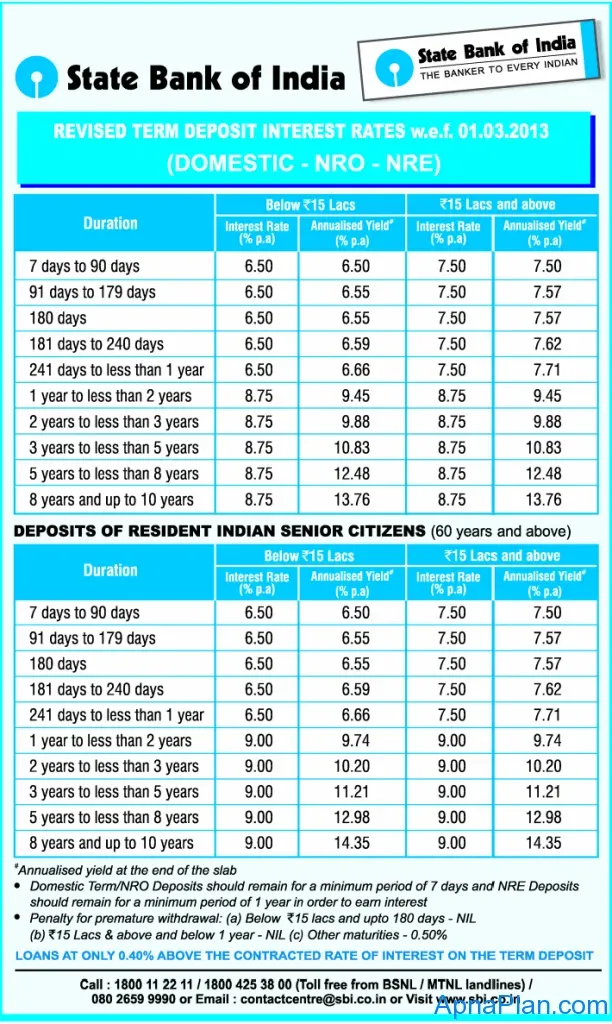

| State Bank of India | 7.00 – 7.40% | 1 to 10 years |

| Punjab & Sind Bank | 7.25 – 7.75% | 1 year, 555 days (special) |

| Bank of Maharashtra | 7.30% – 7.95% | 1 to 5 years |

| Union Bank of India | 7.10% – 7.75% | 1 to 5 years |

| Indian Bank | 7.25% – 7.65% | 1 year, 400–555 days |

| Bank of Baroda | 7.25% – 7.80% | 1 to 5 years (non-callable) |

Summary

Senior Citizen Fixed Deposit Rates are currently offering attractive options for seniors looking to secure their investments. As of June 2025, senior citizens can earn fixed deposit interest rates reaching up to 7.95%, particularly from leading public sector banks like the Bank of Maharashtra, which offers competitive rates tailored for mid-term tenures. With fixed deposits providing a low-risk investment avenue, along with additional benefits for senior citizens, it remains a sensible choice for financial stability and income planning during retirement.